Published: 2025-04-22T08:12:51.000Z

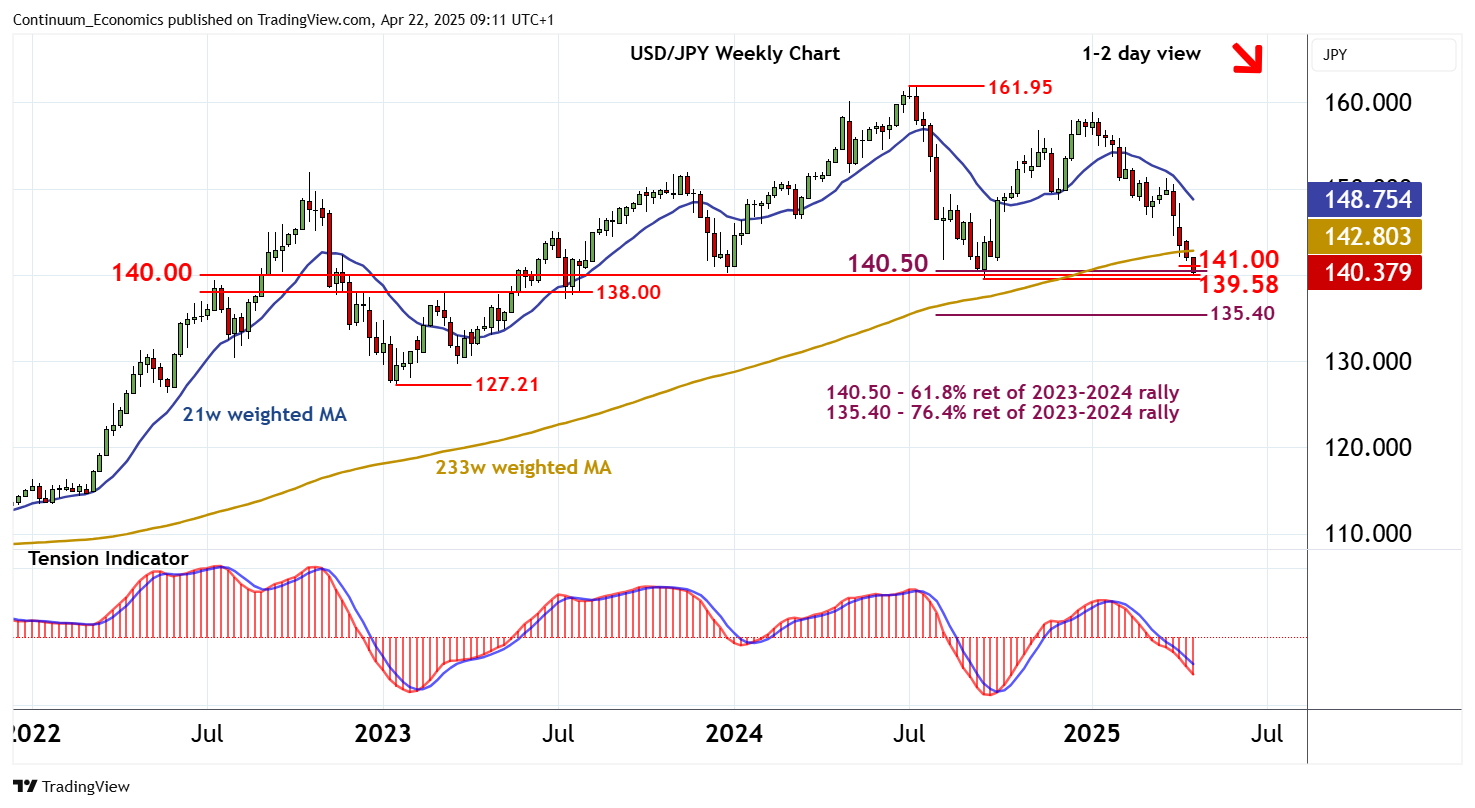

Chart USD/JPY Update: Fresh year lows - critical support at 139.58

Senior Technical Strategist

1

Cautious trade has given way to fresh losses

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 145.00 | * | congestion | S1 | 140.50 | ** | 61.8% ret of 2023-2024 rally | |

| R3 | 144.00 | * | congestion | S2 | 140.00 | ** | congestion | |

| R2 | 142.00 | * | congestion | S3 | 139.58 | ** | 16 Sep 2024 (y) low | |

| R1 | 141.00 | * | congestion | S4 | 138.00 | * | congestion |

Asterisk denotes strength of level

08:50 BST - Cautious trade has given way to fresh losses, with prices currently pressuring support within congestion around 140.00 and the 140.50 Fibonacci retracement. Negative daily readings highlight potential for a test of critical support at the 139.58 year low of 16 September 2024. But flattening oversold weekly stochastics could limit any initial tests in further consolidation, before the negative weekly Tension Indicator and deteriorating longer-term charts prompt a break. A close beneath here will add weight to sentiment and extend July 2024 losses initially to congestion around 138.00. Meanwhile, a close above congestion resistance at 141.00 would help to stabilise price action and give way to consolidation beneath further congestion around 142.00.