Published: 2024-12-16T18:16:46.000Z

Chartbook: Chart USD/CHF: Room for extension towards strong resistance at 0.9225/40

Senior Technical Strategist

-

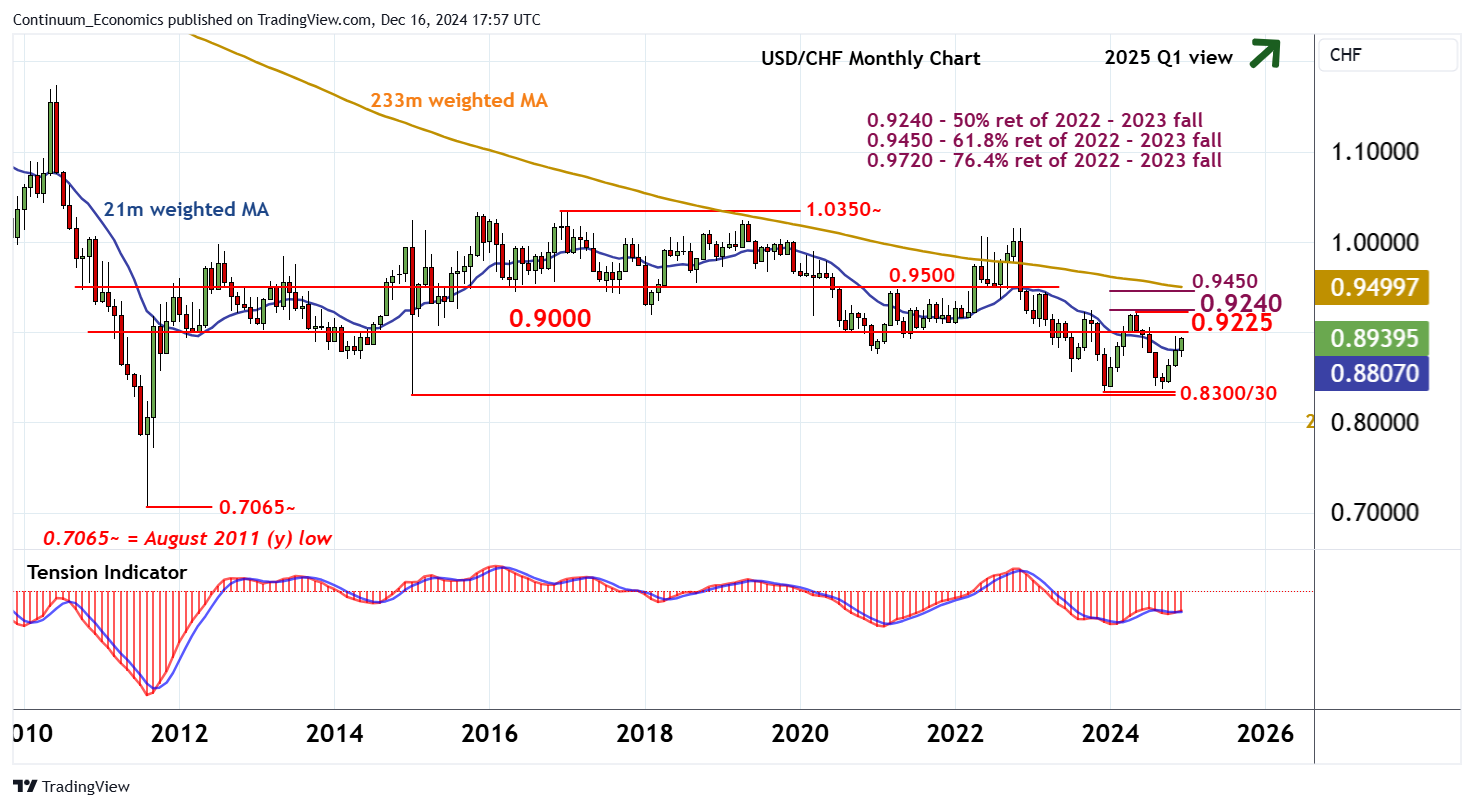

The anticipated minor bounce from critical support at 0.8300 and the 0.8330 multi-year low of December 2023 has extended

The anticipated minor bounce from critical support at 0.8300 and the 0.8330 multi-year low of December 2023 has extended,

with steady USD- and CHF-driven gains opening up congestion resistance at 0.9000.

Monthly stochastics have turned higher and the monthly Tension Indicator is also improving, highlighting potential for a test above here.

Focus will then turn to strong resistance at the 0.9225 current year high of May 2024 and the 0.9240 Fibonacci retracement. But mixed/negative longer-term charts are expected to limit any initial tests of this latter area in profit-taking/consolidation.

A close above here, however, will reinvigorate buying interest and extend December 2023 gains towards the 0.9450 retracement and congestion around 0.9500.

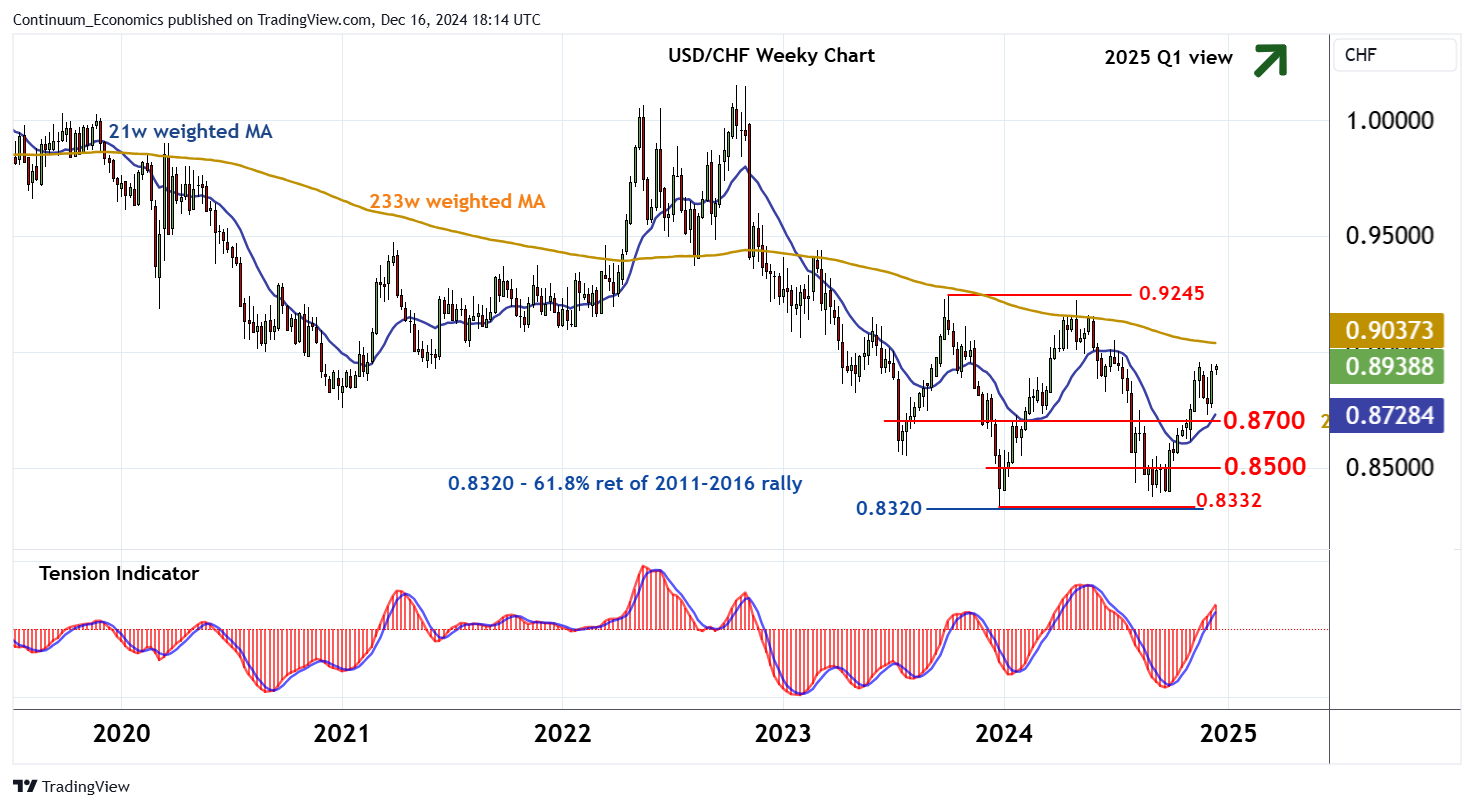

Meanwhile, support is raised to congestion around 0.8700.

A close beneath here, if seen, would add weight to sentiment and prompt a pullback towards further congestion around 0.8500.

However, a close below critical support at 0.8300/30~ is needed to turn sentiment outright negative and confirm continuation of losses from the 1.0350~ multi-year high of December 2016.

Initial focus will then turn to psychological support at 0.8000.