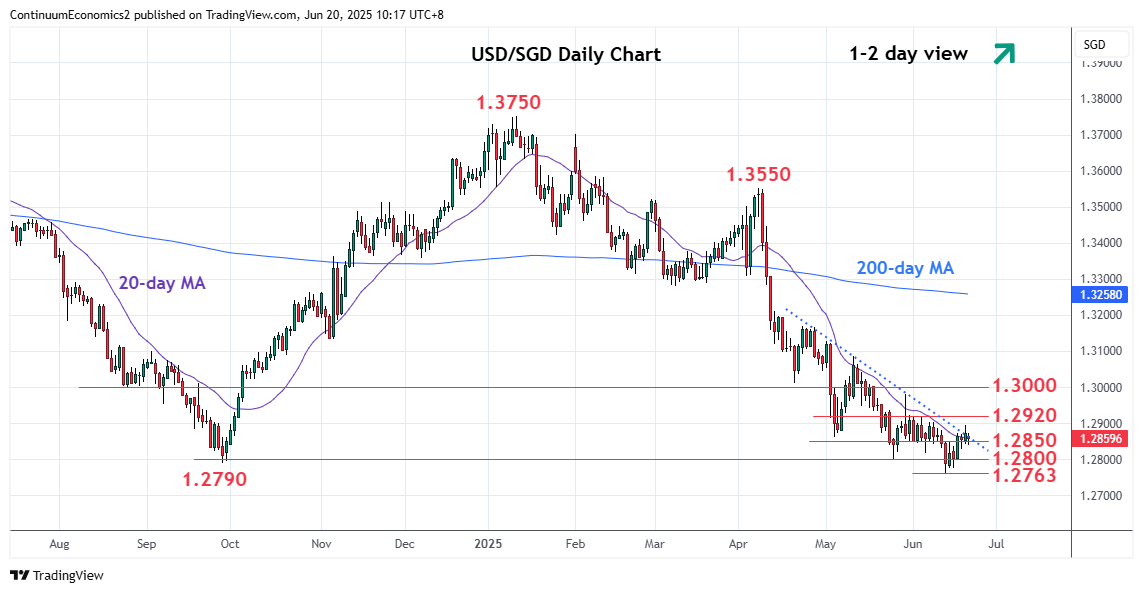

Met with selling pressure beneath the 1.2900 level as prices unwind overbought intraday studies

| Level | Comment | Level | Comment | ||||

|---|---|---|---|---|---|---|---|

| R4 | 1.3063 | * | 38.2% Apr/Jun fall | S1 | 1.2820/00 | * | congestion |

| R3 | 1.3000/10 | ** | congestion, Apr low | S2 | 1.2763 | ** | 12 Jun YTD low |

| R2 | 1.2980 | * | 29 May high | S3 | 1.2700 | * | congestion from Oct 2014 |

| R1 | 1.2900/20 | * | congestion | S4 | 1.2677 | * | Oct 2014 low |

Asterisk denotes strength of level

02:20 GMT - Met with selling pressure beneath the 1.2900 level as prices unwind overbought intraday studies and consolidate bounce from 1.2763 low. Positive daily studies suggest consolidation to give way to renewed buying pressure later to correct losses from the April high. Break above the Clearing resistance at the 1.2900/20 congestion will see room for extension to 1.2980, 29 May high, then 1.3000/10 congestion. Meanwhile, support remains at the 1.2820/00 area which should underpin and sustain corrective bounce from the 1.2763 low.