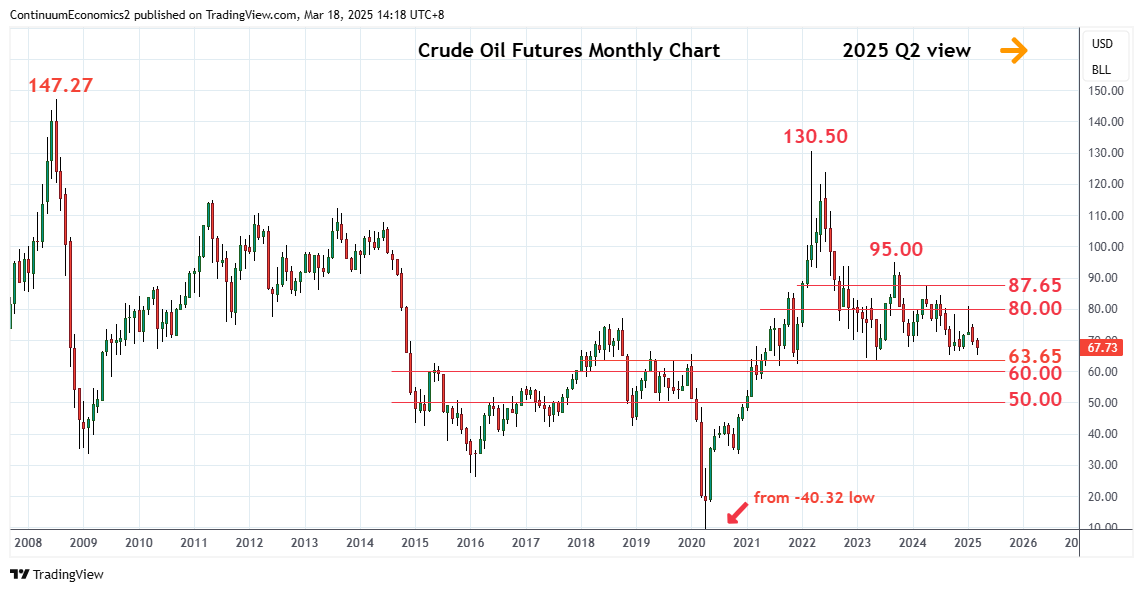

Saw sharp gains at the start of the year to reach 80.00 level before giving way to selling pressure to retrace all the gains from the 65.25, September 2024 year low

Saw sharp gains at the start of the year to reach 80.00 level before giving way to selling pressure to retrace all the gains from the 65.25, September 2024 year low.

Losses has since stabilised at the 65.22 low as prices unwind the oversold weekly studies and suggest potential for corrective bounce. Resistance is lowered to the 72.50 previous lows and clearance here will open up room for stronger gains to retest strong resistance at the 76.00 congestion and extending to the 80.00 level. This area is expected to cap and sustain losses from the 95.00, 2023 year high. Gains beyond this, if seen, will see scope for extension towards the 84.50/85.00 area.

Meanwhile, support at the 65.25 congestion and this extend to the 63.65, 2023 year low. Break here will extend losses from the March 2022 year high and see room to the support the 60.00 psychological level. Lower still, will see scope to the 57.00 congestion.