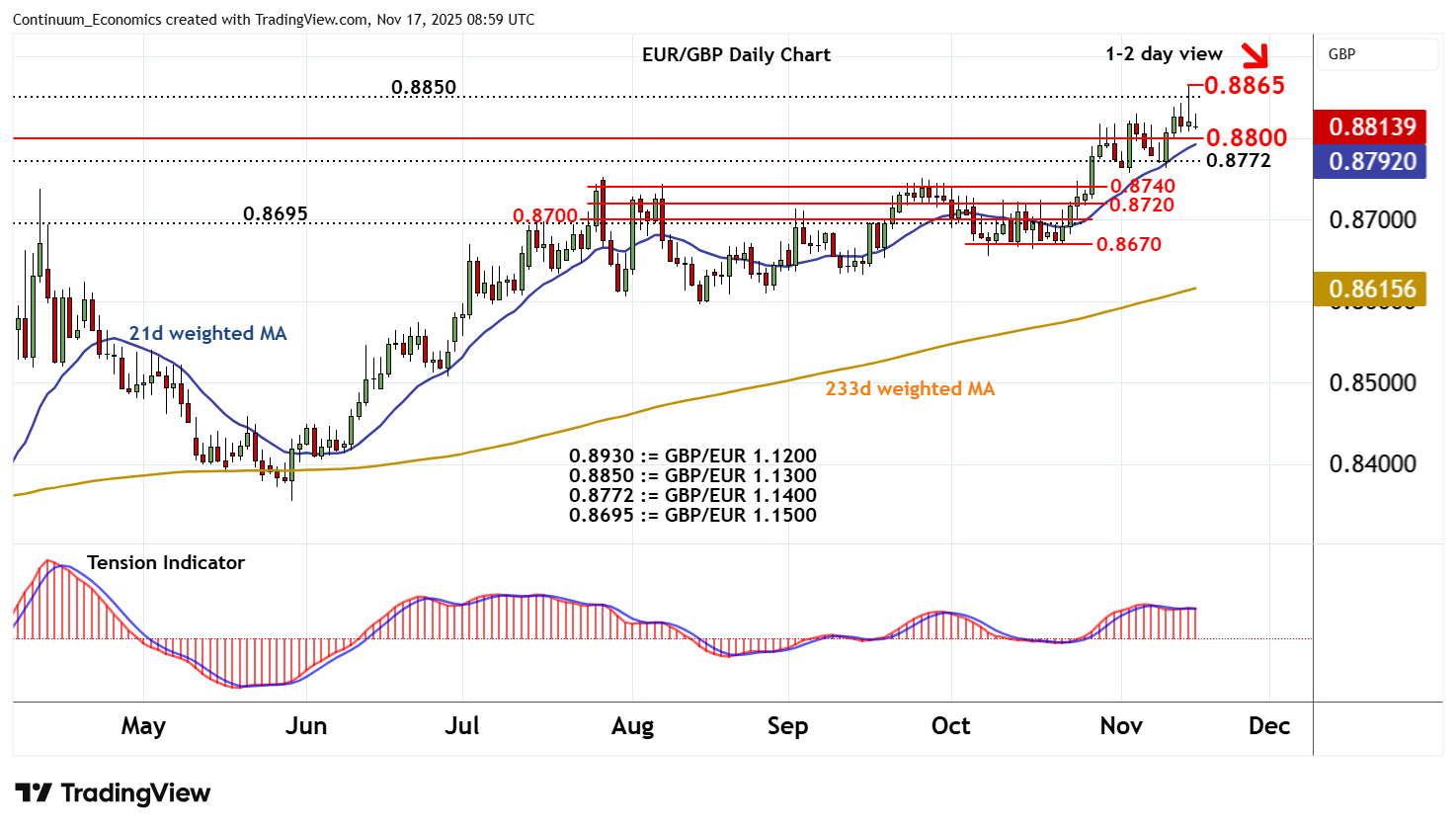

Chart EUR/GBP Update: Turning away from fresh 2025 year high

The spike above 0.8850, (GBP/EUR 1.1300), has posted a fresh 2025 year high around 0.8865

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8900 | * | congestion | S1 | 0.8800 | * | figure | |

| R3 | 0.8875 | * | April 2023 high | S2 | 0.8772 | * | GBP/EUR 1.1400 | |

| R2 | 0.8865 | * | 14 Nov YTD high | S3 | 0.8740 | intraday break level | ||

| R1 | 0.8850 | * | GBP/EUR 1.1300, cong | S4 | 0.8720 | * | congestion |

Asterisk denotes strength of level

08:50 GMT - The spike above 0.8850, (GBP/EUR 1.1300), has posted a fresh 2025 year high around 0.8865, before falling sharply into consolidation above 0.8800. Daily stochastics and the daily Tension Indicator are under pressure, highlighting room for a test beneath 0.8800. But rising weekly charts should limit scope in renewed buying interest/consolidation above 0.8772, (GBP/EUR 1.1400). A close beneath here, however, will add weight to sentiment and extend losses into 0.8720/40. Meanwhile, a close above 0.8850/65, not yet seen, will improve sentiment and extend December 2024 gains beyond the 0.8875 high of April 2023 towards congestion around 0.8900.