Published: 2025-03-18T17:46:24.000Z

Chartbook: US Chart 10 Year Yield: Choppy trade - background studies under pressure

Senior Technical Strategist

3

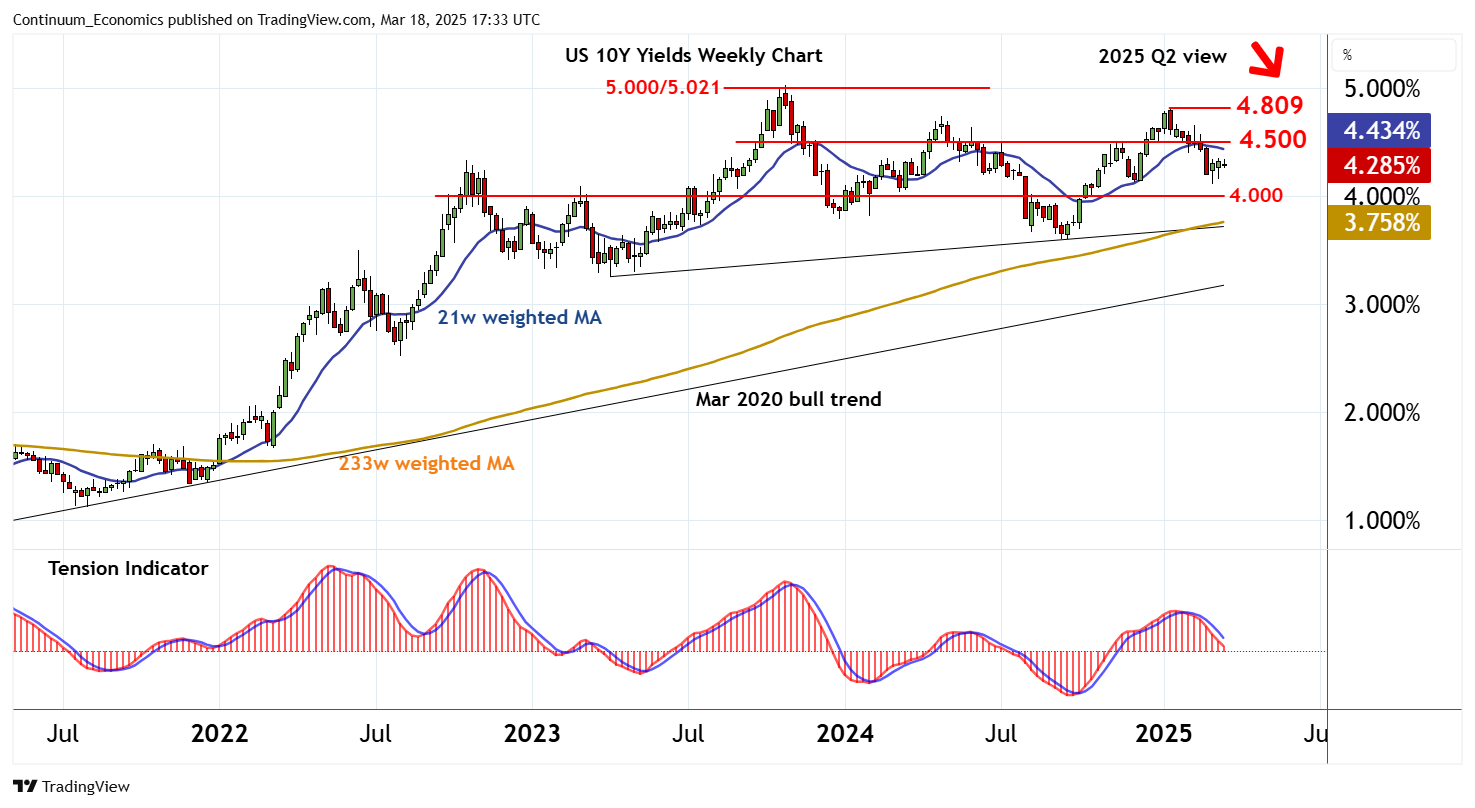

The anticipated test above 4.500% has posted a 2025 year high at 4.809%

The anticipated test above 4.500% has posted a 2025 year high at 4.809%,

before falling back into cautious trade below 4.500%.

Oversold weekly stochastics are ticking higher, suggesting potential for a retest of 4.500%. But the bearish weekly Tension Indicator and deteriorating monthly charts are expected to limit any break above here in renewed selling interest beneath 4.809%.

Following cautious trade, deteriorating monthly charts highlight room for fresh losses.

Support is at congestion around 4.000%, with a later break targeting critical support at the 3.670% Fibonacci retracement and the 3.599% year low of September 2024.

Bearish longer-term charts highlight scope for a later break beneath here. This will confirm a significant top in place at 5.000%/5.021% and complete a multi-month distribution top, as a deeper correction of the rally from the 0.333% all-time low of March 2020 develops. Strong support within the 3.250% year high of October 2018 and the 2.230% retracement should initially attract.