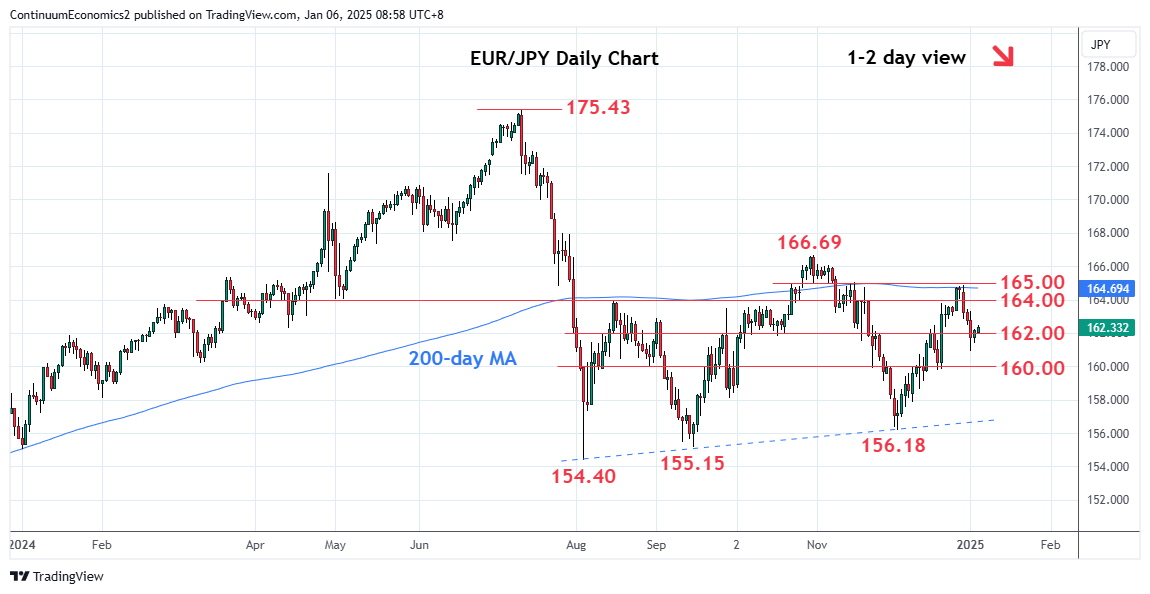

Higher in consolidation from the 160.90 low as prices consolidate losses from the 164.90 high of last week

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 166.00 | * | congestion | S1 | 160.90 | * | 2 Jan low | |

| R3 | 164.90 | ** | 30 Dec high | S2 | 160.00 | ** | congestion | |

| R2 | 164.00 | * | congestion | S3 | 158.65 | * | 11 Dec low | |

| R1 | 162.45 | * | 31 Dec low | S4 | 158.00 | * | congestion |

Asterisk denotes strength of level

02:10 GMT - Higher in consolidation from the 160.90 low as prices consolidate losses from the 164.90 high of last week. Intraday studies are unwinding oversold readings but bounce see resistance starting at 162.45 then the 163.80/164.00 area. The latter expected to cap and lower high sought to further pressure the downside later. Below the 160.90 low will see room for extension to the strong support at the 160.00 figure where reaction can be expected. Break here will further retrace the December rally. and open up room to 158.65 support then the 158.00 level.