Published: 2025-07-28T08:13:14.000Z

Chart USD Index DXY Update: Room for higher

Senior Technical Strategist

3

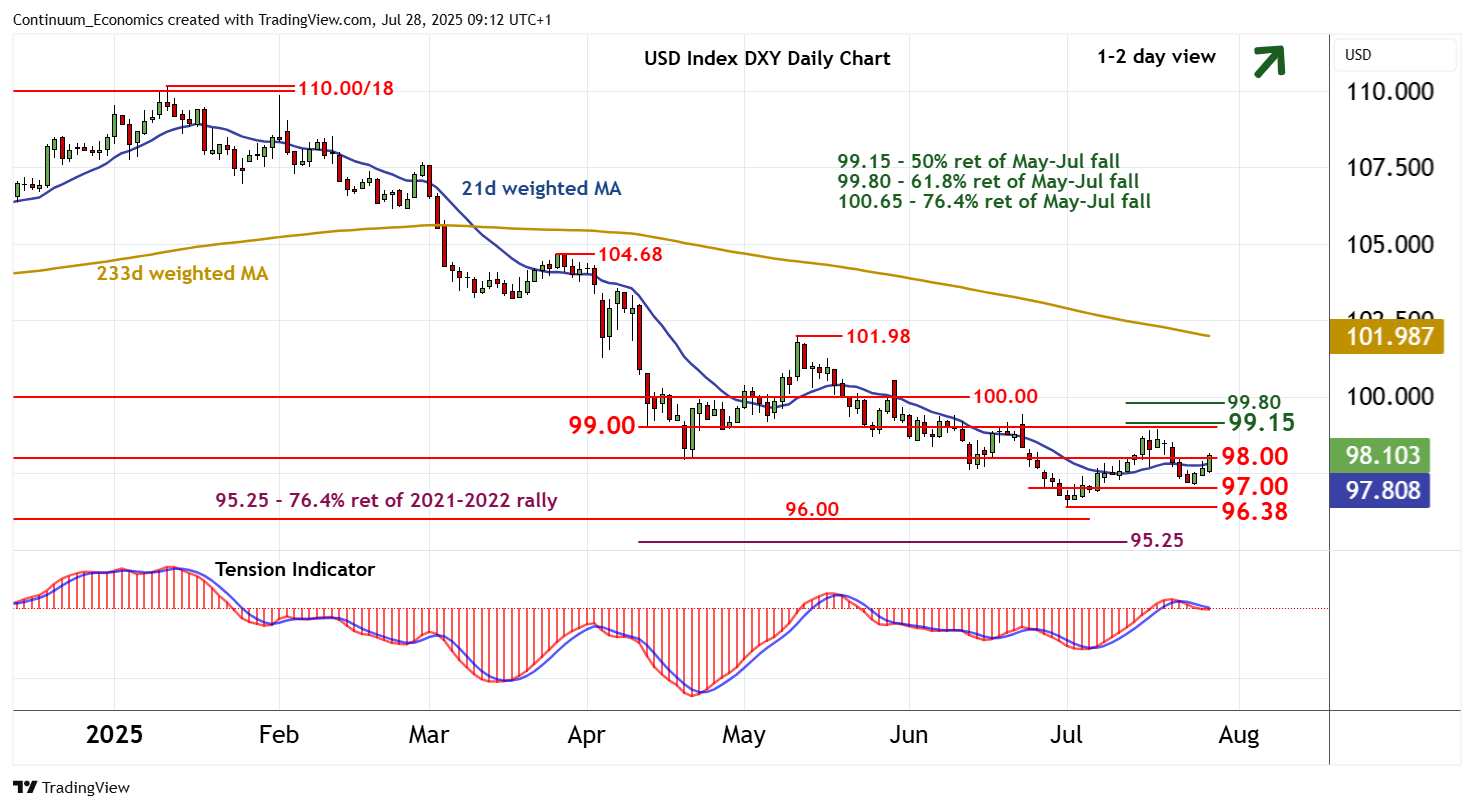

Minor consolidation around 97.50 has given way to a sharp bounce

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 99.15 | ** | 50% ret of May-Jul fall | S1 | 97.00 | * | congestion | |

| R3 | 99.00 | break level | S2 | 96.50 | * | congestion | ||

| R2 | 98.95 | * | 17 Jul (w) high | S3 | 96.38 | * | 1 Jul YTD low | |

| R1 | 98.00 | * | congestion | S4 | 96.00 | * | congestion |

Asterisk denotes strength of level

09:00 BST - Minor consolidation around 97.50 has given way to a sharp bounce, with prices currently trading just above congestion resistance at 98.00. Intraday studies have turned higher, highlighting room for further strength. But mixed daily and weekly readings are expected to limit initial scope in consolidation beneath strong resistance within the tight 98.95 - 99.00/15 range. Meanwhile, support remains down to congestion around 97.00. A close beneath here, if seen, should be limited in fresh buying interest above critical support at the 96.38 current year low of 1 July.