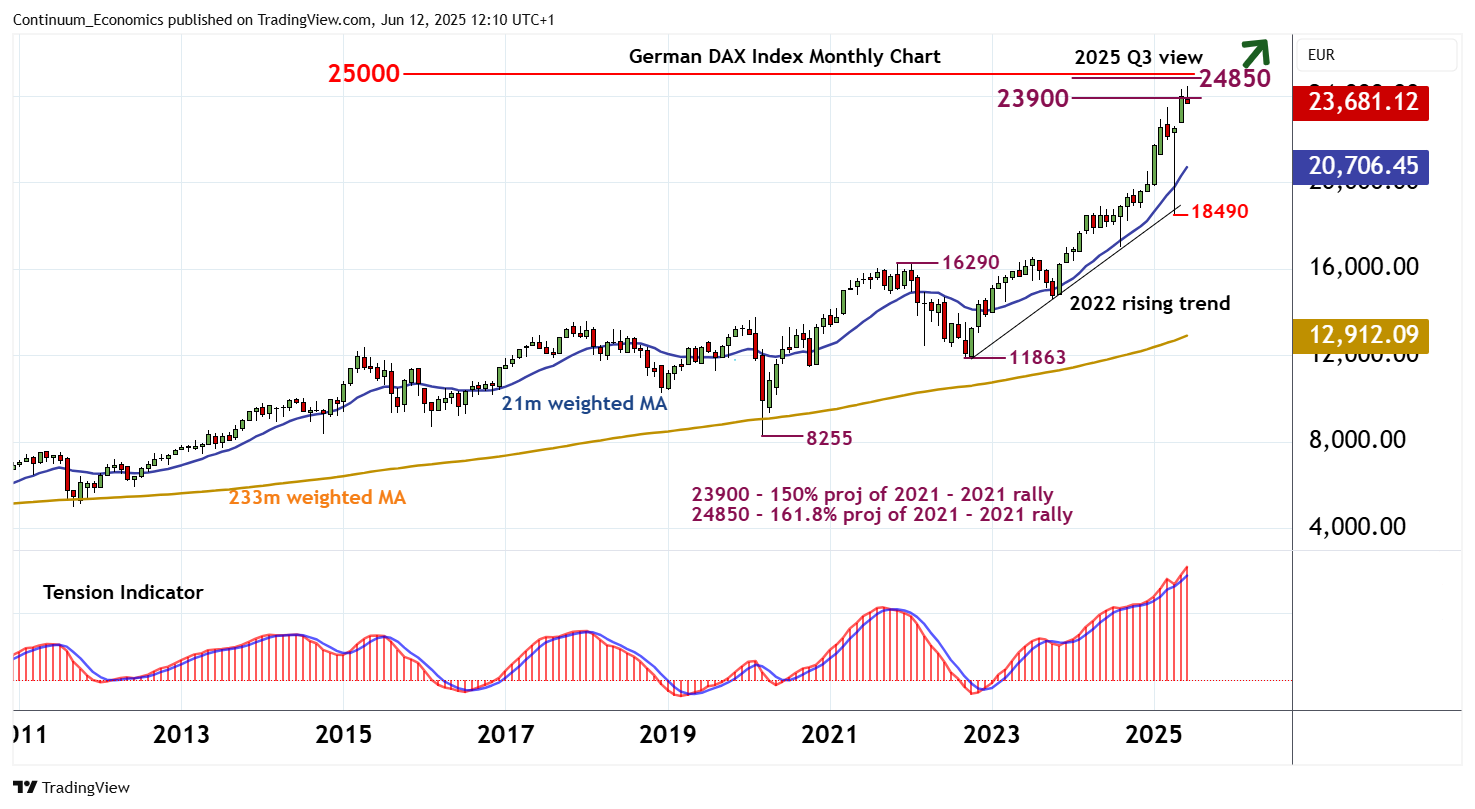

Chartbook: DAX Chart: Fresh highs - reactions possible before prices continue higher

The extension of broad 2022 gains in March was met by sharp selling interest in early April

The extension of broad 2022 gains in March was met by sharp selling interest in early April,

as heightened global volatility pushed prices sharply lower to 18490.

The subsequent bounce has extended to test the 23,900 Fibonacci projection, with selling interest currently appearing around fresh contract highs at 24,490.

Flat overbought monthly stochastics highlight room for a corrective pullback/profit-taking into the coming weeks. But the monthly Tension Indicator is positive and longer-term readings are also constructive, highlighting room for later gains.

Immediate resistance is at the 24,850 projection and psychological barrier at 25,000. This could provide an initial barrier, before prices extend beyond here.

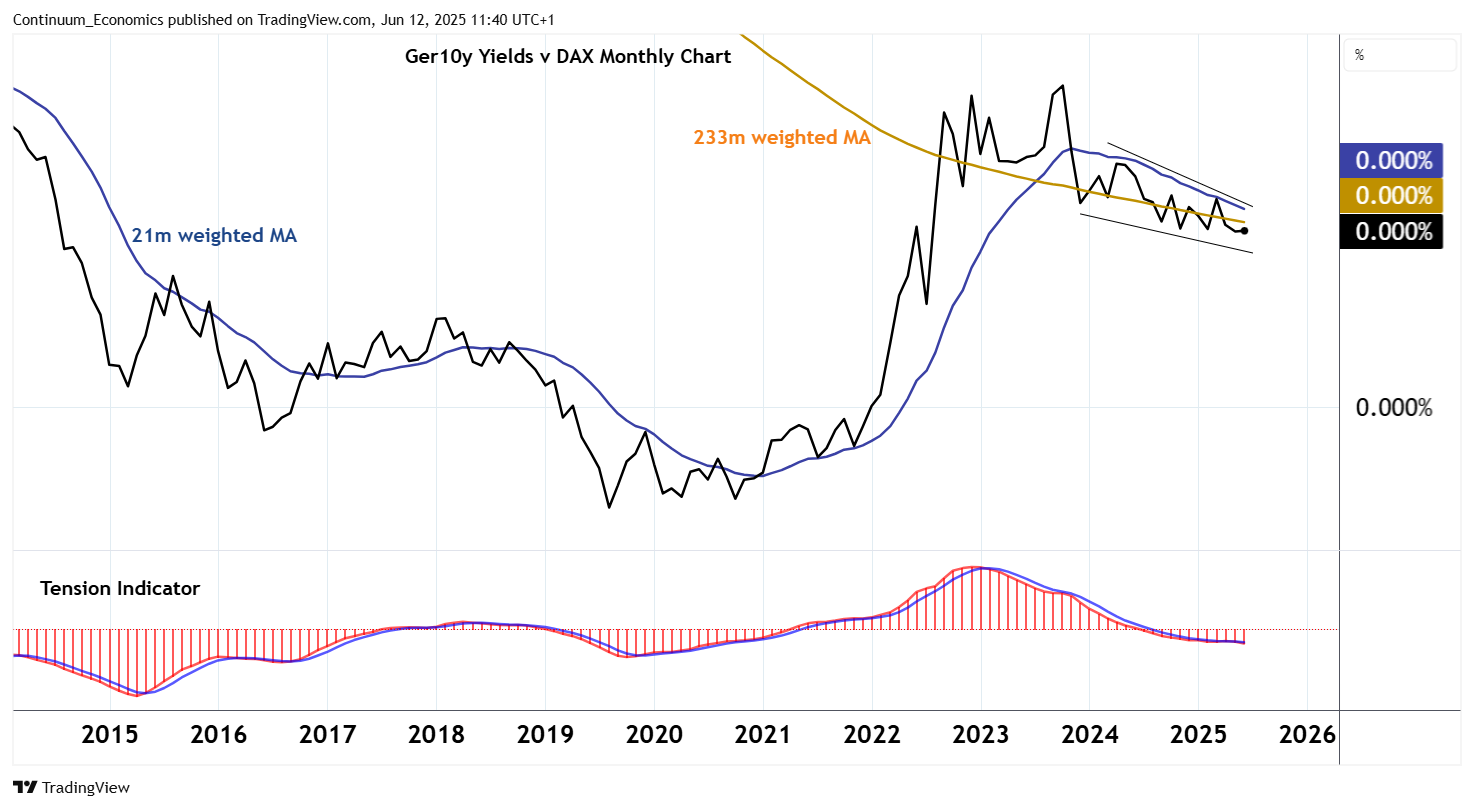

Additionally, there are early signs of German 10Y yields weakening, relative to German equities, suggesting possible asset rotation into equities.

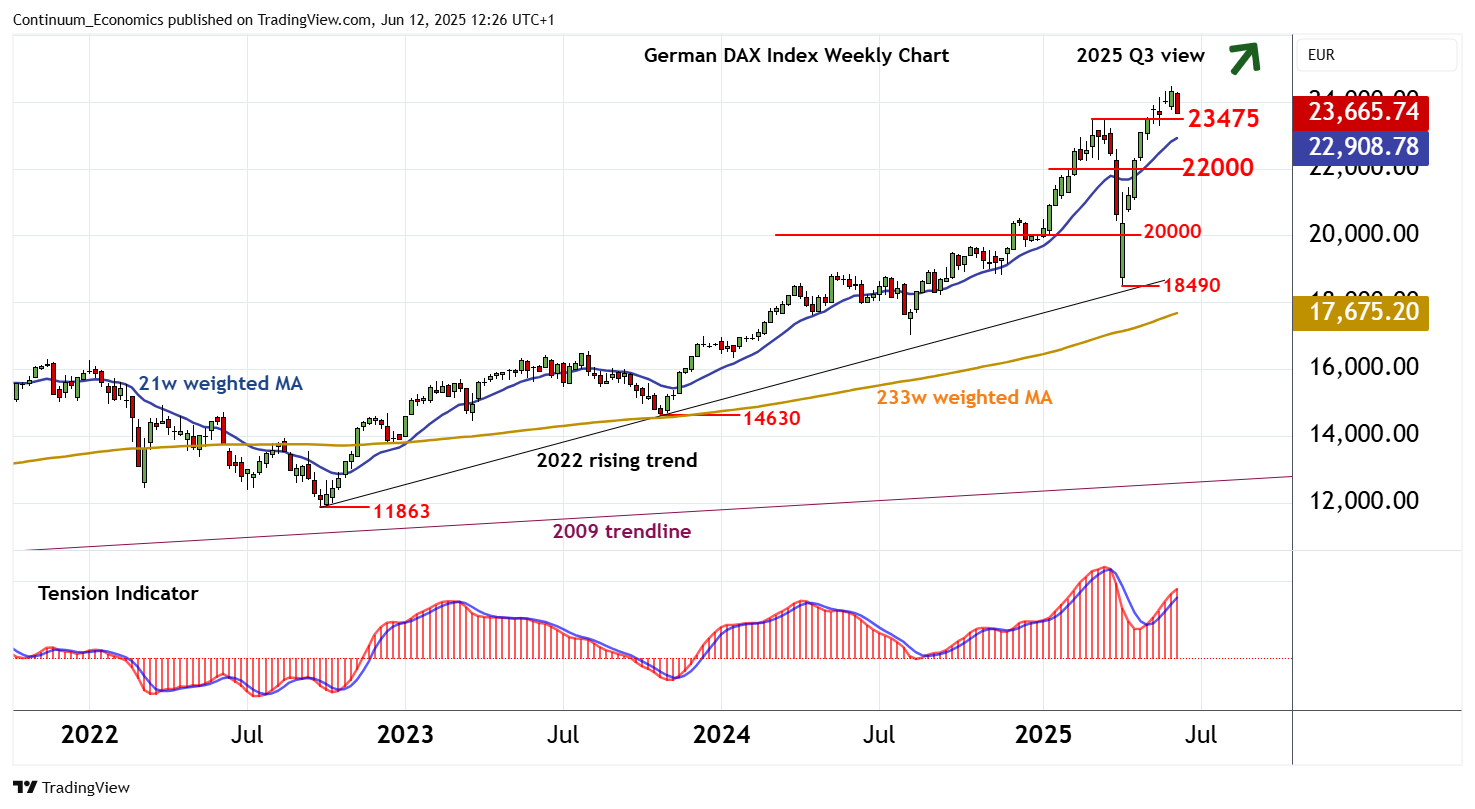

Meanwhile, support is at the 23,475 monthly high of 6 March.

A tick lower in weekly studies highlights potential for a test beneath here.

But the positive longer-term readings are expected to limit scope in renewed buying interest above congestion around 22,000.

A further close beneath here, however, would stabilise price action and delay higher levels, as price action then settles in cautious trade above 20,000.