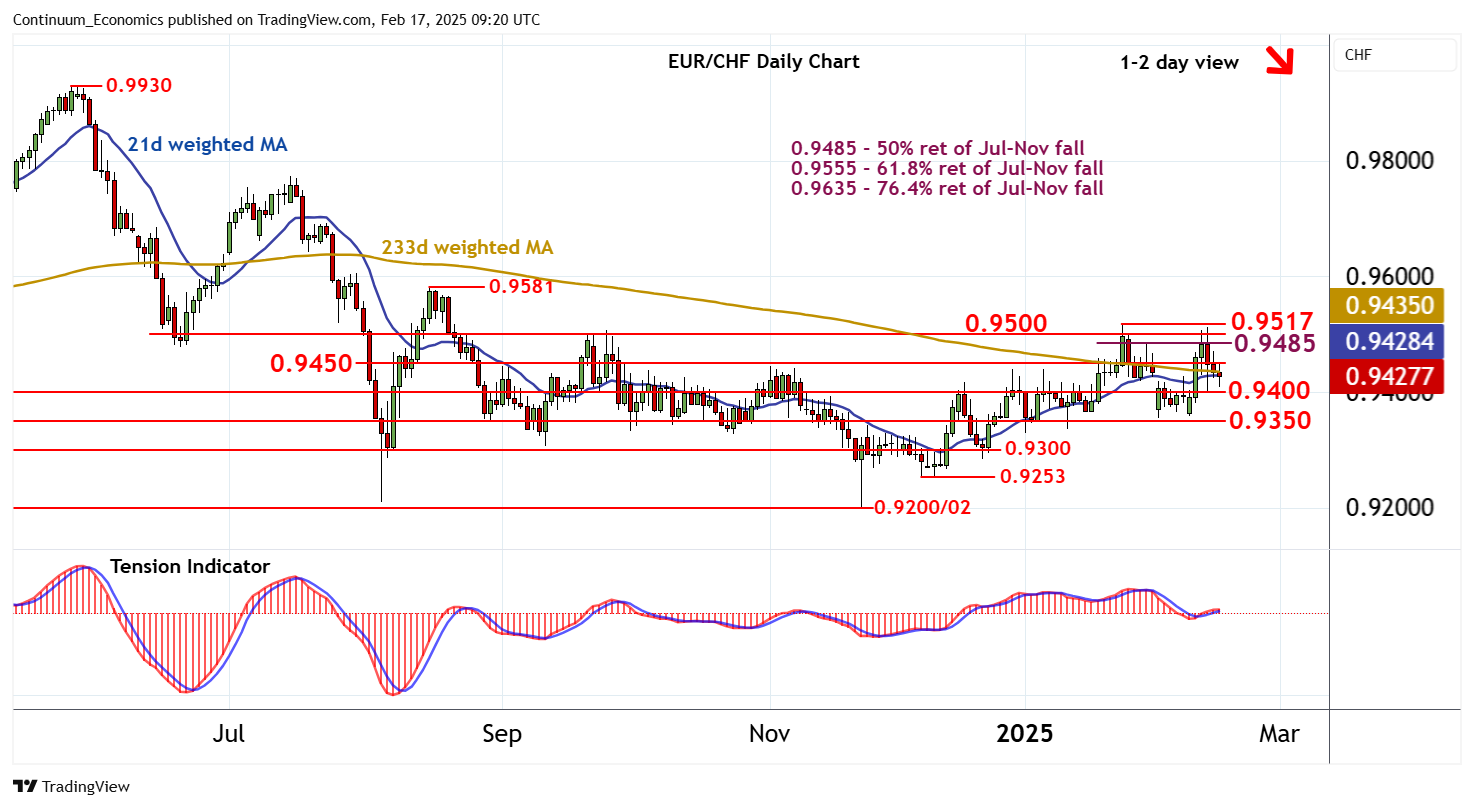

Chart EUR/CHF Update: Leaning lower

Anticipated losses are meeting buying interest just above congestion support at 0.9400

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.9517 | ** | 24 Jan YTD high | S1 | 0.9400 | ** | congestion | |

| R3 | 0.9500 | ** | break level | S2 | 0.9350 | * | congestion | |

| R2 | 0.9485 | ** | 50% ret of Jul-Nov fall | S3 | 0.9300 | * | congestion | |

| R1 | 0.9450 | * | break level | S4 | 0.9253 | ** | 6 Dec (m) low |

Asterisk denotes strength of level

09:10 GMT - Anticipated losses are meeting buying interest just above congestion support at 0.9400, as oversold intraday studies flatten, with prices currently trading around 0.9425. Daily readings have turned lower, however, and broader weekly charts are coming under pressure, highlighting a deterioration in sentiment and room for further losses in the coming sessions. A break below 0.9400 will add weight to sentiment and extend January losses towards further congestion around 0.9350. A close beneath here will signal a near-term top in place at the 0.9517 current year high of 24 January, and open up 0.9300. Meanwhile, resistance is lowered to 0.9450. A close above here, if seen, will turn sentiment neutral and prompt consolidation beneath strong resistance within the 0.9485 - 0.9517 area.