Chart USD Index DXY Update: Consolidating - room for lower

Little change, as mixed intraday studies keep near-term sentiment cautious

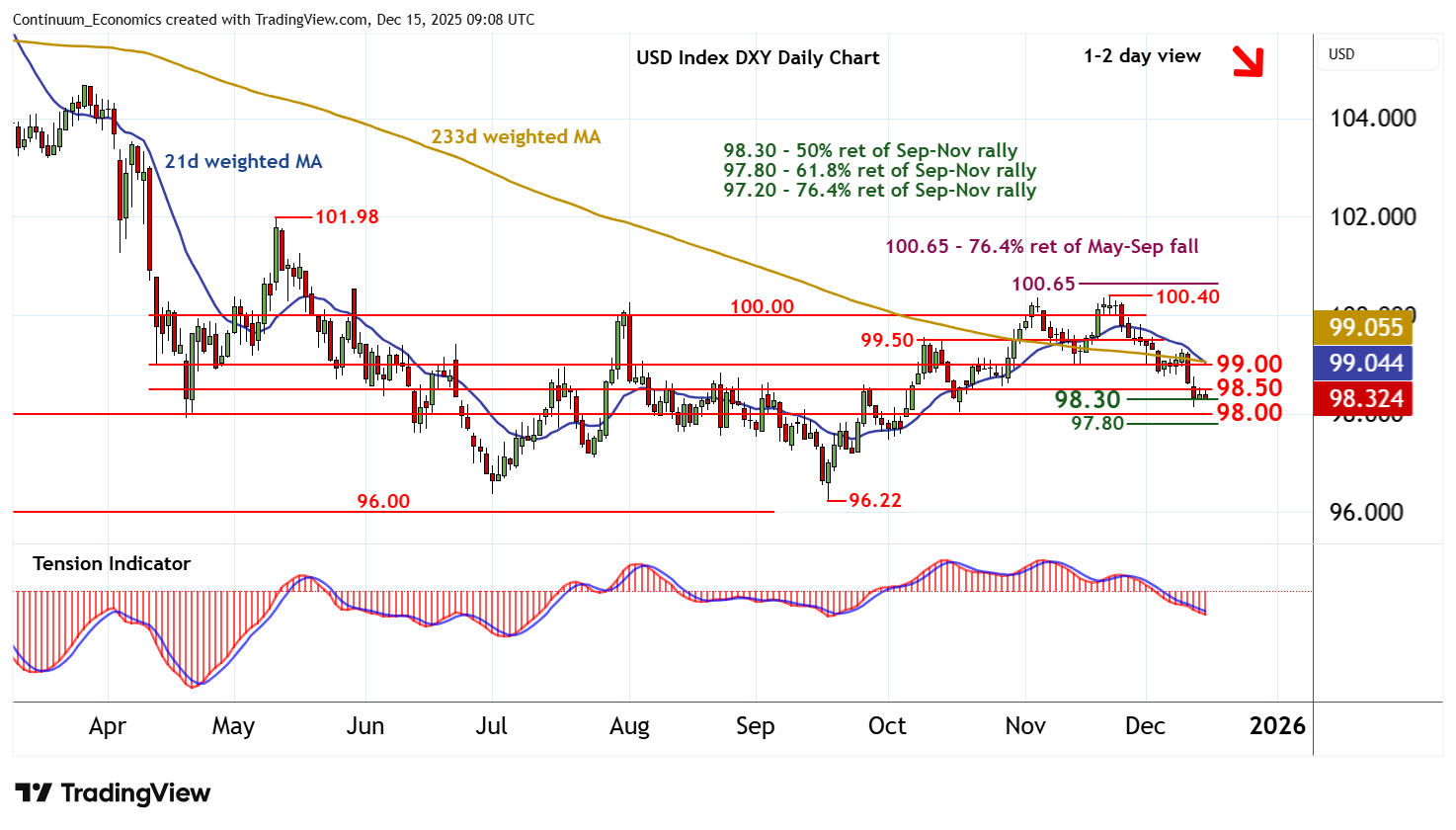

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 100.00 | ** | congestion | S1 | 98.30 | ** | 50% ret of Sep-Nov rally | |

| R3 | 99.50 | * | break level | S2 | 98.00 | * | congestion | |

| R2 | 99.00 | * | congestion | S3 | 97.80 | ** | 61.8% ret of Sep-Nov rally | |

| R1 | 98.50 | * | congestion | S4 | 97.50 | congestion |

Asterisk denotes strength of level

09:00 GMT - Little change, as mixed intraday studies keep near-term sentiment cautious and extend consolidation above support at the 98.30 Fibonacci retracement. Daily readings continue to track lower and broader weekly charts are under pressure, highlighting a bearish tone and room for further losses in the coming sessions. A break beneath will add weight to sentiment and extend late-November losses towards the 97.80 retracement and congestion around 98.00. Already oversold daily stochastics could prompt short-covering/consolidation within here. Meanwhile, resistance remains at congestion around 98.50. A close back above here would help to stabilise price action and prompt consolidation beneath further congestion around 99.00.