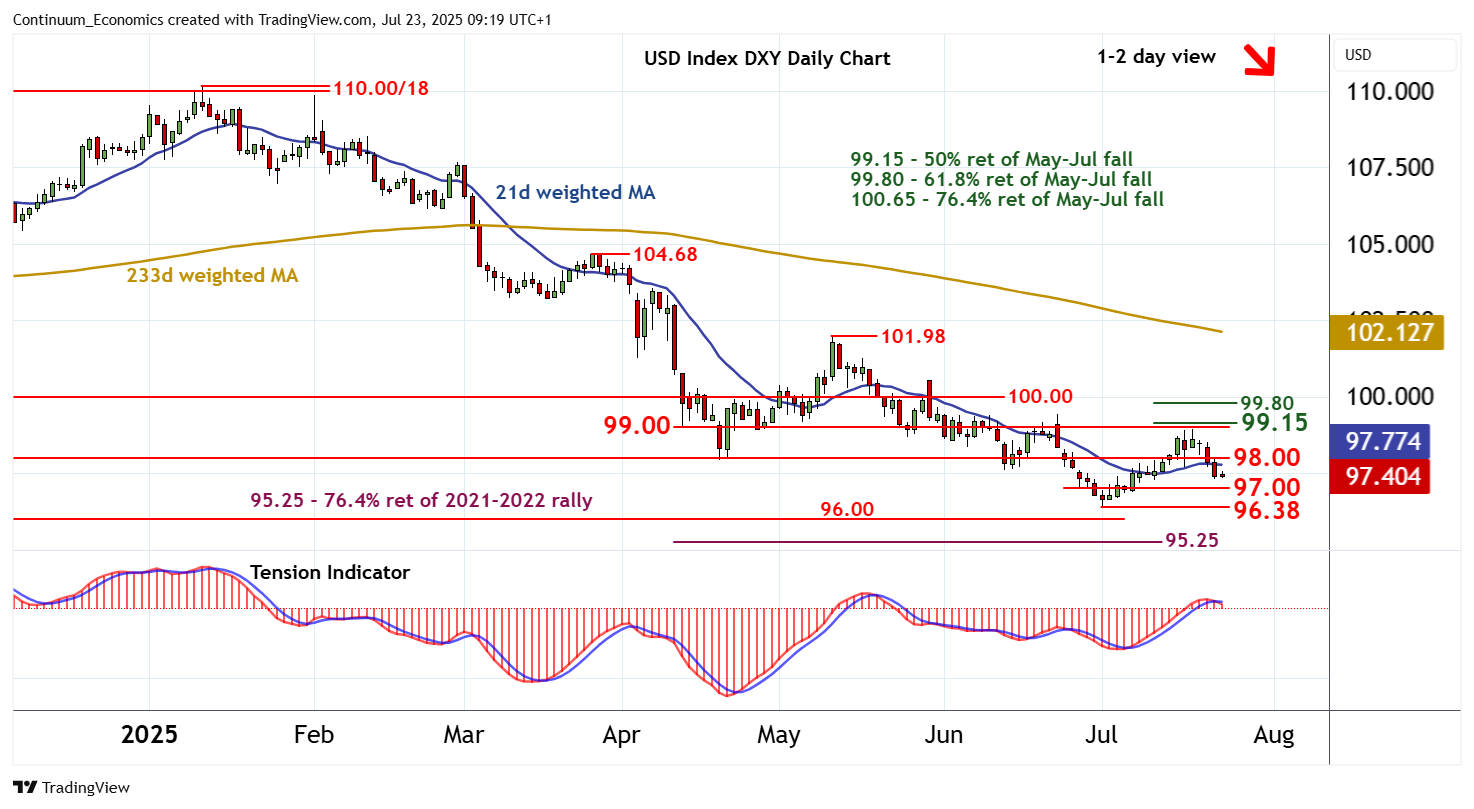

Chart USD Index DXY Update: Leaning lower

Cautious trade beneath congestion resistance at 98.00 has given way to renewed selling interest

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 99.15 | ** | 50% ret of May-Jul fall | S1 | 97.00 | * | congestion | |

| R3 | 99.00 | break level | S2 | 96.50 | * | congestion | ||

| R2 | 98.95 | * | 17 Jul (w) high | S3 | 96.38 | * | 1 Jul YTD low | |

| R1 | 98.00 | * | congestion | S4 | 96.00 | * | congestion |

Asterisk denotes strength of level

09:05 BST - Cautious trade beneath congestion resistance at 98.00 has given way to renewed selling interest, as mixed/negative intraday studies keep near-term sentiment under pressure, with prices currently trading around 97.40. Daily stochastics are tracking lower, unwinding overbought areas, and the daily Tension Indicator is also turning down, highlighting room for further losses in the coming sessions. Support is next at congestion around 97.00. But rising weekly charts should limit any break in fresh buying interest above critical support at the 96.38 current year low of 1 July. Meanwhile, a close back above 98.00, if seen, would help to stabilise price action and prompt consolidation beneath 98.95/00.