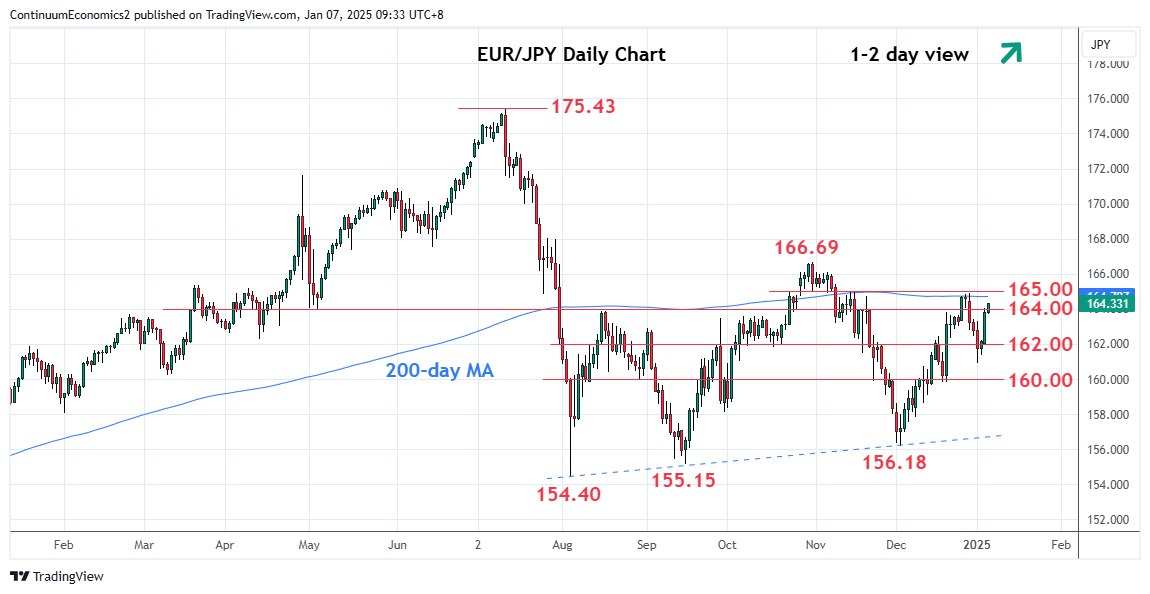

Sharply higher to extend bounce from the 160.90 low of last week

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 167.40 | * | 61.8% Jul/Aug fall | S1 | 162.50 | * | congestion | |

| R3 | 166.69 | ** | Oct high | S2 | 162.00 | * | congestion | |

| R2 | 166.00 | * | congestion | S3 | 160.90 | * | 2 Jan low | |

| R1 | 164.90 | ** | Dec high | S4 | 160.00 | ** | congestion |

Asterisk denotes strength of level

01:40 GMT - Sharply higher to extend bounce from the 160.90 low of last week. Break above the 163.80/164.00 resistance opens up the 164.90 high of December to retest. Overbought intraday studies suggest reaction on test of the latter likely though positive daily and weekly chart see scope for break. Clearance will return focus to the 166.00 congestion and the 166.69, October high. Meanwhile, support is raised to the 162.50/162.00 area which now underpin and this should now sustain bounce from the 160.90 low and the broader gains from the 156.18, December low.