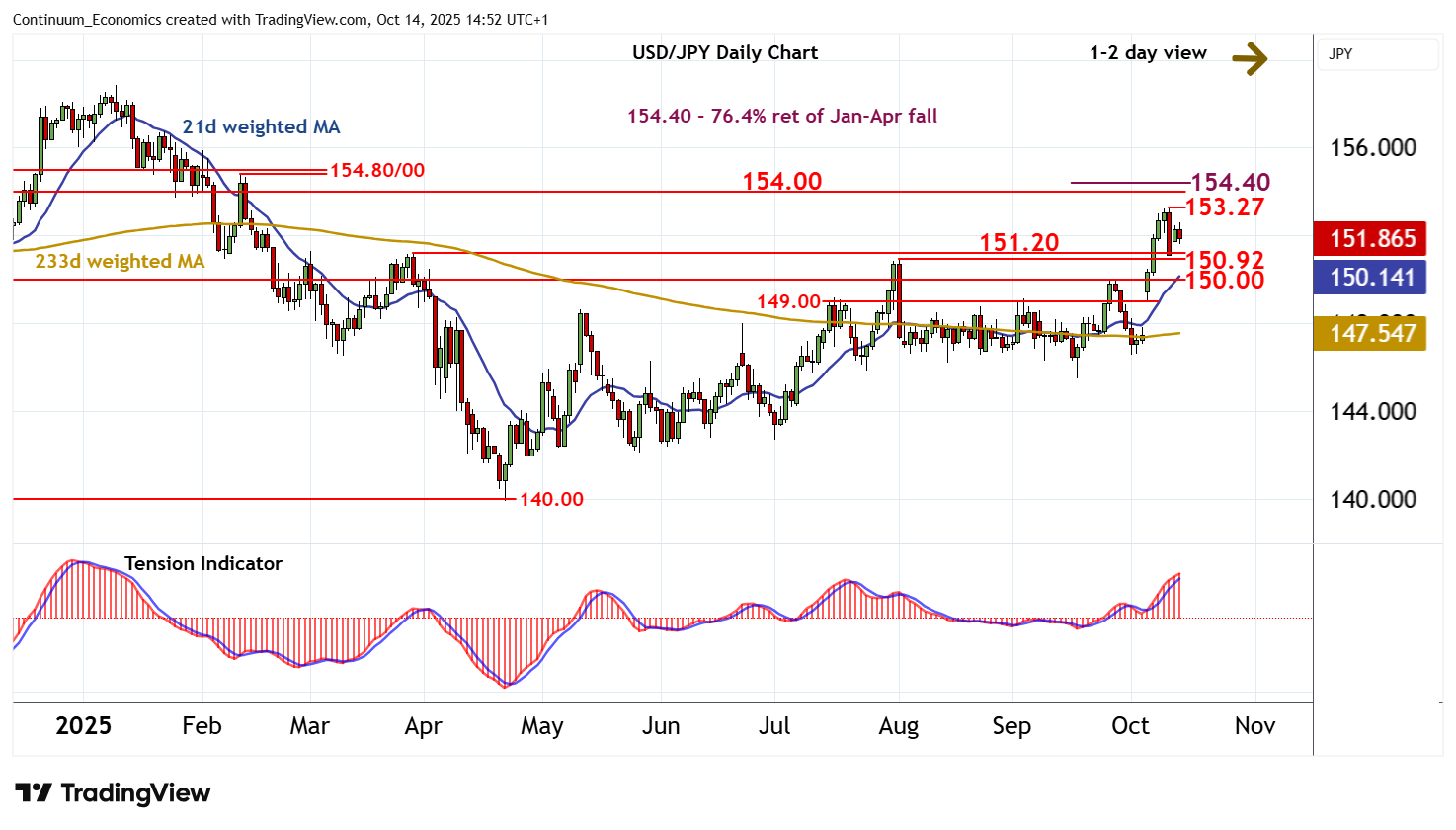

Chart USD/JPY Update: Consolidating

Little change, as mixed intraday studies keep near-term sentiment cautious

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 154.80/00 | ** | 12 Feb (w) high; cong | S1 | 150.92/10 | ** | Mar-Aug (m) highs | |

| R3 | 154.40 | ** | 76.4% ret of Jan-Apr fall | S2 | 150.00 | ** | congestion | |

| R2 | 154.00 | ** | congestion | S3 | 149.00 | * | congestion | |

| R1 | 153.25~ | * | 10 Oct YTD high | S4 | 148.00 | * | break level |

Asterisk denotes strength of level

14:30 BST - Little change, as mixed intraday studies keep near-term sentiment cautious and extend consolidation around 152.00. Overbought daily stochastics are unwinding, highlighting room for a drift lower towards support at the 150.92 - 151.10 monthly highs from March-August. But the rising daily Tension Indicator and mixed weekly charts are expected to limit any break in renewed consolidation above congestion around 150.00. Meanwhile, resistance remains at the 153.25~ current year high of 10 October. A close above here, not yet seen, will turn sentiment positive and extend April gains towards critical resistance at congestion around 154.00 and the 154.40 Fibonacci retracement.