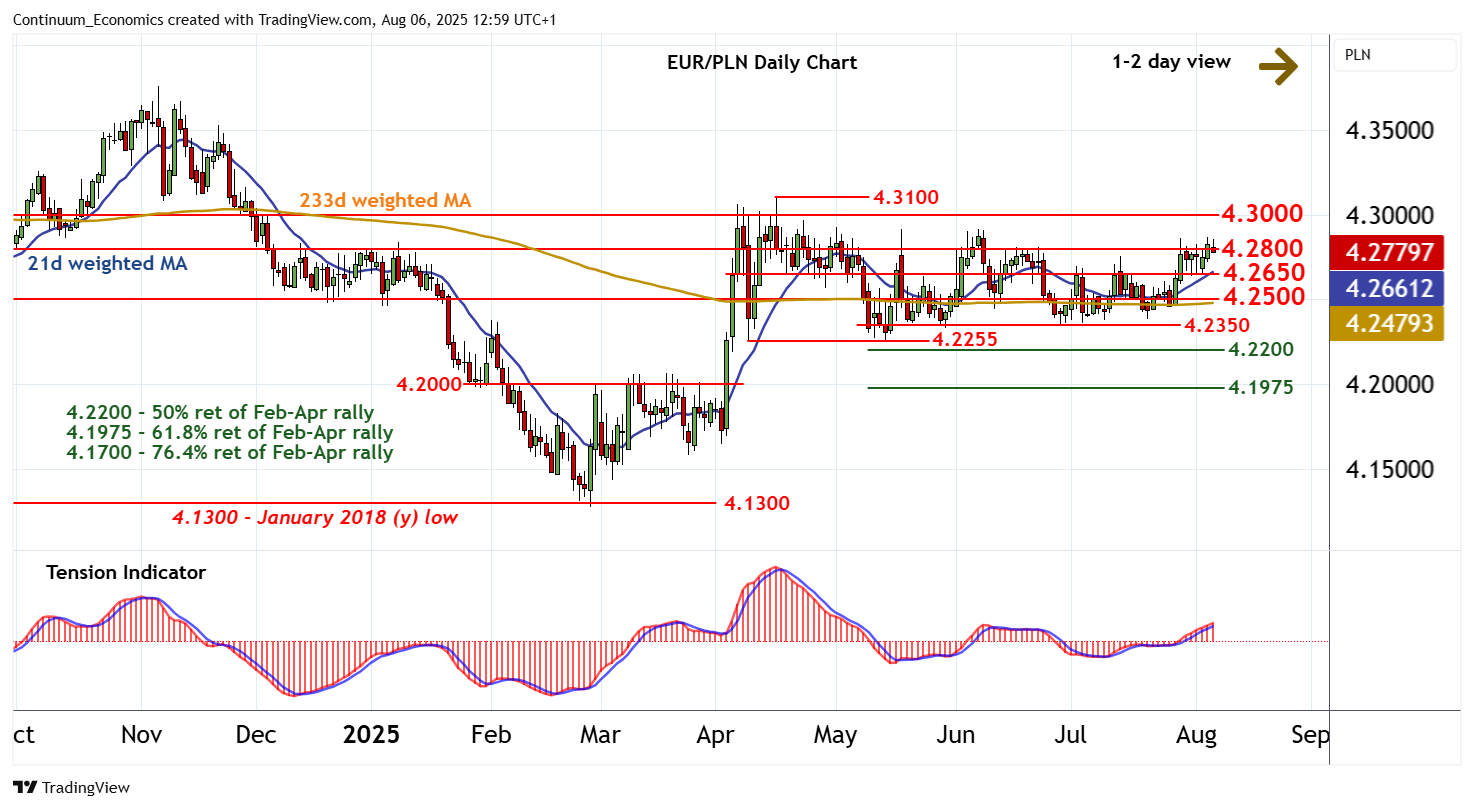

Chart EUR/PLN Update: Choppy in range

The anticipated break above 4.2800 has proven short-lived

| Levels | Imp | Comment | Levels | Imp | Comment | |||

| R4 | 4.3200 | * | break level | S1 | 4.2650 | * | break level | |

| R3 | 4.3100 | ** | 16 Apr YTD high | S2 | 4.2500 | * | congestion | |

| R2 | 4.3000 | * | break level | S3 | 4.2350 | * | congestion | |

| R1 | 4.2800 | ** | congestion | S4 | 4.2200/55 | ** | 50% ret; 9 Apr (w) low |

Asterisk denotes strength of level

12:35 BST - The anticipated break above 4.2800 has proven short-lived, as overbought intraday studies unwind, with prices falling from 4.2860 to once again trade around 4.2800. Overbought daily stochastics are unwinding, highlighting room for a test lower. But the flat daily Tension Indicator and rising weekly charts should limit downside scope in renewed buying interest towards support at 4.2650. Following cautious trade, fresh gains are looked for. A close back above 4.2800 will improve sentiment. But a close above critical resistance at the 4.3100 current year high of 16 April is needed to turn sentiment positive and confirm continuation of broad February gains.