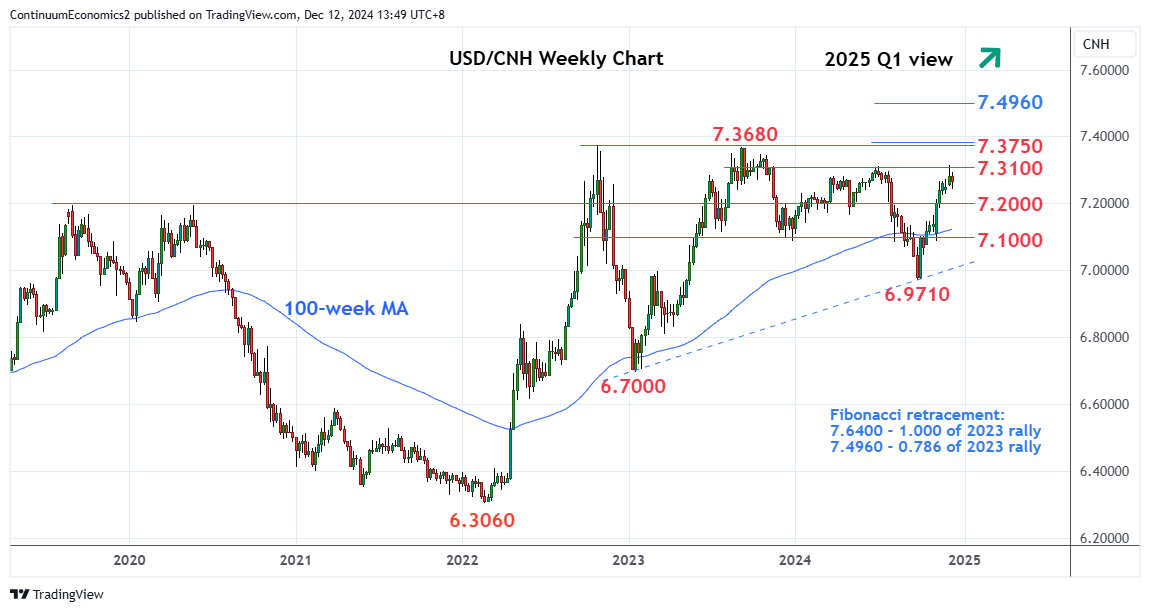

Rebound from the 6.9710 low has given way to strong rally to retrace all the losses from the Q3 and current year high at 7.3100

Rebound from the 6.9710 low has given way to strong rally to retrace all the losses from the Q3 and current year high at 7.3100 before settling back in consolidation.

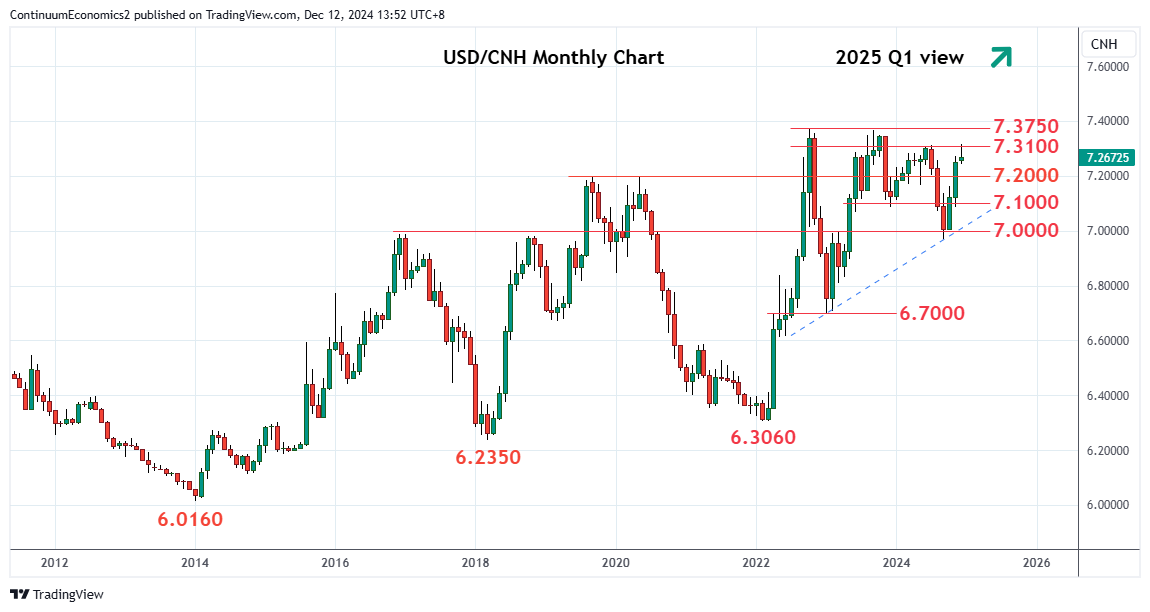

Consolidation see prices unwinding the overbought daily studies but a later break here cannot be ruled out. Clearance will see room to extend gains from the September YTD low at 6.9710 to target the 7.3500 level. Break here will turn focus to the critical 2023 and 2022 year highs at 7.3680 and 7.3750 which are expected to cap. Break here, will open up room for further extension to the 7.4000 figure. Beyond this, if seen, will see scope for extension to projection target at 7.4960 and the nearby 7.5000 figure.

Meanwhile, support is raised to the 7.2250 congestion which extend to the 7.2000 figure as well as the 2019 and 2020 year highs. This area now expected to underpin and sustains bullish run-up from the September YTD low. Would take break of the latter to return focus to the downside for retest of the strong support at the 7.1000 level and the 7.0000 figure.