Published: 2025-07-15T08:21:26.000Z

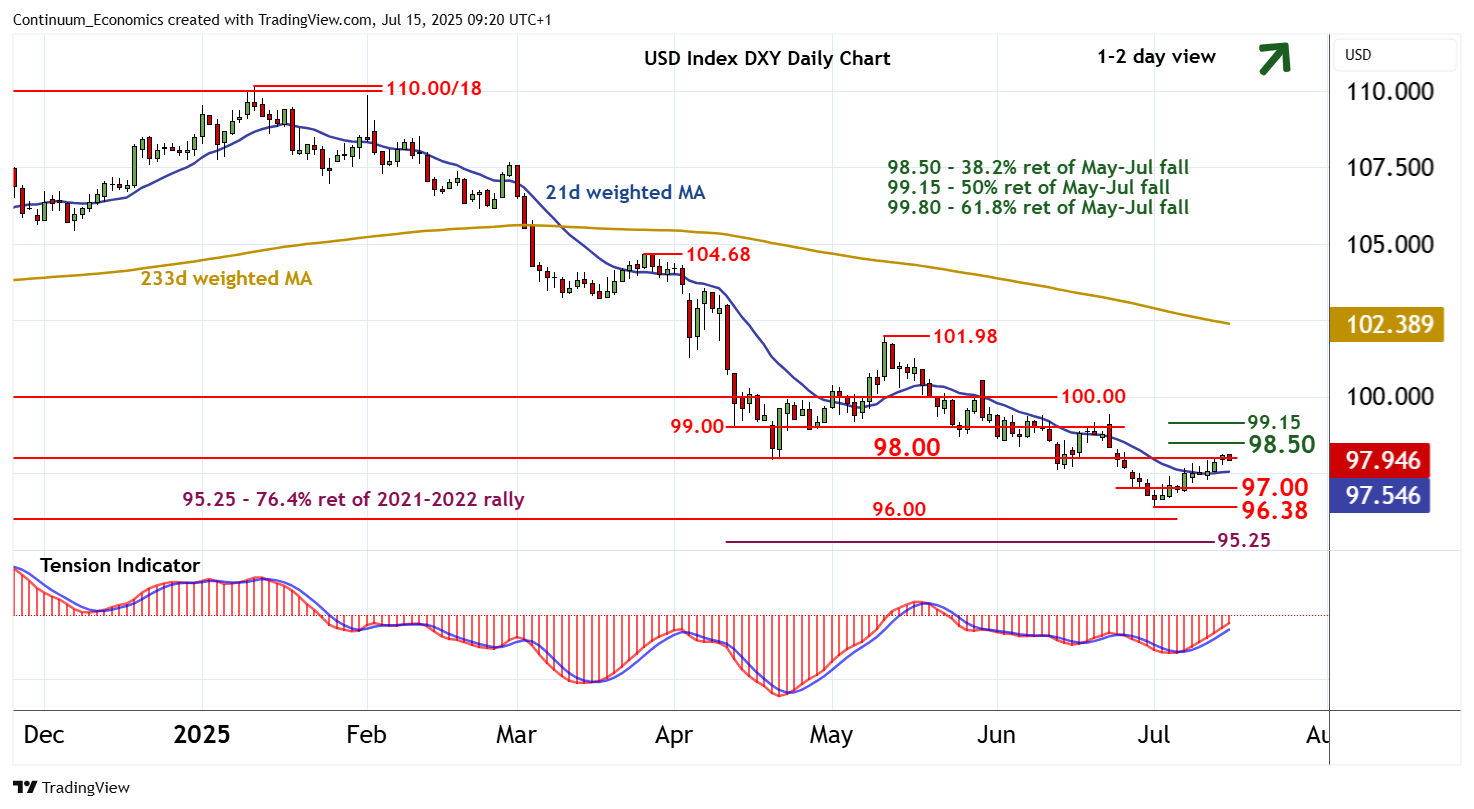

Chart USD Index DXY Update: Balanced around 98.00 - background studies rising

Senior Technical Strategist

-

The anticipated test above congestion resistance at 98.00 has met selling interest at 98.15~

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 99.15 | ** | 50% ret of May-Jul fall | S1 | 97.00 | * | congestion | |

| R3 | 99.00 | break level | S2 | 96.50 | * | congestion | ||

| R2 | 98.50 | * | 38.2% ret of May-Jul fall | S3 | 96.38 | * | 1 Jul YTD low | |

| R1 | 98.00 | * | congestion | S4 | 96.00 | ** | congestion |

Asterisk denotes strength of level

09:05 BST - The anticipated test above congestion resistance at 98.00 has met selling interest at 98.15~, as overbought intraday studies unwind and overbought daily stochastics flatten, with prices currently balanced around 98.00. A minor pullback is possible, but the rising daily Tension Indicator and positive weekly charts should limit downside risks in renewed buying interest above congestion support at 97.00. In the coming sessions, cautious trade is expected to give way to fresh gains. A close above 98.00 will improve price action and extend July gains towards the 98.50 Fibonacci retracement. Beyond here is 99.00/15, but already overbought daily stochastics could limit any initial tests of this range in fresh consolidation.