Published: 2025-07-25T10:51:41.000Z

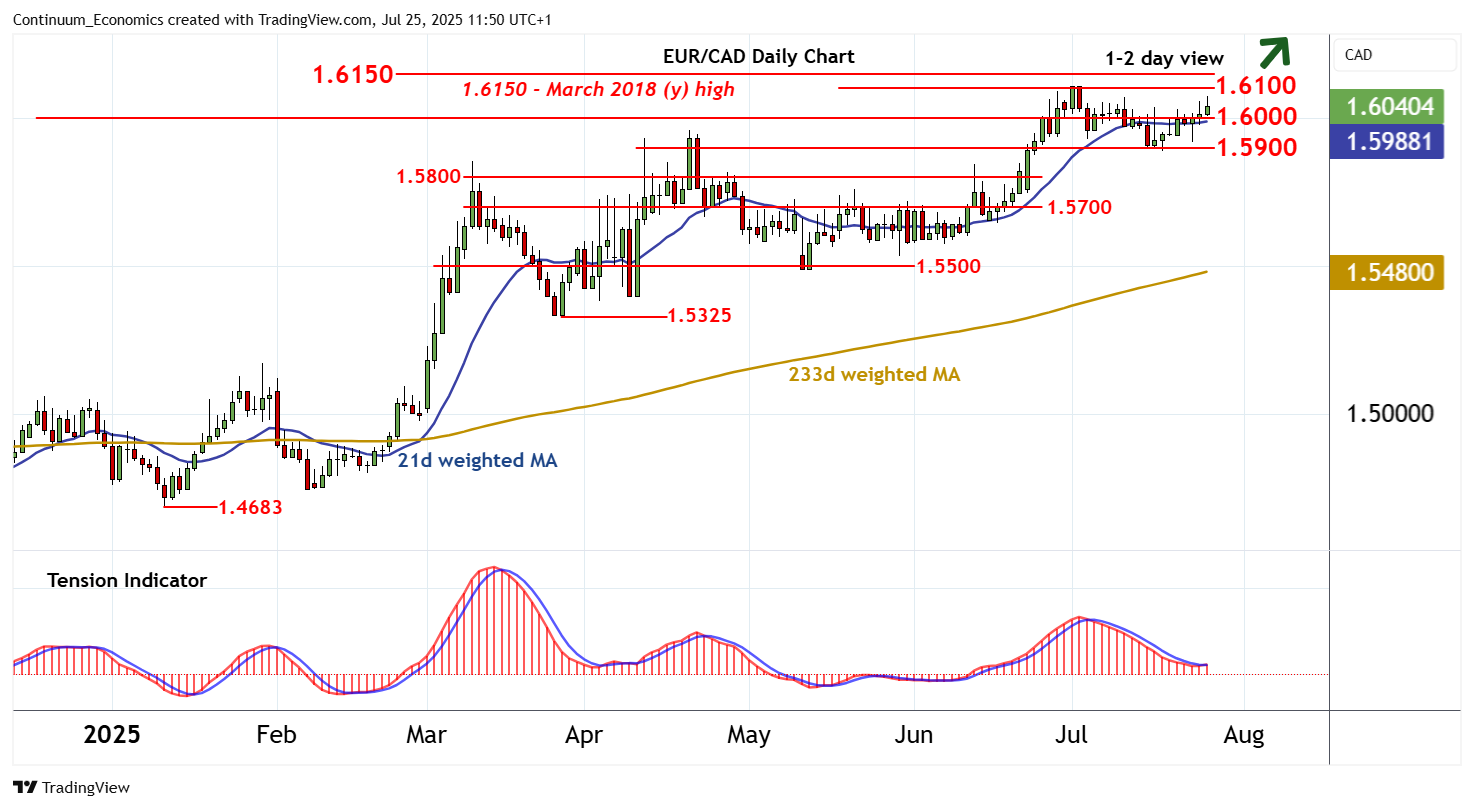

Chart EUR/CAD Update: Critical resistance at 1.6100/09

Senior Technical Strategist

-

Minor consolidation around 1.6000 has given way to further gains to 1.6075

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.6325/30 | ** | June-July 2009 highs | S1 | 1.6000 | ** | congestion | |

| R3 | 1.6200 | historic congestion | S2 | 1.5900 | congestion | |||

| R2 | 1.6150~ | ** | March 2018 (y) high | S3 | 1.5800 | congestion | ||

| R1 | 1.6100/09 | * | cong; 1 Jul YTD high | S4 | 1.5700 | break level |

Asterisk denotes strength

11:30 BST - Minor consolidation around 1.6000 has given way to further gains to 1.6075, where flattening overbought intraday studies are prompting a pullback to 1.6050. Daily readings continue to rise, pointing to room for continuation towards critical resistance at congestion resistance at 1.6100 and the 1.6109 current year high of 1 July. However, mixed/negative weekly charts are expected to limit any initial tests in fresh consolidation. A close above here would turn sentiment positive and extend August 2022 gains towards the 1.6150~ year high of March 2018. Meanwhile, a close back below congestion support at 1.6000 will turn price action neutral and give way to consolidation above further congestion around 1.5900.