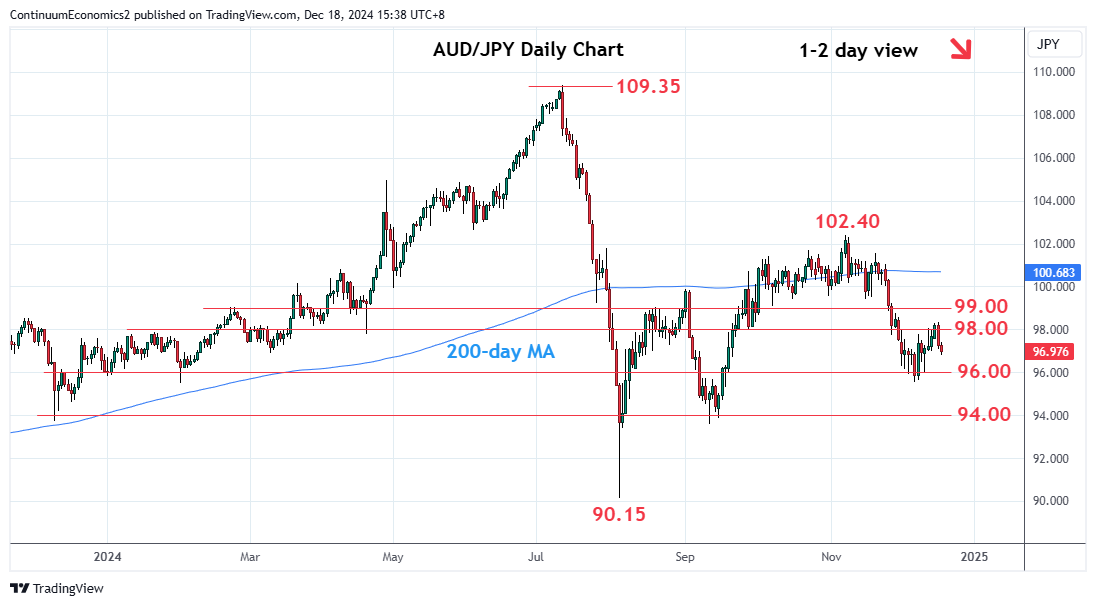

Limited on break above the 98.00/15 level and 38.2% Fibonacci level

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 99.42 | ** | 15 Dec low | S1 | 96.00 | * | congestion | |

| R3 | 99.00 | * | Aug high | S2 | 95.52 | ** | 6 Dec low | |

| R2 | 98.35 | * | 17 Dec high | S3 | 94.80 | * | 61.8% Aug/Nov rally | |

| R1 | 97.80 | * | 9 Dec high | S4 | 93.60 | ** | Sep low |

Asterisk denotes strength of level

07:45 GMT - Limited on break above the 98.00/15 level and 38.2% Fibonacci level with corrective bounce coming under selling pressure at the 98.35 high. Break of the 97.00 congestion will see room for extension to retest the 96.00 level and 95.52 low. Below this will see deeper pullback to retrace the August/November rally to 94.80, 61.8% Fibonacci retracement. Lower still will see retest of the 93.60, September low. Meanwhile, resistance at the 97.80/98.35 area now expected to cap and sustain losses from the November high.