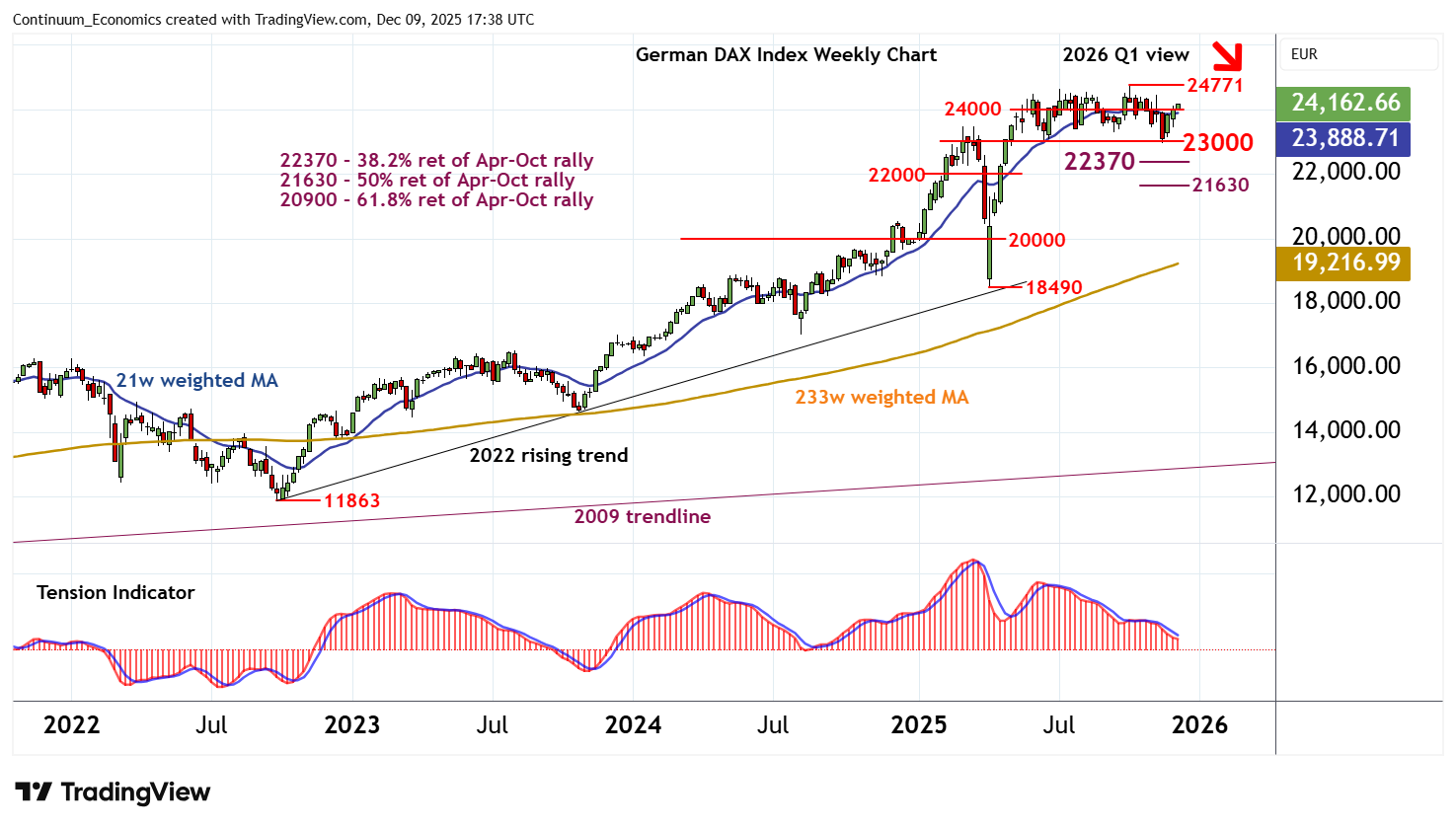

Chartbook: DAX Chart: Balanced at fresh highs - room for a corrective pullback before higher levels unfold

After posting fresh marginal contract highs at 24771, prices have bounced from congestion support at 23000 to trade around 24000

After posting fresh marginal contract highs at 24771, prices have bounced from congestion support at 23000 to trade around 24000.

Weekly stochastics are rising, suggesting potential for fresh tests higher.

But the negative weekly Tension Indicator should limit any gains in renewed selling interest beneath 24771.

In the coming weeks, cautious trade is expected to give way to fresh losses, with focus to turn back to congestion around 23000. A break beneath here will complete a multi-month distribution top and extend October losses towards the 22370 Fibonacci retracement.

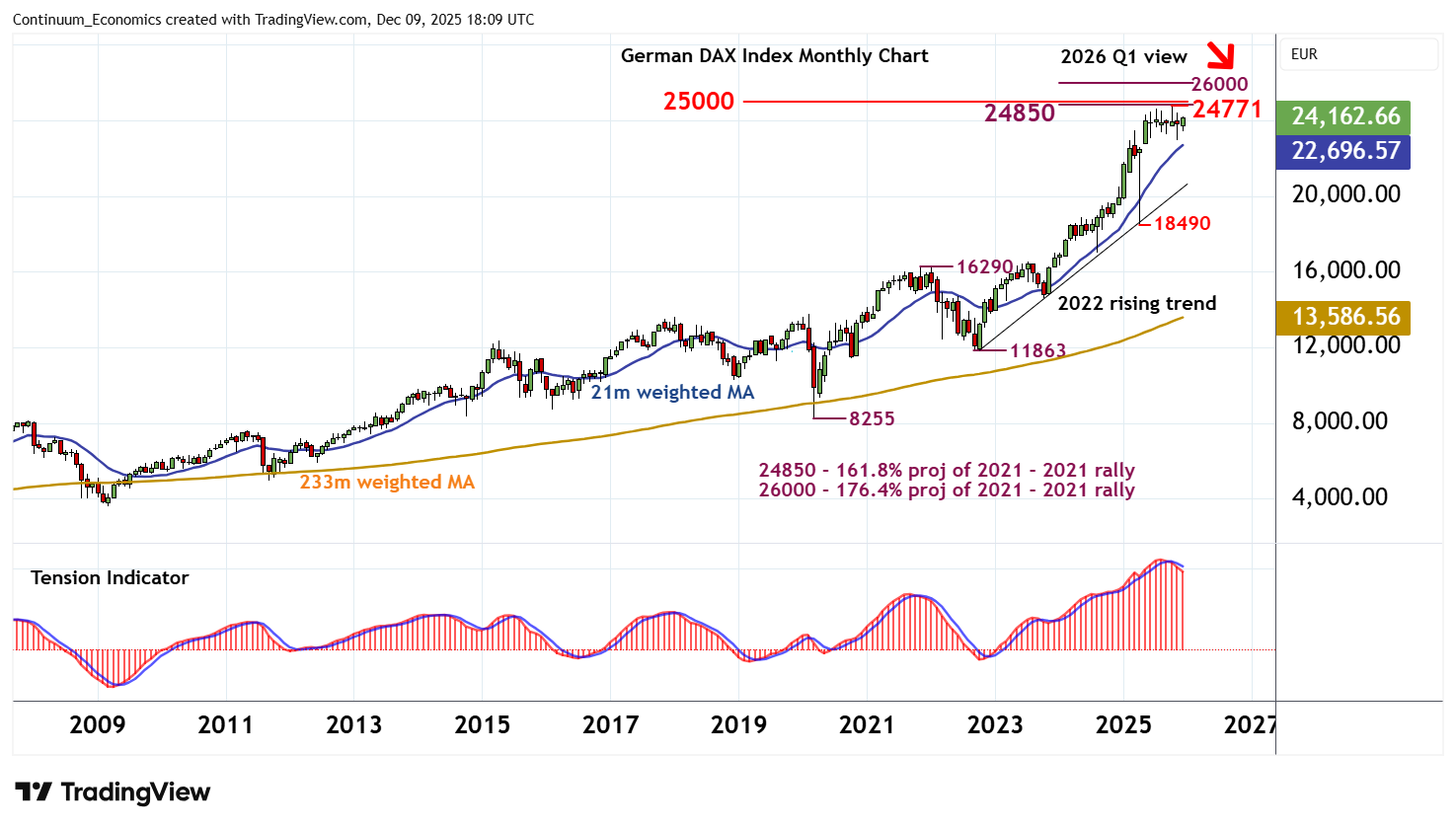

Deteriorating monthly charts highlight room for still deeper losses.

Meanwhile, resistance is at the 24771 contract high of 9 October and extends to the 24850 Fibonacci projection and psychological barrier at 25000.

The negative monthly Tension Indicator is expected to limit any tests of this critical range in profit-taking.

However, a close above here, if seen, will turn sentiment positive and extend long-term bull trends to fresh contract highs, focusing on the 26000 projection.