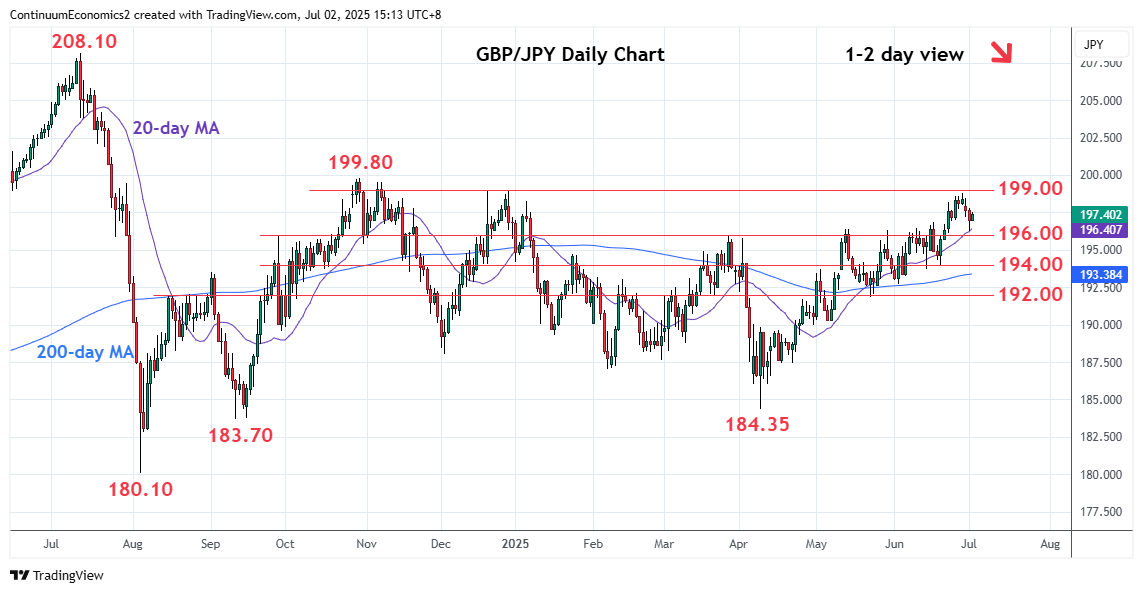

Leaning lower from the June current year high at 198.80 as prices unwind overbought daily studies

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 200.70 | * | 23 Jul 2024 low | S1 | 196.40/00 | * | May high, congestion | |

| R3 | 199.80 | ** | Oct high | S2 | 194.00 | ** | congestion | |

| R2 | 198.80/00 | ** | 27 Jun YTD high, congestion | S3 | 193.30 | * | 38.2% Apr/Jun rally | |

| R1 | 198.00 | * | congestion | S4 | 192.00 | * | 22 May low, congestion |

Asterisk denotes strength of level

07:20 GMT - Leaning lower from the June current year high at 198.80 as prices unwind overbought daily studies. Bounce from the 196.40/00 support area see prices unwinding the oversold intraday studies but this is expected to meet with fresh selling pressure later. Break of the 196.40/00 support will fade the upside pressure and see deeper retracement of the April/June rally to the 194.00 congestion then 193.30, 38.2 Fibonacci level. Meanwhile, resistance is lowered to 198.00 congestion which is expected to cap and sustain losses from the 198.80 high.