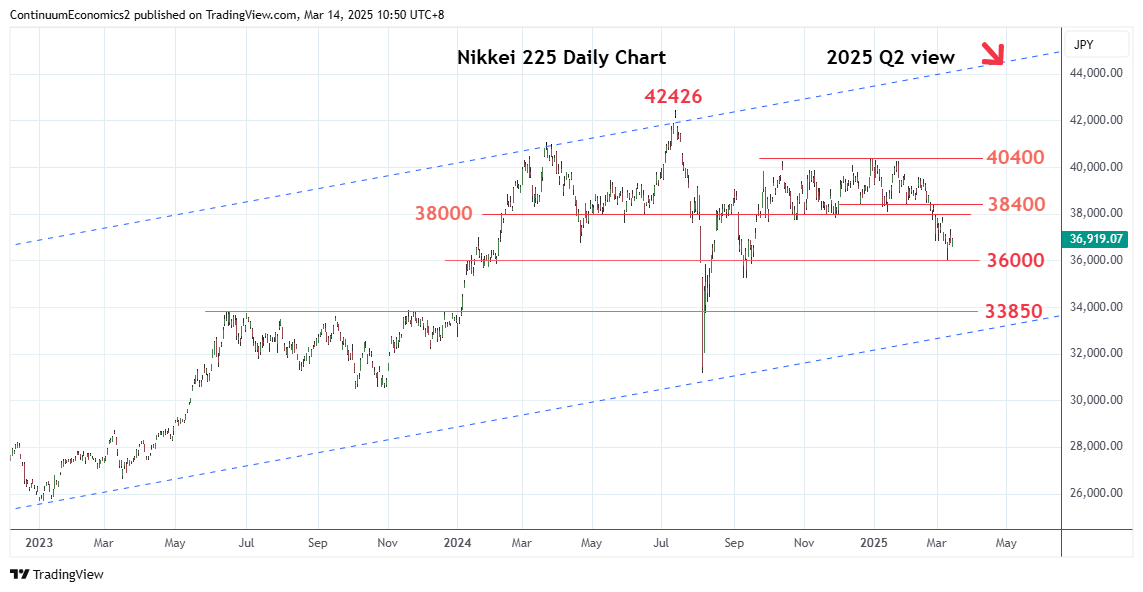

Choppy trade within the 40400/38000 range area through 2024 Q4 extended into the new year before giving way to selling pressure at the end of February.

Breakdown and extension through the 37500 congestion has seen losses to reach support at the 36000 level and the 100-week EMA. Consolidation here see prices unwinding oversold daily studies but this is expected to give way to deeper pullback within the bullish channel from the 2020 year low. Lower will see room to the September low at 35248 then the strong support at the 33850, the 2023 year high. Failure to hold the latter will see further extension to channel support at the 33000 level. Lower still, will see room to 32470, 38.2% Fibonacci level, then 31156 the August 2024 year low.

Meanwhile, resistance is lowered to the 38000/38400 previous congestive lows before the breakdown to the 36000 low. This area now expected to cap corrective bounce and sustain losses from the 40000/40400 congestion and December high.