Published: 2025-06-18T15:43:11.000Z

Chartbook: Chart USD/CHF: Choppy above 2025 lows - studies under pressure

0

1

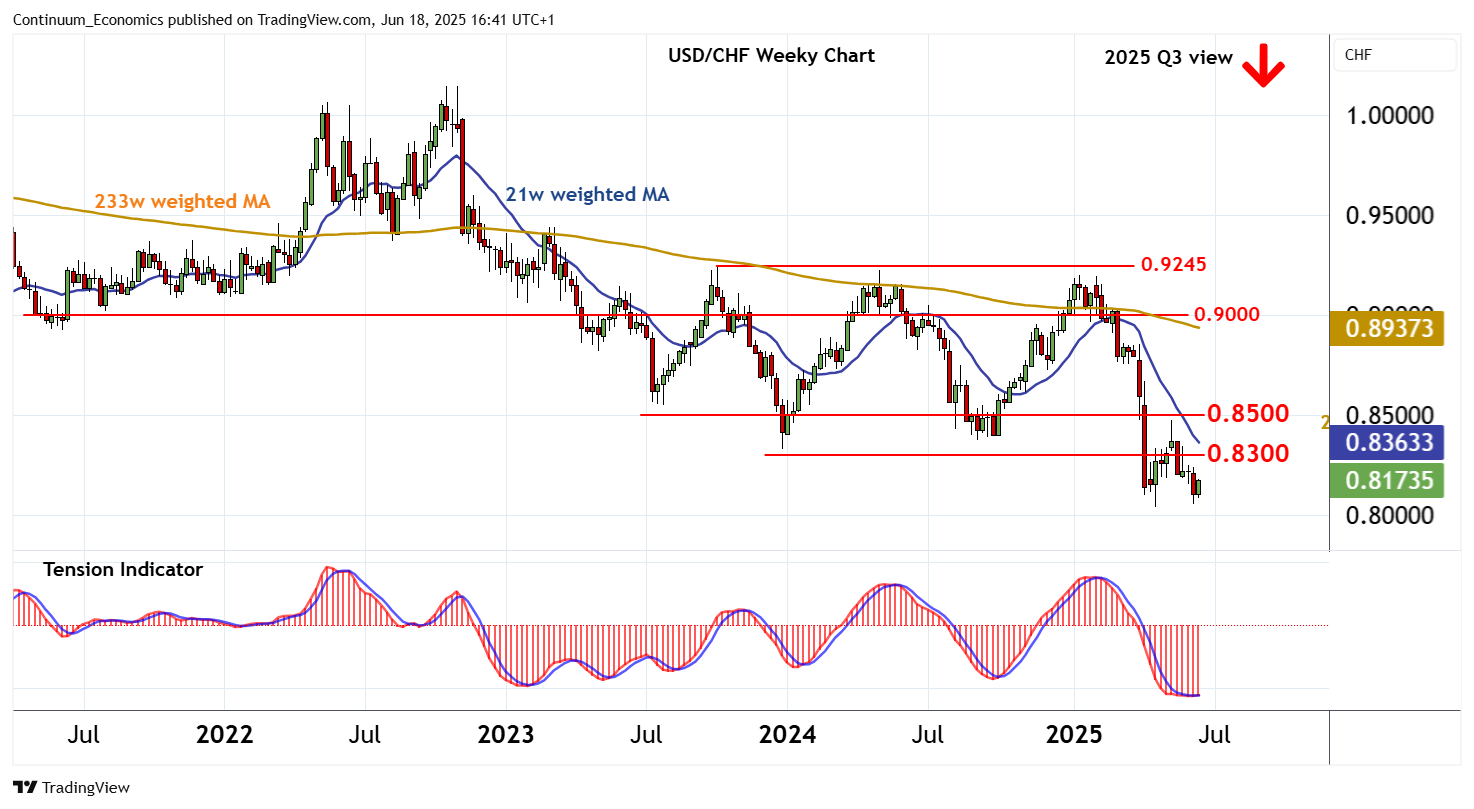

Anticipated losses have extended, with prices posting a fresh 2025 year low around 0.8035 before settling into choppy trade beneath 0.8300

Anticipated losses have extended, with prices posting a fresh 2025 year low around 0.8035 before settling into choppy trade beneath 0.8300.

Monthly stochastics continue to point lower and the monthly Tension Indicator is also bearish, highlighting room for further losses into the coming weeks/months.

Support is at the psychological 0.8000. A break beneath here will add weight to already bearish sentiment and extend losses from the 1.0345 year high of December 2016 and multi-year range top towards the 0.7850 Fibonacci retracement.

However, monthly stochastics are already oversold, suggesting any initial tests could give way to consolidation, before negative longer-term readings extend losses still further.

A close beneath here will open up the 0.7710 low of September 2011, with room for still deeper losses in the following months.

Meanwhile, resistance is at 0.8300.

Rising weekly studies highlight potential for a test above here in the coming weeks, towards strong resistance at the 0.8500 break level.

However, negative monthly studies are expected to prompt renewed selling interest into any tests.

A close above 0.8500, if seen, would turn sentiment cautiously positive and extend gains back into the broad consolidation pattern from July 2023. Fresh selling interest is expected to appear towards 0.9000.