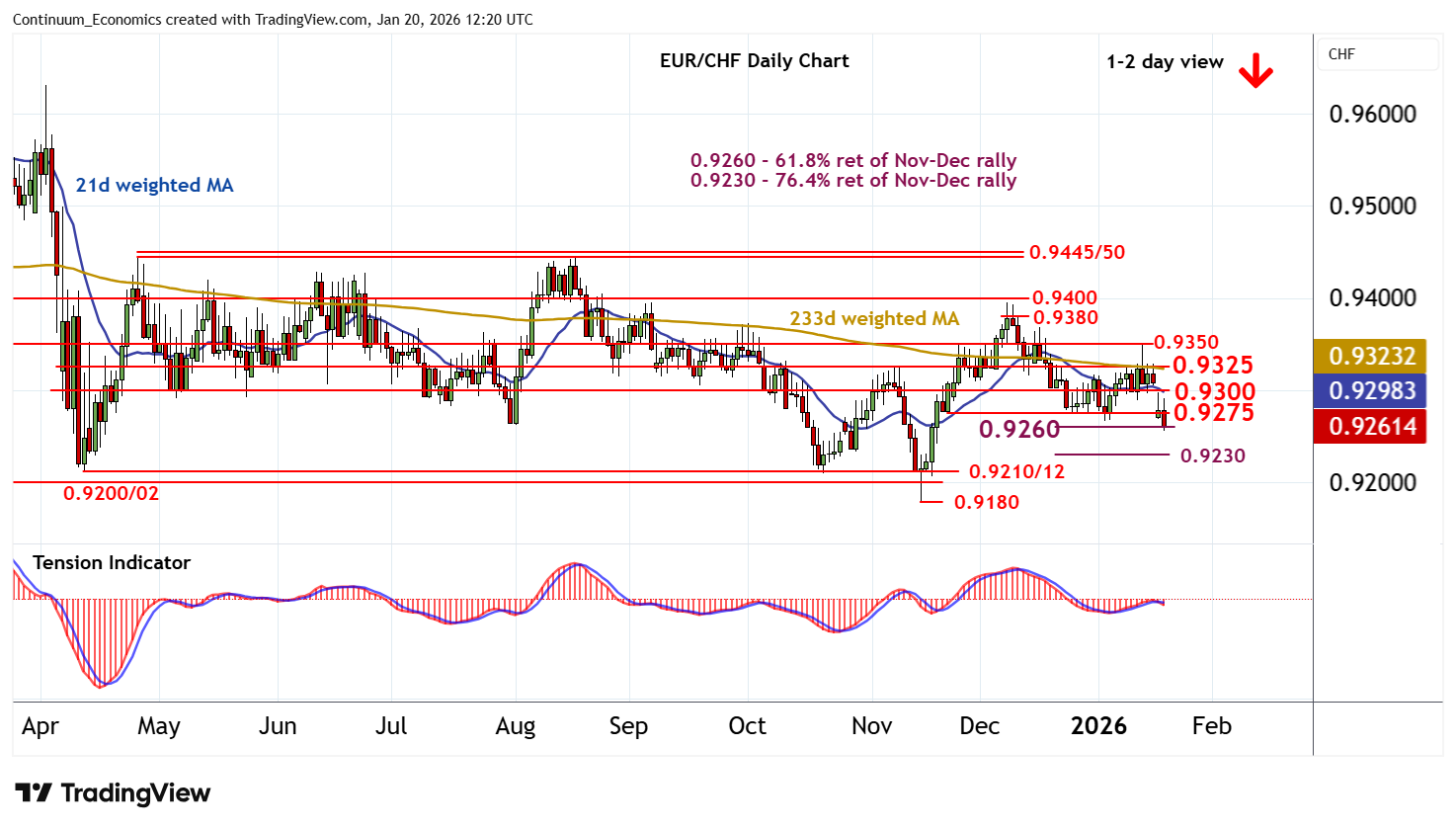

Chart EUR/CHF Update: Pressuring strong support - studies under pressure

Anticipated selling interest has reached support within the 0.9275 congestion lows and the 0.9260 Fibonacci retracement

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.9380 | break level | S1 | 0.9275 | ** | congestion lows | ||

| R3 | 0.9350 | ** | congestion | S2 | 0.9260 | ** | 61.8% ret of Nov-Dec rally | |

| R2 | 0.9325 | congestion | S3 | 0.9230 | ** | 76.4% ret of Nov-Dec rally | ||

| R1 | 0.9300 | ** | congestion | S4 | 0.9210/12 | ** | Apr-Oct (y) lows |

Asterisk denotes strength of level

12:10 GMT - Anticipated selling interest has reached support within the 0.9275 congestion lows and the 0.9260 Fibonacci retracement, as intraday studies turn down. Daily readings are also bearish and broader weekly charts are under pressure, highlighting room for further losses in the coming sessions. A break below this range will add weight to sentiment and extend early-December losses towards the 0.9230 retracement. However, by-then oversold daily stochastics could limit any initial tests in short-covering/consolidation. Meanwhile, resistance remains at congestion around 0.9300. A close above here, if seen, will help to stabilise price action and prompt consolidation beneath further congestion around 0.9325.