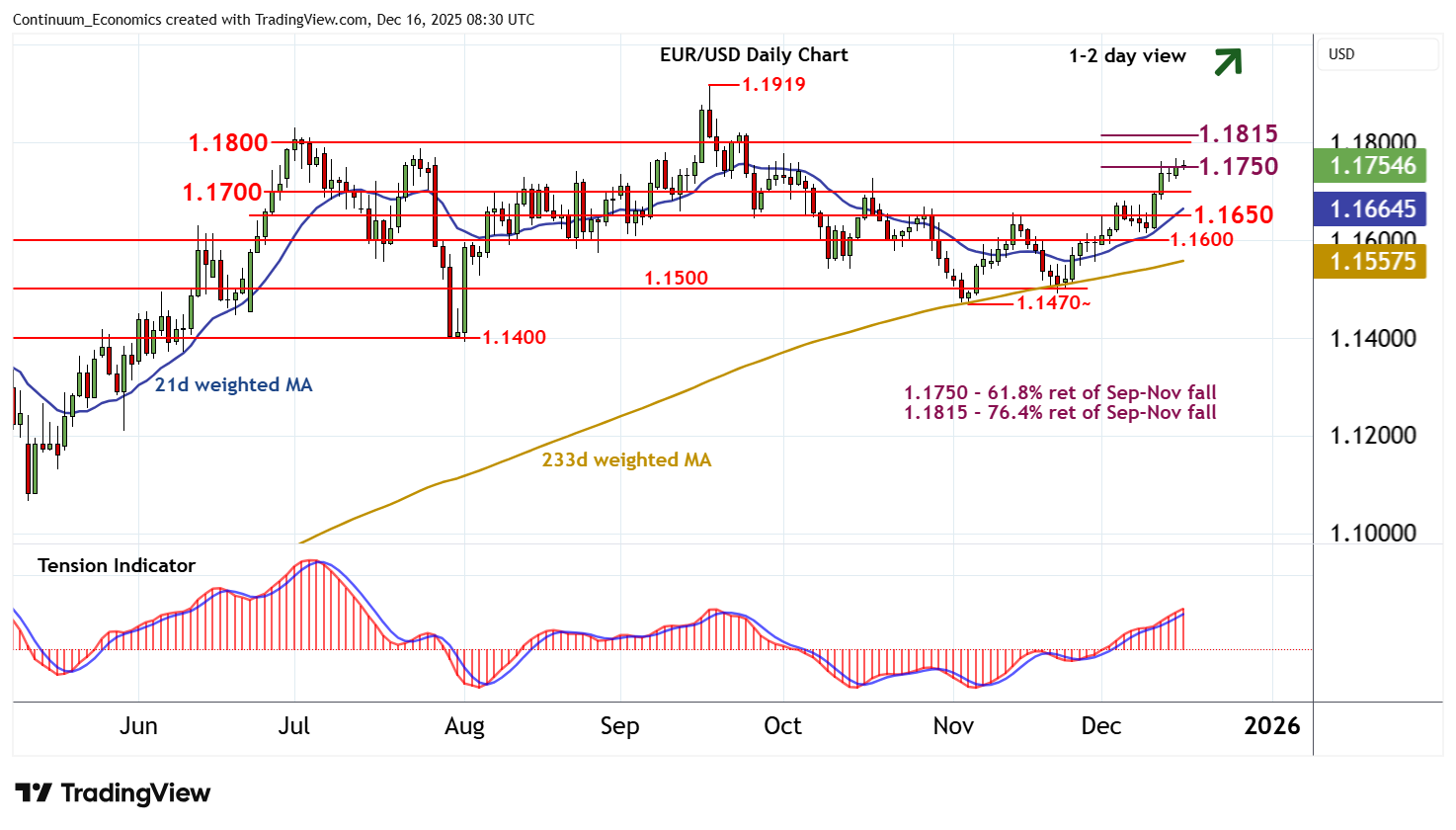

Chart EUR/USD Update: Balanced around the 1.1750 Fibonacci retracement - studies rising

Still little change, as mixed intraday studies keep near-term sentiment cautious

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.1919 | ** | 17 Sep YTD high | S1 | 1.1700 | * | congestion | |

| R3 | 1.1815 | ** | 76.4% ret of Sep-Nov fall | S2 | 1.1650 | * | congestion | |

| R2 | 1.1800 | * | congestion | S3 | 1.1600 | * | congestion | |

| R1 | 1.1750 | ** | 61.8% ret of Sep-Nov fall | S4 | 1.1550 | * | break level |

*Asterisk denotes strength of level

08:20 GMT - Still little change, as mixed intraday studies keep near-term sentiment cautious and extend consolidation around resistance at the 1.1750 Fibonacci retracement. Flat overbought daily stochastics highlight potential for further range trade, before the rising daily Tension Indicator and positive weekly charts prompt further gains. A close above 1.1750 will improve sentiment and extend November gains towards 1.1800/15, where already overbought daily stochastics could prompt profit-taking/consolidation. Meanwhile, support remains at congestion around 1.1700. A close beneath here, if seen, would turn sentiment neutral and prompt further consolidation above congestion around 1.1650.