2025 Q2 Shadow Credit Ratings to Download in Excel

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. We produce Shadow Credit Ratings for 162 countries, comparable to those from credit rating agencies.

The ratings are based on our Country Strength Index (CSI), which is our most comprehensive assessment across our full range of Country Insights data. The ratings are consistent with our 2025 Q2 Country Insights update.

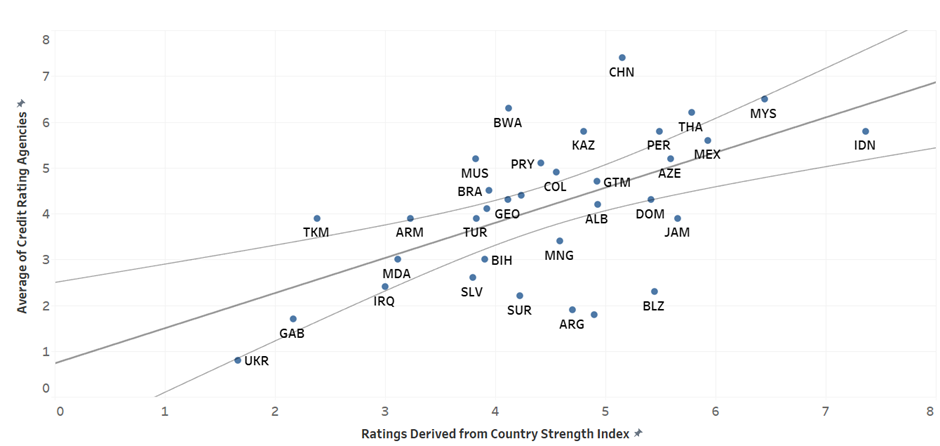

Figure 1 compares the average sovereign credit ratings assigned by major credit rating agencies with our Country Strength Index (CSI). Countries falling within the confidence band exhibit a close correlation between the two measures, suggesting that credit ratings are broadly aligned with underlying country fundamentals. This group includes selected upper middle-income economies as Moldova, Turkey, Georgia, Albania, Guatemala, Mexico, and others.

Several countries, however, fall below the confidence band, indicating that the CSI scores them more favorably than the rating agencies do. This may suggest that these countries are potentially underrated, with structural fundamentals stronger than reflected in their ratings. An example of this is Ukraine. In May 2025, Fitch Ratings affirmed Ukraine at Restricted Default (RD) and a month later S&P Global maintained the country’s rating at Selective Default (SD); similarly, Moody’s argues that “the impact of the war with Russia will continue to pose long-lasting challenges to Ukraine's economy and public finances”. Our model suggests, however, that while the country scores below average in the external adjustment capacity pillar, it is supported by the institutional robustness and social inclusion pillars and this would translate into a CCC rating.

Conversely, a number of countries appear above the confidence band, suggesting that credit rating agencies assign higher scores than warranted by their CSI values. A notable example is China, where the institutional robustness and the medium-term growth potential weighs down on the country’s strength index.

Figure 1: Shadow Ratings for Selected Upper Middle-Income Economies

Source: Continuum Economics

See Article Resources (below) to access the full range of scores.

| Article Resources |

| Country Insights Shadow Ratings Q2 2025.xlsx |

I,Marlon Chacon, the Senior Quantatitive Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.