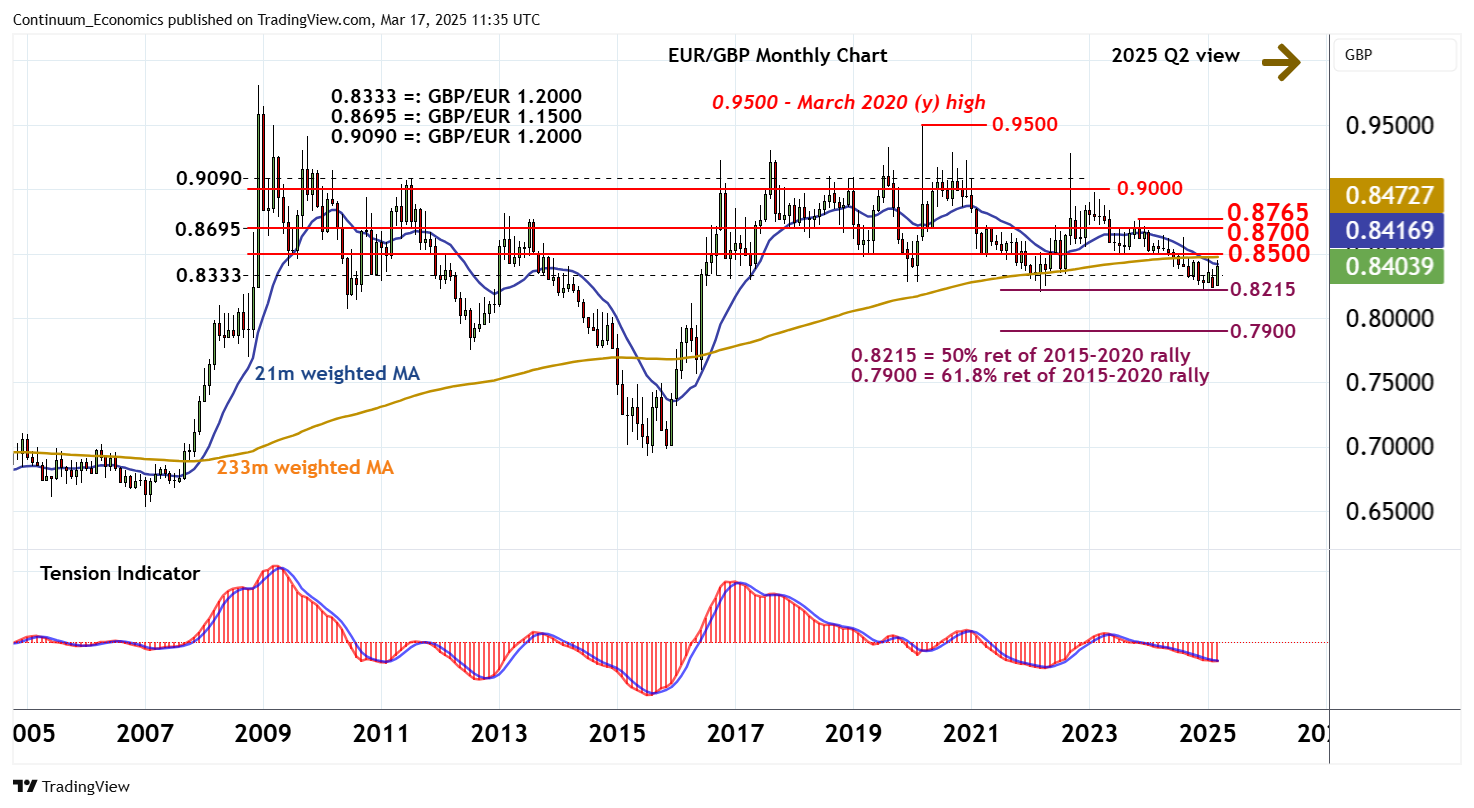

Chartbook: Chart EUR/GBP: Balanced above critical support at the 0.8215 Fibonacci retracement

The anticipated test of critical support at the 0.8215 multi-year Fibonacci retracement is giving way to choppy trade

The anticipated test of critical support at the 0.8215 multi-year Fibonacci retracement is giving way to choppy trade,

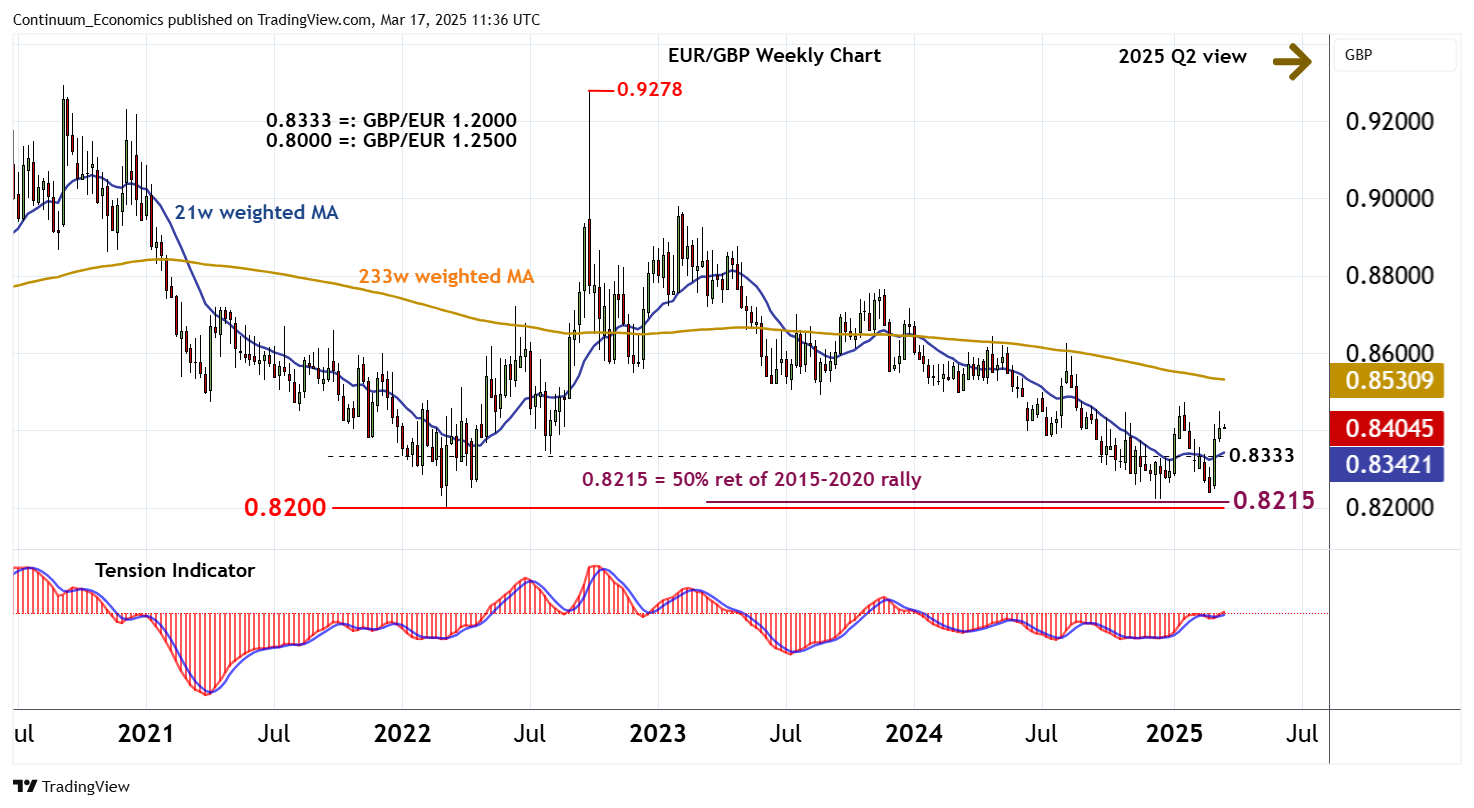

with prices currently balanced around 0.8400. (choppy) drift lower is posting fresh 2024 year lows around congestion support at 0.8350 and 0.8333, (GBP/EUR 1.2000).

Oversold monthly stochastics are unwinding and the monthly Tension Indicator is turning higher, highlighting an improvement in broad sentiment and potential for fresh gains in the coming weeks.

Resistance is at congestion around 0.8500.

A close above here is needed to improve price action and prompt further gains beyond congestion around 0.8600 towards strong resistance at 0.8695, (GBP/EUR 1.1500), and congestion around 0.8700. Just higher is the 0.8765 monthly high of November 2023. But mixed/negative multi-month studies are expected to limit any initial tests of this broad area in renewed consolidation.

Meanwhile, support is at 0.8333, (GBP/EUR 1.2000), and extends to critical support at 0.8215.

Rising weekly charts should limit any immediate tests of this area in consolidation.

But a close beneath here, if seen, would turn sentiment negative and extend March 2020 losses towards strong support at congestion around 0.8000 and the 0.7900 retracement.