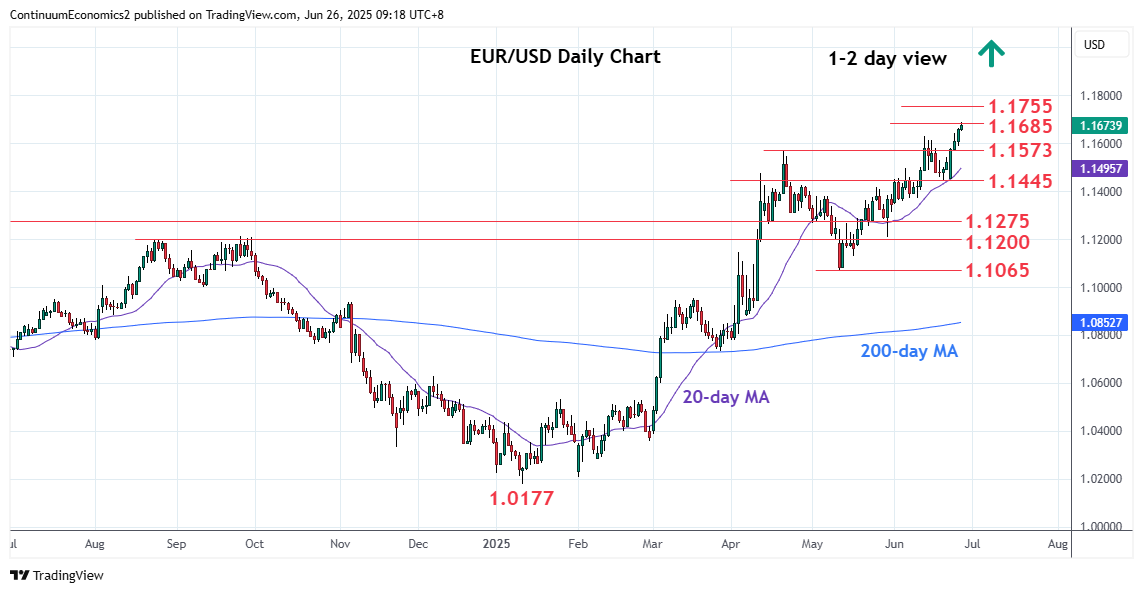

Extending bounce from Monday's low at 1.1445 to reach the 1.1685, 76.4% Fibonacci retracement

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.1800 | * | congestion | S1 | 1.1573 | * | Apr high | |

| 14 | 1.1755 | * | 22 Sep 2021 high | S2 | 1.1500 | * | congestion | |

| R2 | 1.1700 | ** | congestion | S3 | 1.1445 | ** | 19 Jun low | |

| R1 | 1.1685 | * | 76.4% 2021/2022 fall | S4 | 1.1400 | * | congestion |

Asterisk denotes strength of level

01:25 GMT - Extending bounce from Monday's low at 1.1445 to reach the 1.1685, 76.4% Fibonacci retracement. Nearby see room to the 1.1700 level where reaction can be expected to unwind overbought intraday studies. However, daily and weekly studies are still tracking higher and suggest consolidation giving way to break later to extend the broader gains from September 2022 low to 1.1755/1.1800 area. Meanwhile, support is raised to the 1.1600/1.1573 congestion and April high which should underpin and sustain bounce from the 1.1445 support.