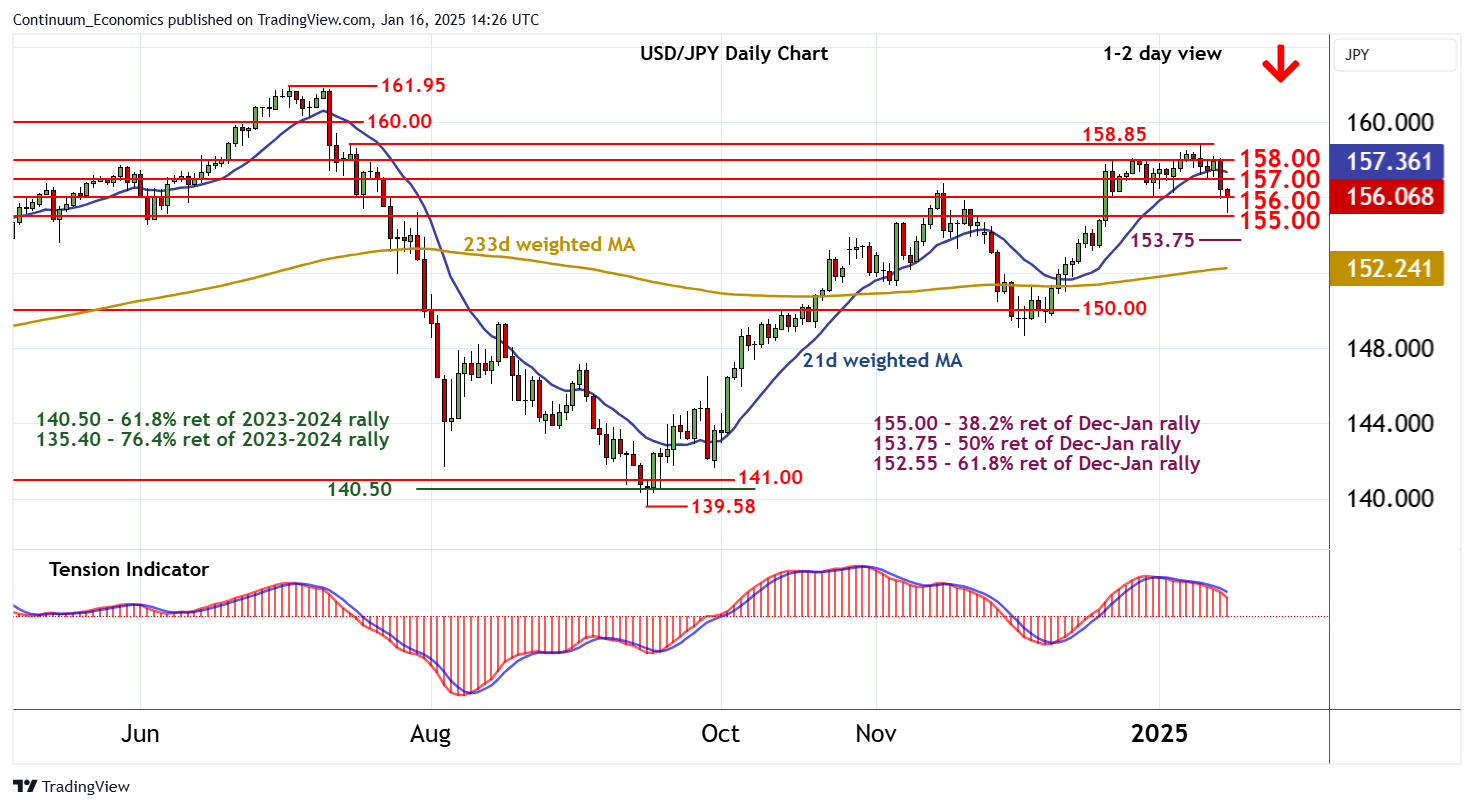

Chart USD/JPY Update: Prices remain under pressure

The anticipated break below 156.00 has bounced from just above congestion support at 155.00

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 160.00 | ** | break level | S1 | 156.00 | * | congestion | |

| R3 | 158.85 | ** | 16 Jul, 10 Jan (w) high | S2 | 155.00 | * | congestion | |

| R2 | 158.00 | * | congestion | S3 | 153.75 | ** | 50% ret of Dec-Jan rally | |

| R1 | 157.00 | * | congestion | S4 | 153.15 | ** | 17 Dec (w) low |

Asterisk denotes strength of level

14:05 GMT - The anticipated break below 156.00 has bounced from just above congestion support at 155.00, with prices currently balanced in cautious trade around 156.00. Daily stochastics are flat in oversold areas, suggesting room for further cautious trade into the coming sessions. However, the bearish daily Tension Indicator and deteriorating weekly charts highlight room for fresh losses. A later close below 156.00 will confirm a near-term top in place at 158.85, and extend losses towards further congestion around 155.00. Beneath here is the 153.75 Fibonacci retracement, where short-covering/consolidation could develop. Meanwhile, a close above congestion resistance at 157.00 would help to stabilise price action and prompt consolidation beneath further congestion around 158.00.