Published: 2026-01-09T09:19:29.000Z

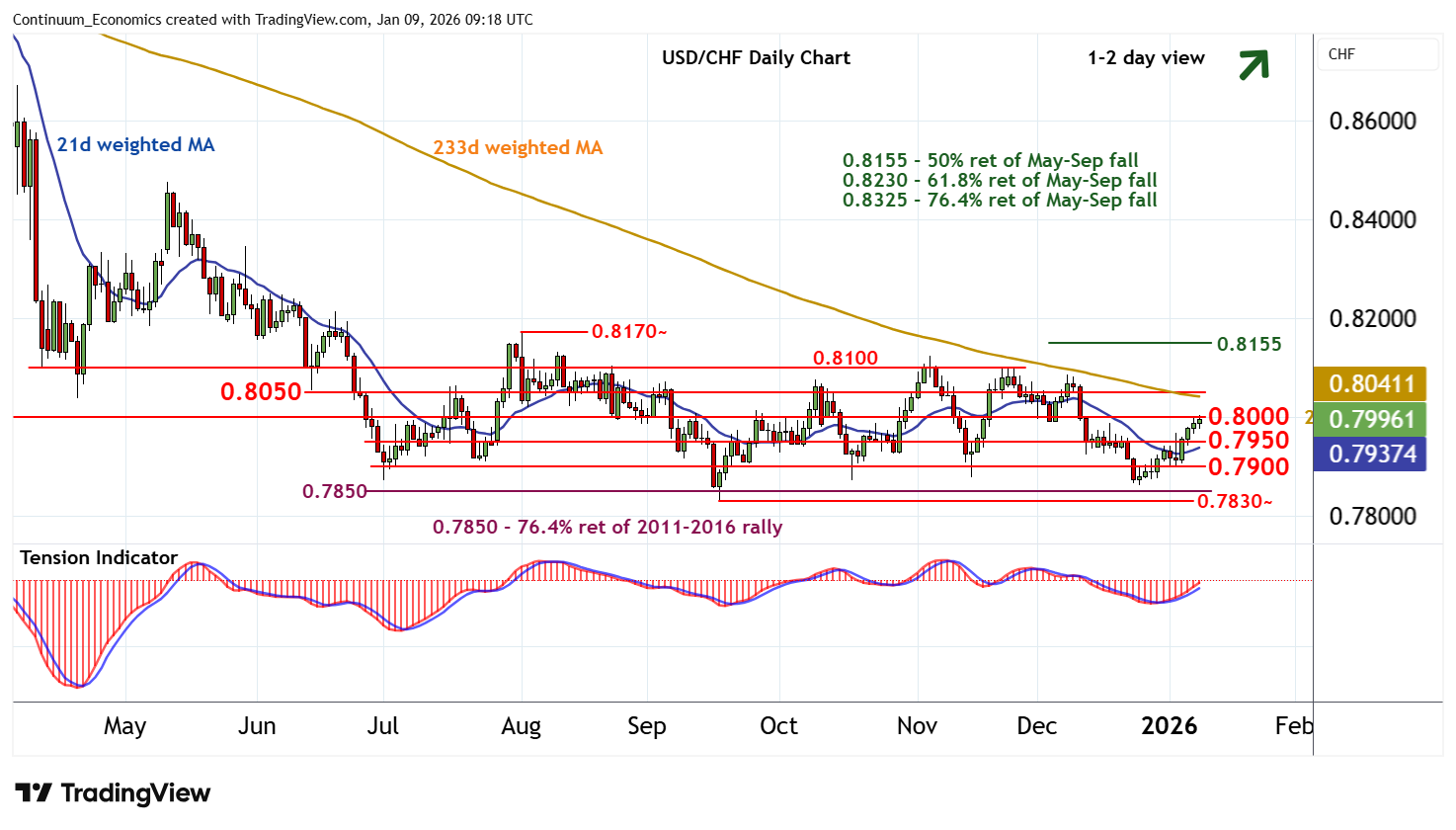

Chart USD/CHF Update: Limited scope above 0.8000

1

The anticipated drift higher has reached congestion resistance at 0.8000

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8155 | ** | 50% ret of May-Sep fall | S1 | 0.7950 | * | congestion | |

| R3 | 0.8100 | ** | break level | S2 | 0.7900 | * | congestion | |

| R2 | 0.8050 | break level | S3 | 0.7850 | ** | 76.4% ret of 2011-2016 rally | ||

| R1 | 0.8000 | ** | congestion | S4 | 0.7830~ | ** | 17 Sep 2025 (y) low |

Asterisk denotes strength of level

09:10 GMT - The anticipated drift higher has reached congestion resistance at 0.8000, where unwinding overbought intraday studies are prompting consolidation. The daily Tension Indicator continues to rise, highlighting room for a test above here. But flattening overbought daily stochastics and mixed weekly charts should limit scope in renewed consolidation beneath 0.8050. Meanwhile, a break back below congestion support at 0.7950, if seen, would help to stabilise price action and prompt fresh consolidation above further congestion around 0.7900.