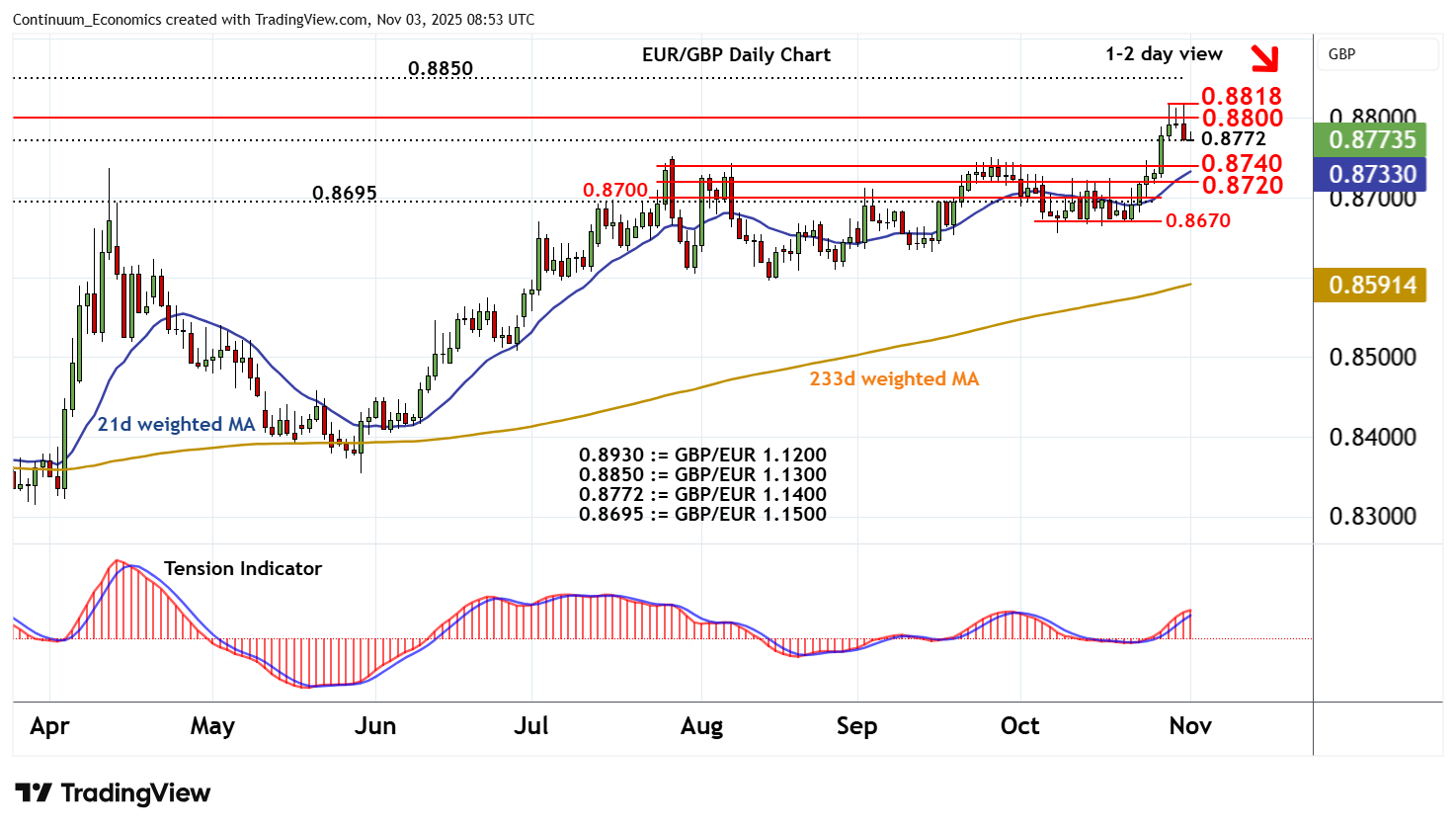

Chart EUR/GBP Update: Leaning lower

Cautious trade around 0.8800 has given way to a sharp pullback to support at 0.8772, (GBP/EUR 1.1400)

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8875 | * | April 2023 high | S1 | 0.8772 | * | GBP/EUR 1.1400 | |

| R3 | 0.8850 | * | GBP/EUR 1.1300, cong | S2 | 0.8740 | intraday break level | ||

| R2 | 0.8818 | * | 29 Oct YTD high | S3 | 0.8720 | congestion | ||

| R1 | 0.8800 | * | figure | S4 | 0.8695/00 | ** | GBP/EUR 1.1500; cong |

Asterisk denotes strength of level

08:45 GMT - Cautious trade around 0.8800 has given way to a sharp pullback to support at 0.8772, (GBP/EUR 1.1400), where short-term consolidation is developing. Overbought daily stochastics are unwinding and the positive daily Tension Indicator is flattening, suggesting room for a deeper losses. A break beneath 0.8772 will open up support within the 0.8720/40 range. But rising weekly charts are expected to limit any tests in renewed buying interest. Following corrective trade, fresh gains are looked for. Resistance is at 0.8800 and extends to the 0.8818 current year high of 29 October. A close above here will improve price action and extend December 2024 gains initially towards strong resistance at 0.8850.