Chartbook: Chart EUR/CHF: Range extension

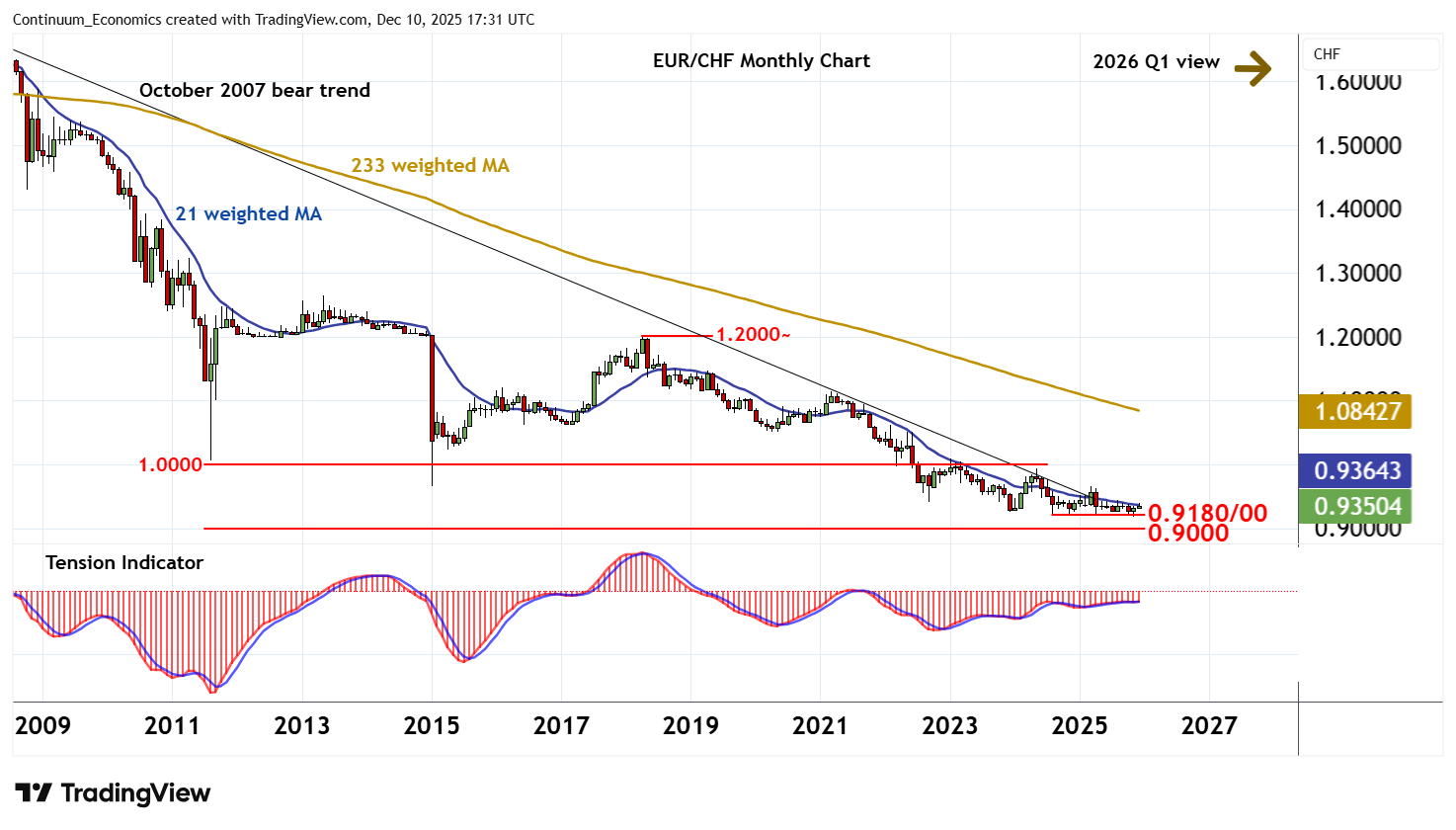

Anticipated tests lower have posted a fresh year low around 0.9180, before bouncing steadily to reach congestion resistance at 0.9400

Anticipated tests lower have posted a fresh year low around 0.9180, before bouncing steadily to reach congestion resistance at 0.9400.

Weekly charts are rising, highlighting room for a break above here towards the 0.9445 monthly high of 18 August.

Beyond here is congestion around 0.9500. But mixed monthly charts are expected to limit any tests of here in renewed selling interest/consolidation.

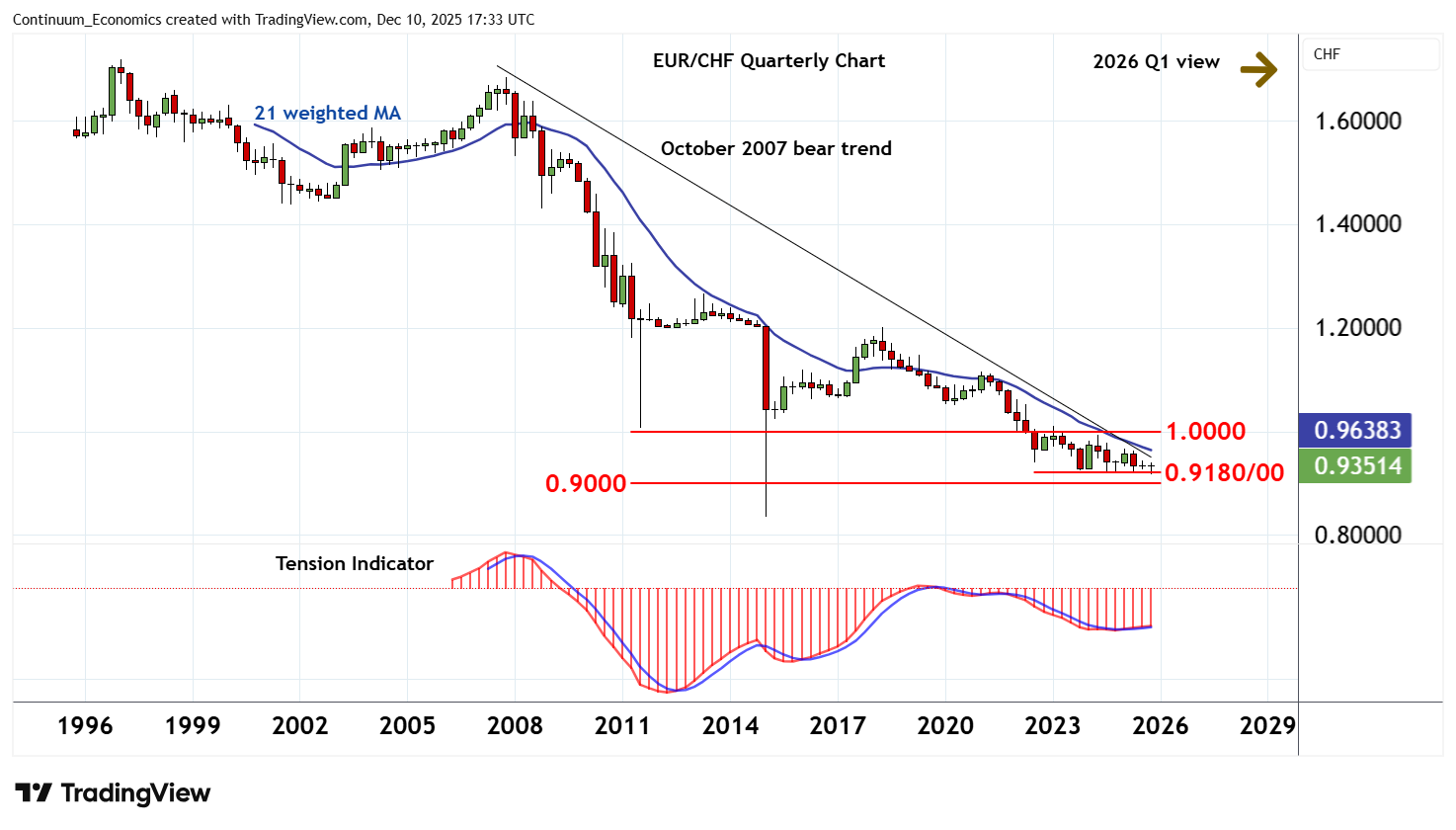

Meanwhile, critical support is down to 0.9180/00.

This is expected to underpin any immediate setbacks into early 2026 Q1, as mixed monthly readings keep long-term sentiment cautious and extend trade within the broad range from August 2024.

A break beneath here will add weight to sentiment and extend multi-year bear trends into fresh historic lows towards psychological support at 0.9000, where mixed longer-term charts could prompt short-covering/consolidation.