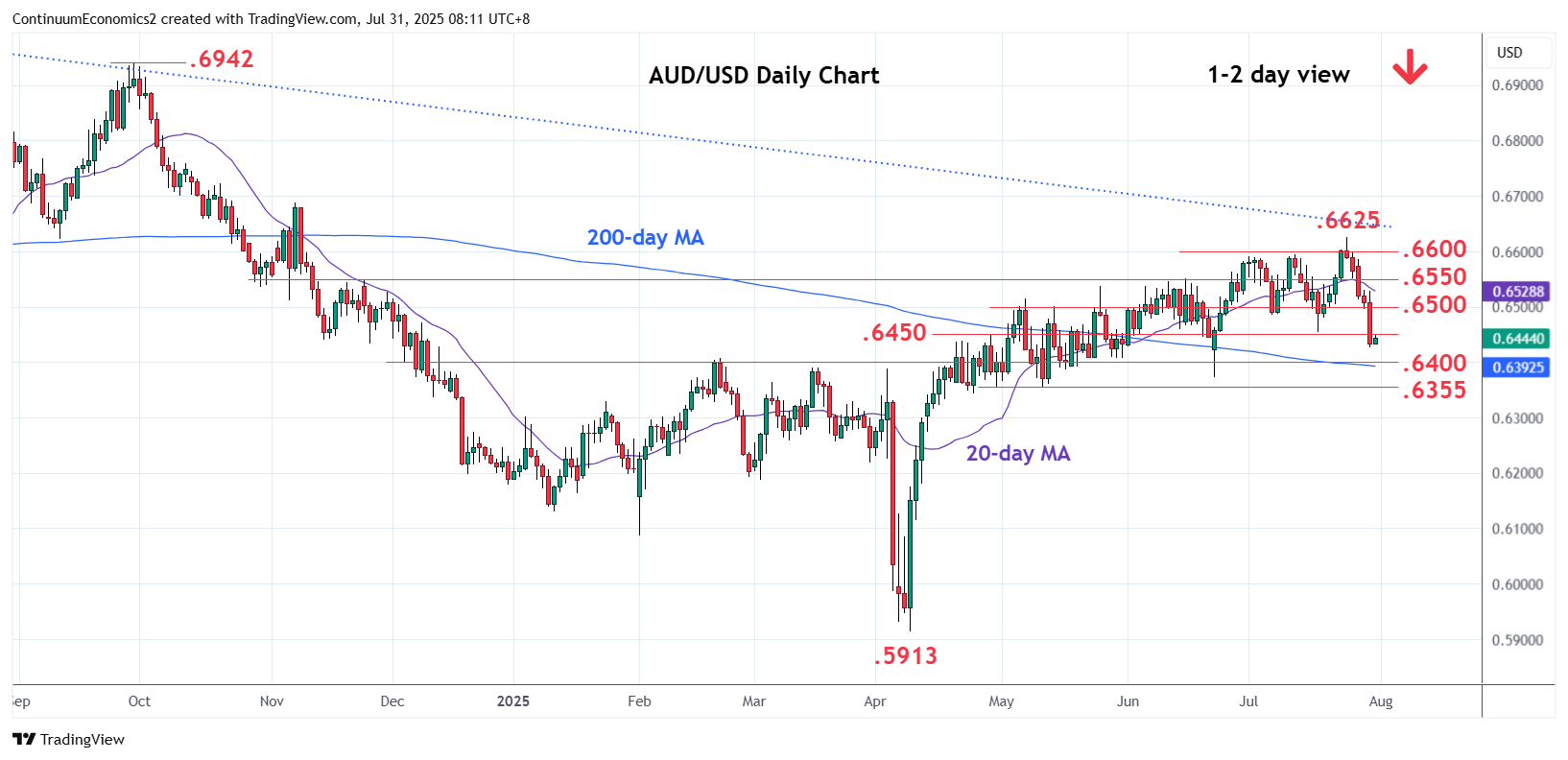

Break of the .6500 level has given way to further losses to extend sharp drop from the .6625 high of last week

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.6595 | * | 11 July high | S1 | 0.6425 | 30 Jul low | ||

| R3 | 0.6550 | * | congestion | S2 | 0.6400 | ** | Feb high, congestion | |

| R2 | 0.6485/00 | * | 7 Jul low, congestion | S3 | 0.6355 | ** | May low, 38.2% | |

| R1 | 0.6455 | 17 Jul low | S4 | 0.6300 | * | congestion |

Asterisk denotes strength of level

00:20 GMT - Break of the .6500 level has given way to further losses to extend sharp drop from the .6625 high of last week to reach .6425 low. Consolidation here see prices unwinding oversold intraday studies but the downside remains vulnerable and expected to give way to fresh selling pressure later. Lower will further retrace the April/July rally and see room to strong support at the .6400 level and .6355, 38.2% Fibonacci level. Meanwhile, resistance is lowered to .6455 congestion then the .6485/.6500 area, expected to cap corrective bounce.