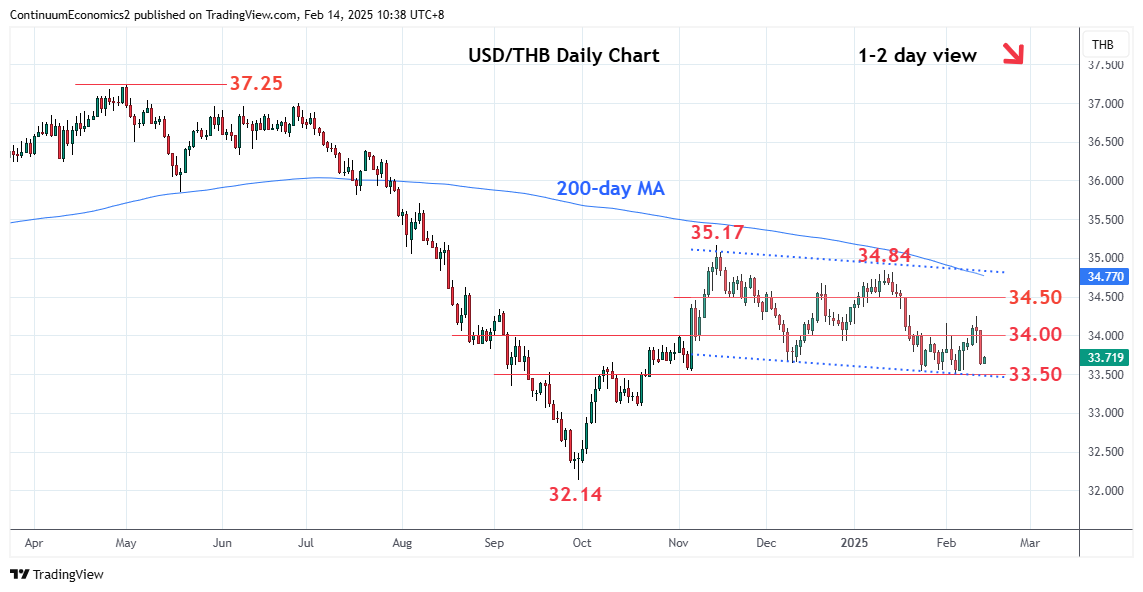

Turned down from the 34.25 bounce high through the 34.00 level to return focus to the downside

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 34.50 | * | congestion | S1 | 33.61 | 13 Feb low | ||

| R3 | 34.35 | * | 17 Jan low | S2 | 33.50 | ** | 5 Feb YTD low | |

| R2 | 34.25 | ** | 12 Feb high | S3 | 33.30 | * | 61.8% Sep/Nov rally | |

| R1 | 34.00 | * | congestion | S4 | 33.08 | * | 18 Oct low |

Asterisk denotes strength of level

02:45 GMT - Turned down from the 34.25 bounce high through the 34.00 level to return focus to the downside as prices unwind the overbought intraday studies and daily studies. Falling daily studies suggest scope for retest of the 33.50 low. Break here will extend the broader losses from the 35.17 high of November to retrace rally from the September low towards 33.30, 61.8% Fibonacci level. Meanwhile, resistance is lowered to the 34.00 congestion and this is now expected to cap and sustain losses from the 34.25 high.