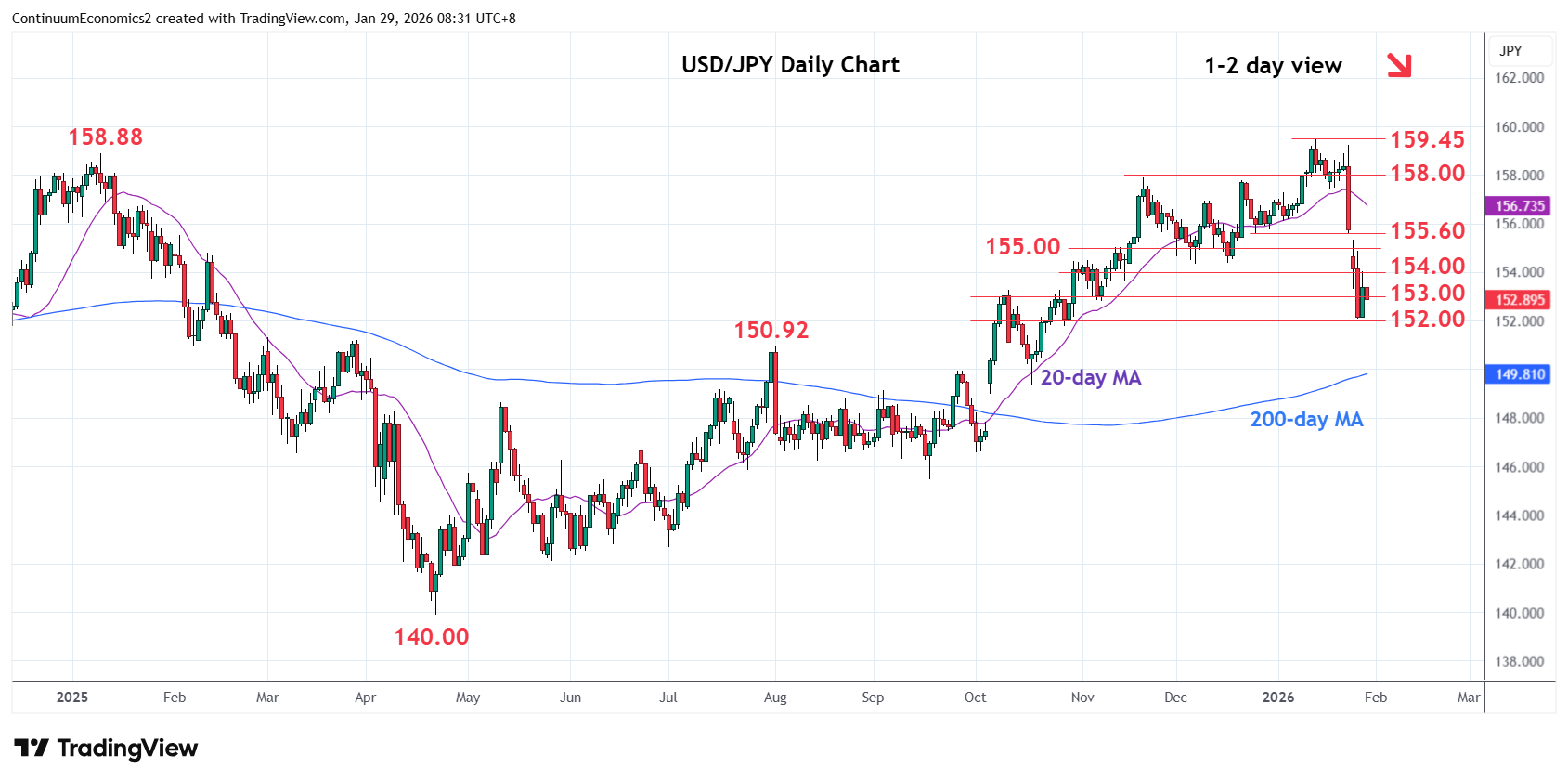

Chart USD/JPY Update: Extend consolidation at 152.10 low

Turned up from the 152.10 low as prices consolidate sharp losses from the high of last week

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 155.60 | ** | 23 Jan low, gap | S1 | 152.00 | * | 38.2% Apr/Jan rally | |

| R3 | 155.00 | * | congestion | S2 | 150.92 | ** | Aug high | |

| R2 | 154.35/40 | * | Dec lows | S3 | 150.00 | ** | figure, congestion | |

| R1 | 154.00 | * | congestion | S4 | 149.65 | * | 50% Apr/Jan rally |

Asterisk denotes strength of level

00:30 GMT - Turned up from the 152.10 low as prices consolidate sharp losses from the high of last week. Consolidation see prices unwinding the oversold intraday and daily studies but this is expected to give way to renewed selling pressure later. Below this and the 152.00, 38.2% Fibonacci level, will open up room for extension to support at 150.92 August high where reaction can be expected. Below this will see room to the 150.00 figure. Meanwhile, resistance is raised to the 154.00 level and this extend to the 154.35/40 December lows are expected to cap. Only above here will open up room for stronger corrective bounce.