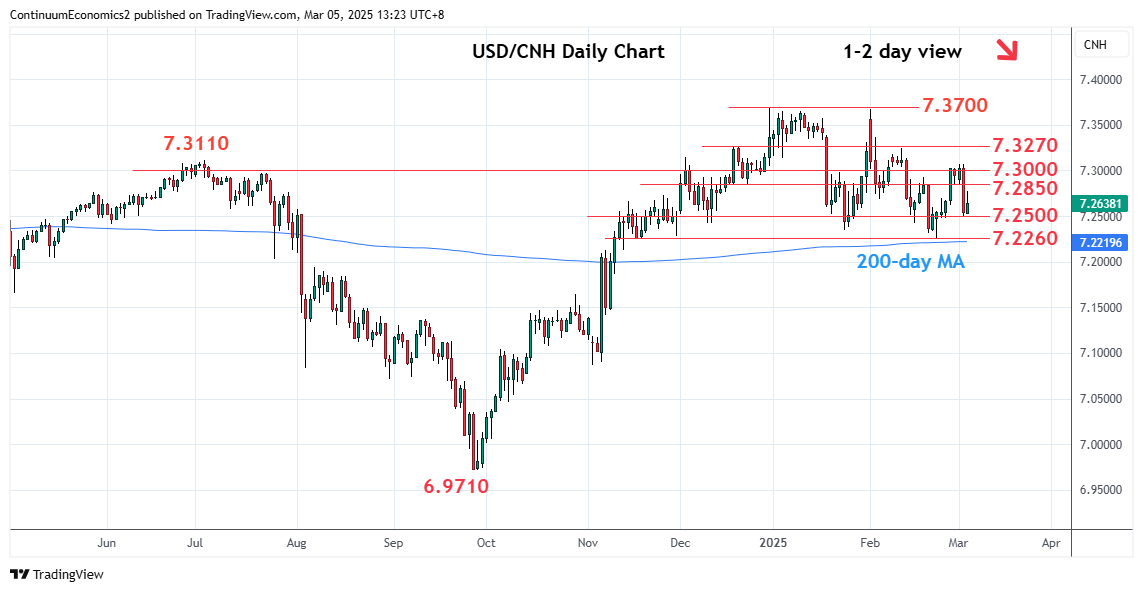

Consolidation at the 7.3000 level has given way to sharp pullback from the 7.3070 high to retrace gains from 7.2260, February low

| Level | Imp | Comment | Level | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 7.3270 | * | 18 Dec high | S1 | 7.2500 | * | congestion | |

| R3 | 7.3150 | * | 3 Dec high | S2 | 7.2345 | * | Jan low | |

| R2 | 7.3070 | ** | 3 Dec high | S3 | 7.2260 | ** | 24 Feb YTD low | |

| R1 | 7.2850 | * | congestion | S4 | 7.2175 | * | 38.2% Sep/Dec rally |

Asterisk denotes strength of level

05:30 GMT - Consolidation at the 7.3000 level has given way to sharp pullback from the 7.3070 high as prices unwind overbought intraday and daily studies to reach support at the 7.2500 congestion. Break here will return focus to the 7.2345/7.2260, January and February lows. Below these will see deeper pullback to retrace the September/December rally to the 7.2175, 38.2% Fibonacci level. Lower still will see room to the 7.2000 level. Meanwhile, resistance is lowered to 7.2850 congestion which is expected to cap and sustain losses from the 7.3070 high.