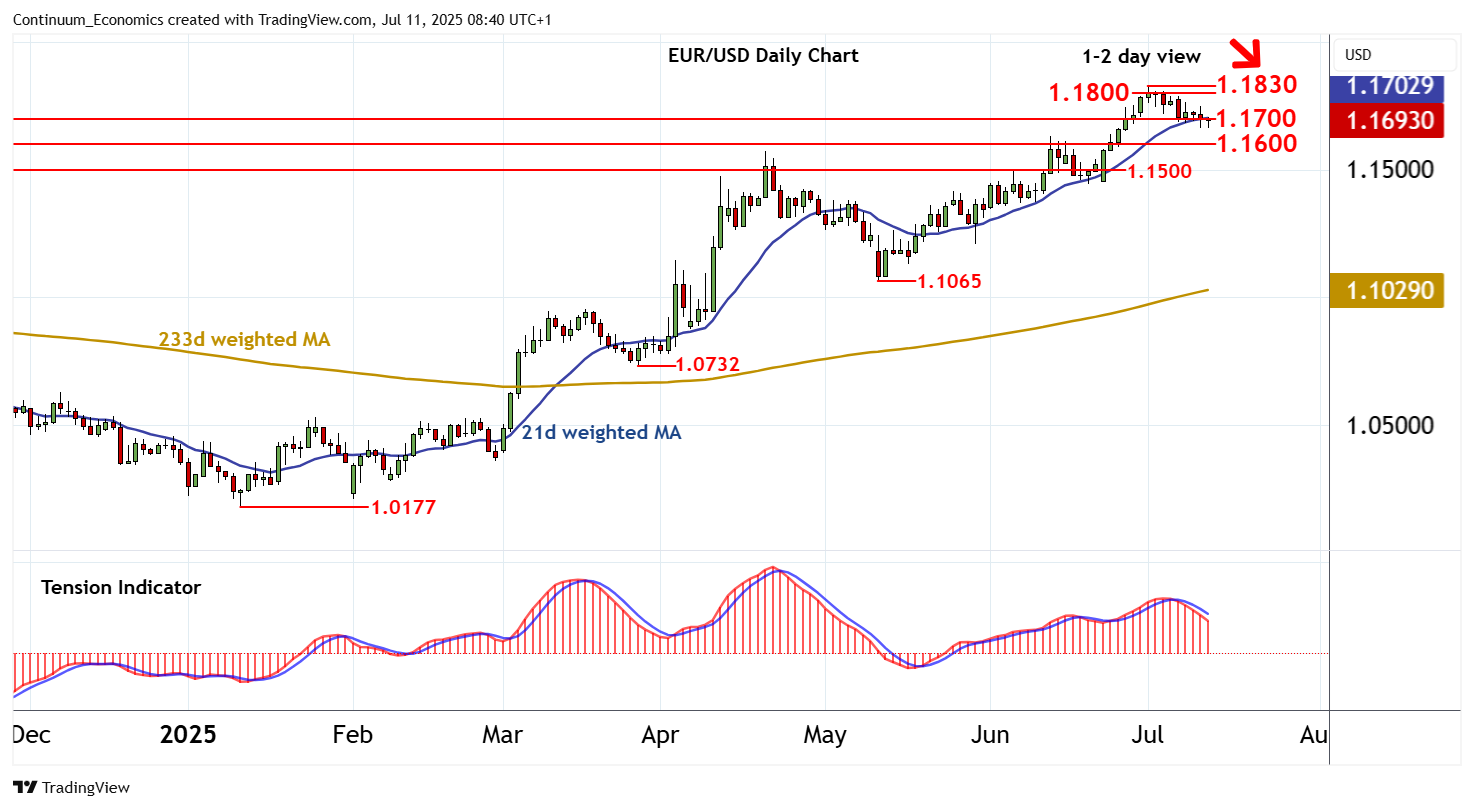

Chart EUR/USD Update: Room for lower in the coming sessions

Little change

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.2000/20 | ** | cong; 38.2% ret of 2008-2022 fall | S1 | 1.1700 | * | congestion | |

| R3 | 1.1900 | * | congestion | S2 | 1.1600 | * | congestion | |

| R2 | 1.1830 | ** | 1 Jul YTD high | S3 | 1.1500 | * | congestion | |

| R1 | 1.1800 | * | congestion | S4 | 1.1446 | * | 19 Jun (w) low |

*Asterisk denotes strength of level

08:35 BST - Little change, as flat oversold intraday studies keep near-term sentiment cautious and prompt further consolidation around congestion support at 1.1700. Daily readings continue to track lower and overbought weekly stochastics are flattening, suggesting room for fresh losses in the coming sessions. Focus is expected to turn to congestion around 1.1600. However, by-then oversold daily stochastics are expected to limit any initial tests in renewed consolidation. (Broader weekly charts are coming under pressure, pointing to risk of a later break.) Meanwhile, resistance remains at congestion around 1.1800 and extends to the 1.1830 current year high of 1 July. A close above here is needed, not yet seen, to turn sentiment positive once again and extend broad September 2022 gains towards further congestion around 1.1900.