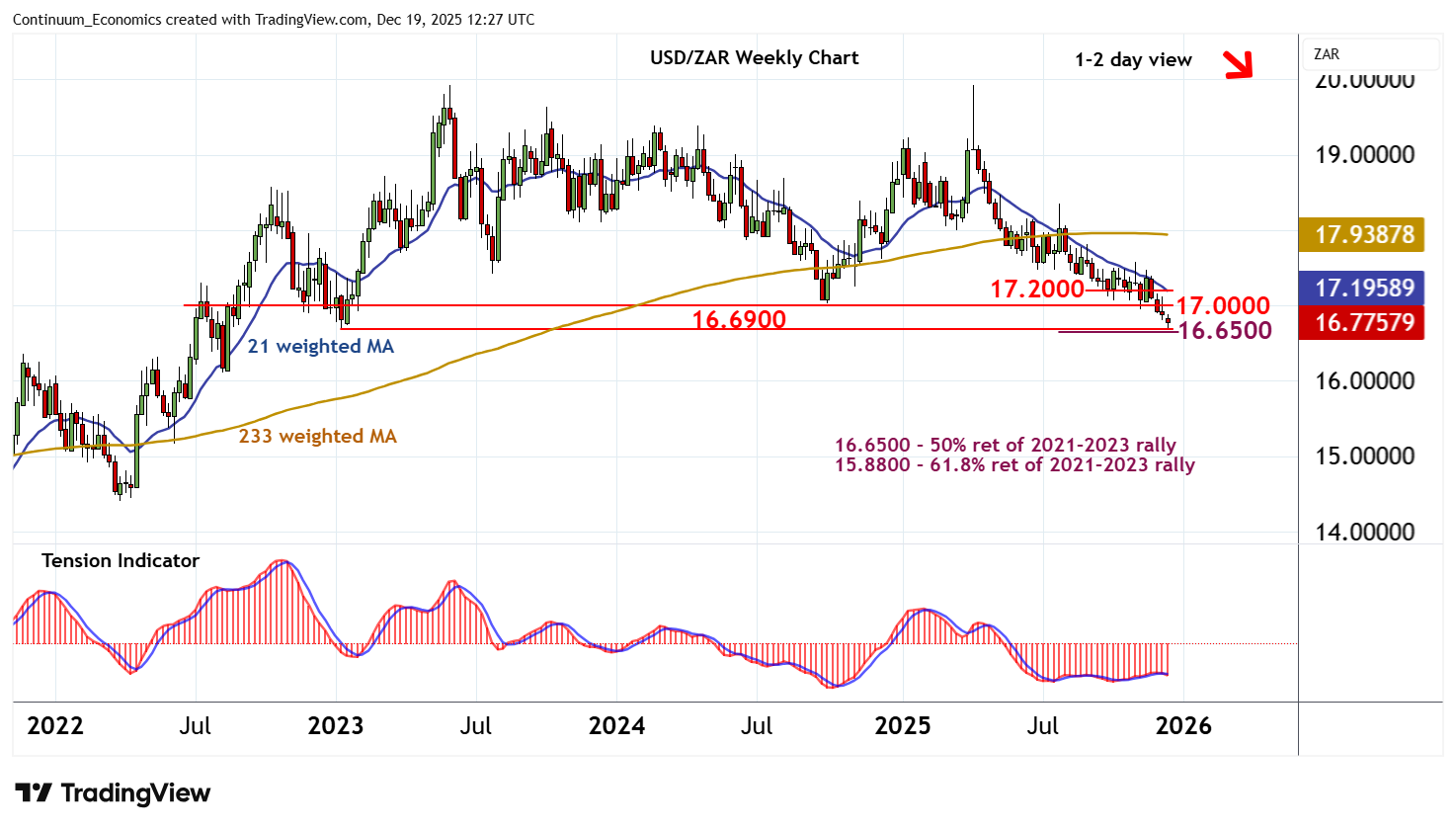

Chart USD/ZAR Update: Consolidating losses - any gains to remain limited

Little change, as prices extend cautious trade

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 17.5000 | ** | congestion | S1 | 16.6950 | 17 Dec YTD low | ||

| R3 | 17.4000 | * | congestion | S2 | 16.6900 | ** | January 2023 (y) low | |

| R2 | 17.2000 | * | congestion | S3 | 16.6500 | ** | 50% ret of 2021-2023 rally | |

| R1 | 17.0000 | ** | congestion | S4 | 16.1060 | ** | August 2022 low |

Asterisk denotes strength of level

12:15 GMT - Little change, as prices extend cautious trade above strong support at the 16.6900 year low of January 2023 and 16.6950 current year low of 17 December. Oversold daily stochastics are unwinding, highlighting potential for a minor bounce. But the negative daily Tension Indicator and bearish weekly charts are expected to limit scope in renewed selling interest beneath congestion resistance at 17.0000. Following cautious trade, fresh losses are looked for. A later break below 16.6900 will extend April losses towards the 16.6500 Fibonacci retracement. However, already oversold weekly stochastics could limit any initial tests in short-covering/consolidation.