2024 Q2 Shadow Credit Ratings to Download in Excel

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. We produce Shadow Credit Ratings for 162 countries, comparable to those from official credit rating agencies.

The ratings are based on our Country Strength Index (CSI), which is our most comprehensive assessment across our full range of Country Insights data. The ratings are consistent with our 2024 Q2 Country Insights update.

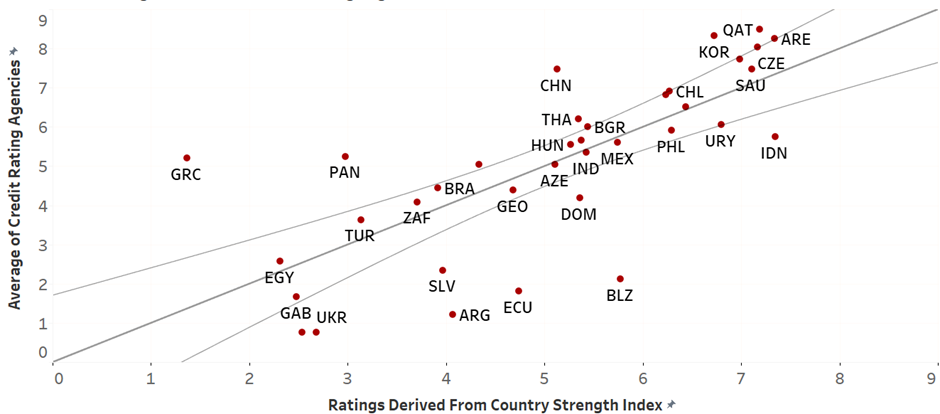

The analysis of the ratings, as shown in Figure 1, indicates that countries like Saudi Arabia (SAU), Czech Republic (CZE), and United Arab Emirates (ARE) have high scores from both Credit Rating Agencies (CRAs) and Country Strength scores, demonstrating strong alignment between the CRAs and the model's assessment of these nations' overall strength. Similarly, Malaysia (MYS) and the Philippines (PHL) exhibit high scores in both metrics, reflecting their perceived stability and strength. Conversely, Egypt (EGY), Turkey (TUR), and Gabon (GAB) have low scores in both metrics, underscoring a consensus on their weaker economic and social conditions. However, some outliers exist; for instance, Greece receives a relatively strong rating from the credit agencies but ranks lower in the model's CSI, particularly due to poor performance in external adjustment capacity and institutional robustness.

Figure 1: Shadow Ratings for Selected Emerging Markets

Source: Continuum Economics

See Article Resources (below) to access the full range of scores.