Published: 2023-12-11T09:06:24.000Z

Chart GBP/USD Update: Consolidating test of 1.2500 - studies leaning lower

Senior Technical Strategist

-

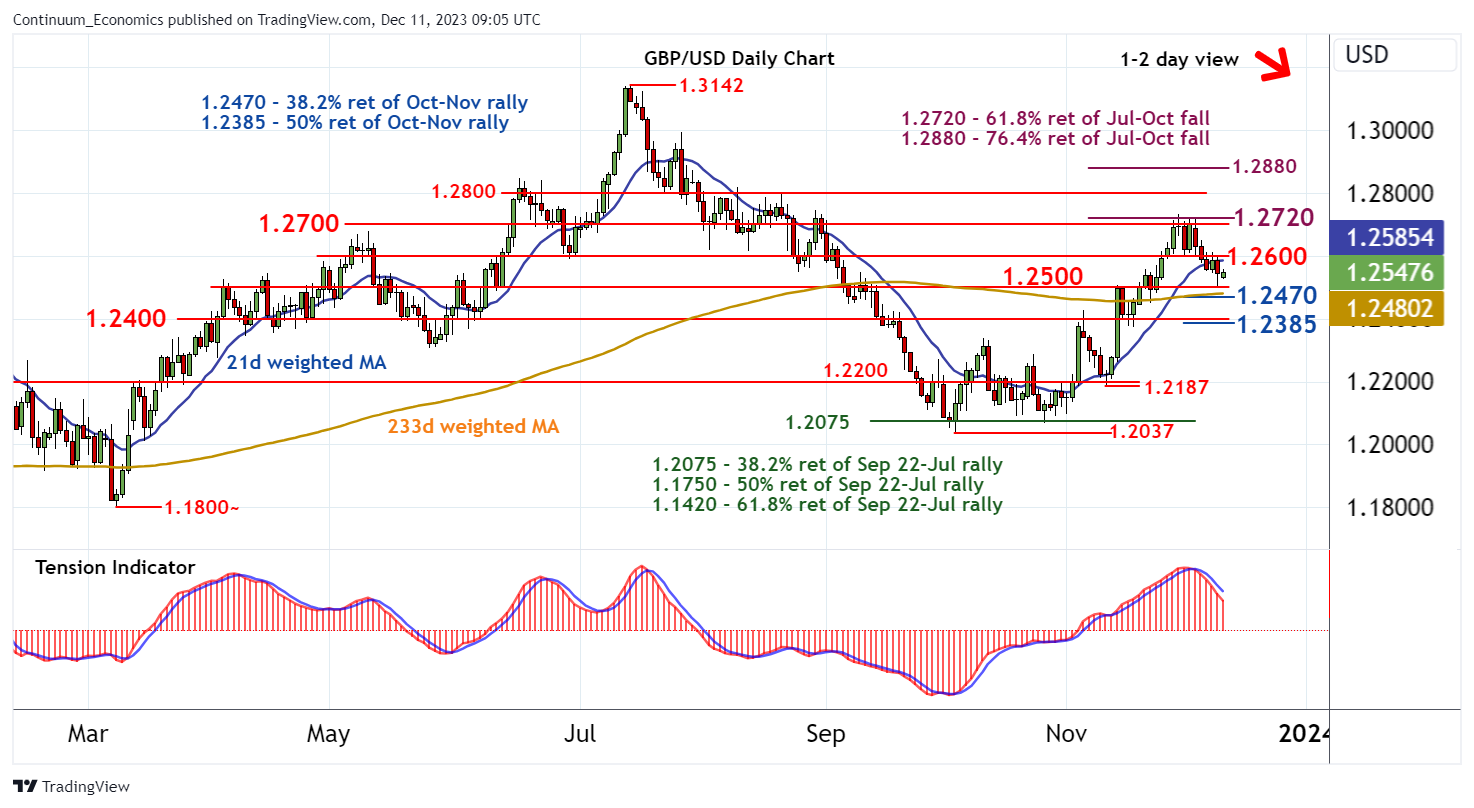

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.2800 | * | break level | S1 | 1.2500 | * | congestion | |

| R3 | 1.2720 | ** | 61.8% ret of Jul-Oct fall | S2 | 1.2470 | ** | 38.2% ret of Oct-Nov rally | |

| R2 | 1.2700 | * | break level | S3 | 1.2385/00 | ** | 50% ret; cong | |

| R1 | 1.2600 | * | congestion | S4 | 1.2300 | * | break level |

Asterisk denotes strength of level

08:55 GMT - Anticipated losses have reached congestion support at 1.2500, where rising intraday studies and flattening oversold daily stochastics are prompting short-term consolidation. A minor test higher cannot be ruled out, but the bearish daily Tension Indicator and unwinding overbought weekly stochastics should limit immediate gains to consolidation beneath congestion resistance at 1.2600. Following corrective trade, fresh tests lower are highlighted. However, a close below the 1.2470 Fibonacci retracement is needed to turn sentiment outright negative and extend November losses towards 1.2385/00. Meanwhile, a close above 1.2600, if seen, will turn sentiment neutral and prompt renewed consolidation beneath strong resistance at 1.2700 and the 1.2720 Fibonacci retracement.