Published: 2025-03-17T15:54:51.000Z

Chartbook: Chart GER 10 Year Yield: Higher in range - background studies improving

Senior Technical Strategist

2

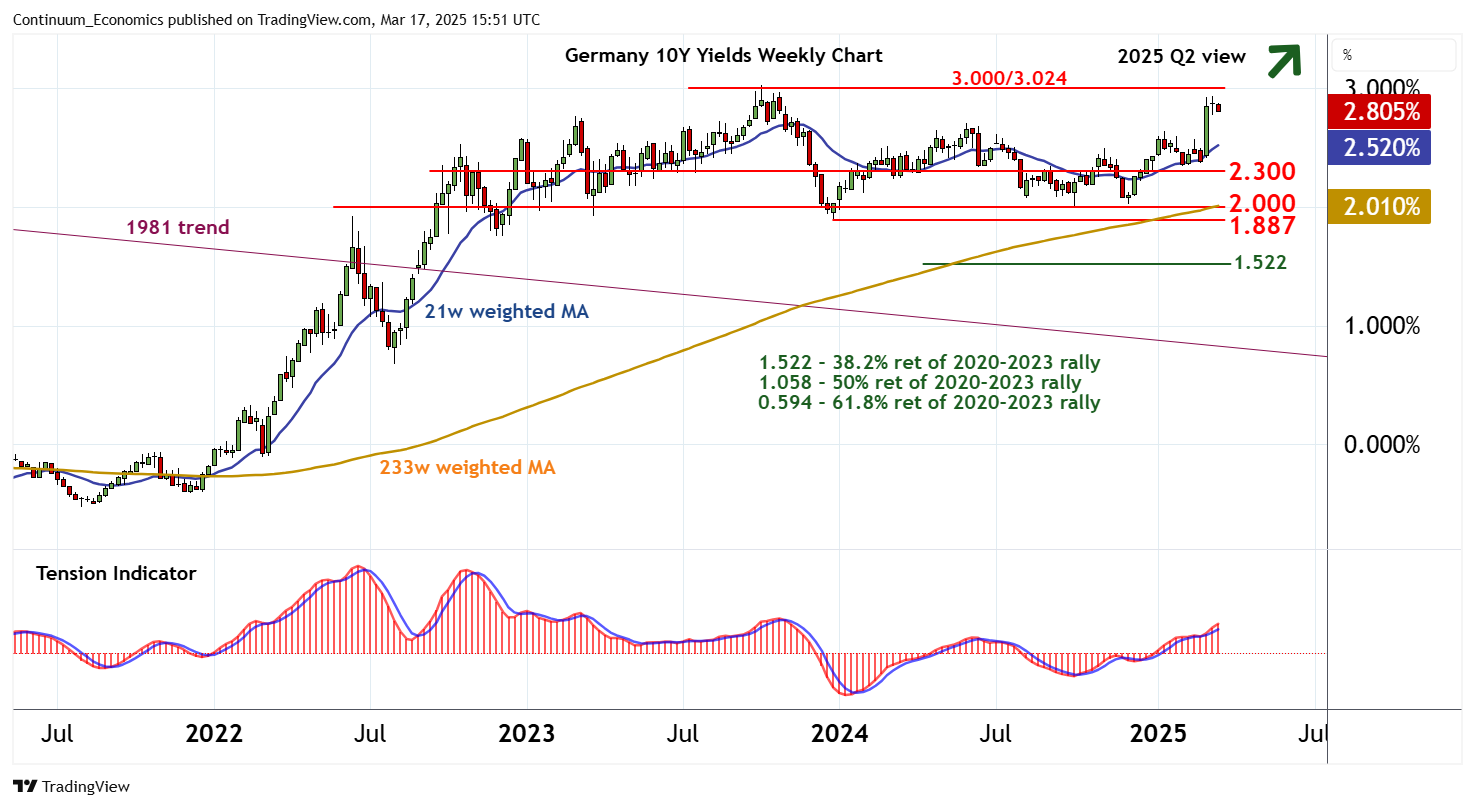

Anticipated consolidation above congestion support at 2.300% has given way to a sharp bounce

Anticipated consolidation above congestion support at 2.300% has given way to a sharp bounce,

with focus turning to critical resistance at congestion around 3.000% and the 3.024% year high of October 2023.

Monthly stochastics are rising and the monthly Tension Indicator is also improving, highlighting room for a later break above here.

A close above 3.024% will turn sentiment positive and extend 2020 gains towards congestion around 3.500%. However, multi-month studies are mixed, suggesting any initial tests of here could give way to consolidation.

Meanwhile, support remains at congestion around 2.300% and extends to critical support at the 1.887% year low of December 2023.

A close beneath here, if seen, would complete a multi-month distribution top and confirm a significant top in place at the 3.024% year high of October 2023. Focus will then turn to next significant support within congestion around 1.500% and the 1.522% Fibonacci retracement, where rising monthly studies could prompt renewed range trade.