Published: 2025-12-16T14:00:40.000Z

Chart USD/JPY Update: Extending losses in both USD- and JPY-driven trade

1

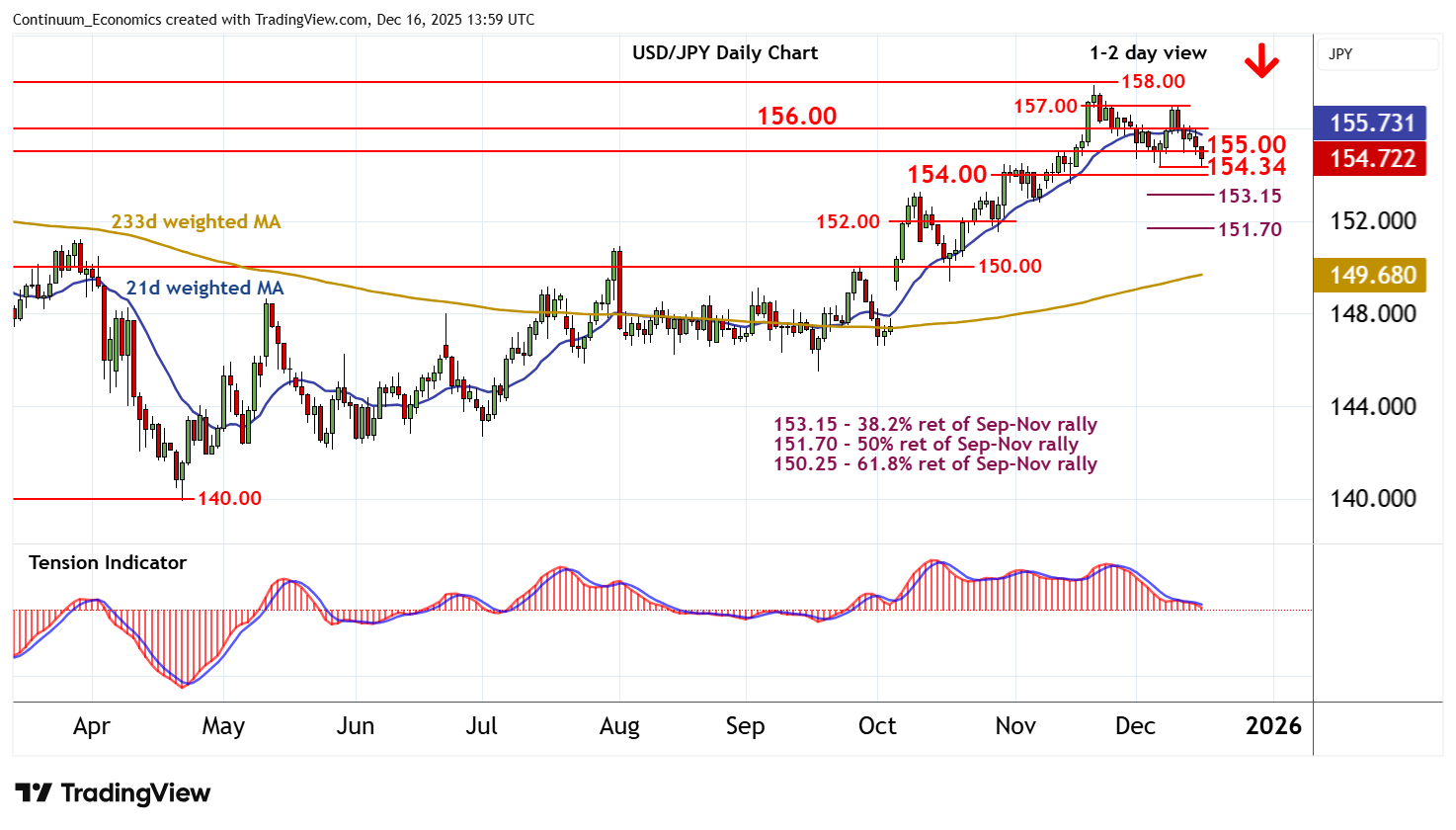

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 157.90/00 | * | 20 Nov (m) high; break level | S1 | 154.34 | * | 5 Dec (w) low | |

| R3 | 157.00 | minor congestion | S2 | 154.00 | * | break level | ||

| R2 | 156.00 | * | congestion | S3 | 153.15 | ** | 38.2% ret of Sep-Nov rally | |

| R1 | 155.00 | * | break level | S4 | 152.00 | ** | congestion |

Asterisk denotes strength of level

13:40 GMT - Cautious trade has given way to fresh losses in both USD- and JPY-driven trade, with prices currently consolidating the test of strong support at the 154.34 weekly low of 5 December. Daily readings are negative and broader weekly charts are turning down, highlighting room for further losses in the coming sessions. A break of 154.34 will add weight to sentiment and confirm continuation of late-November losses, as 154.00 then attracts, ahead of the 153.15 Fibonacci retracement. Meanwhile, resistance is lowered to 155.00. A close above here, if seen, will help to stabilise price action and prompt consolidation beneath congestion around 156.00.