2025 Q1 Shadow Credit Ratings to Download in Excel

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. We produce Shadow Credit Ratings for 162 countries, comparable to those from credit rating agencies.

The ratings are based on our Country Strength Index (CSI), which is our most comprehensive assessment across our full range of Country Insights data. The ratings are consistent with our 2025 Q1 Country Insights update.

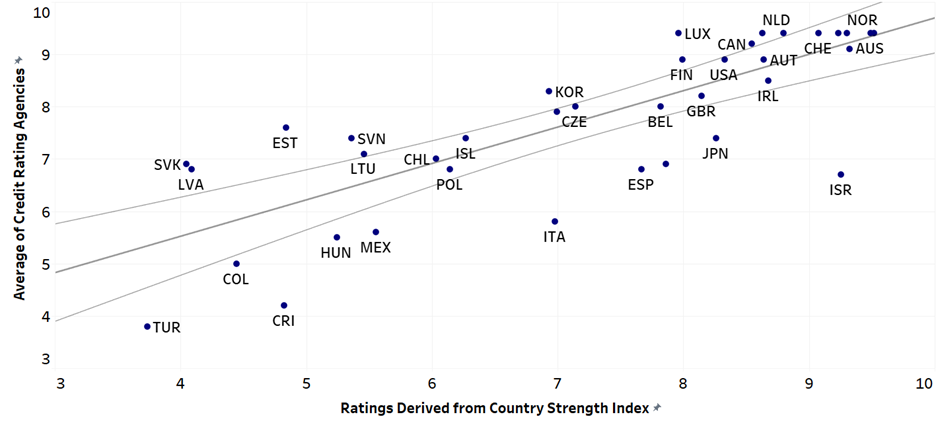

Figure 1 compares the average sovereign credit ratings assigned by major credit rating agencies with our CSI. Countries falling within the confidence band exhibit a close correlation between the two measures, suggesting that credit ratings are broadly aligned with underlying country fundamentals. This group includes many advanced economies such as the United States, Austria, Australia, United Kingdom, and Ireland.

Several countries, however, fall below the confidence band, indicating that the CSI scores them more favorably than the rating agencies do. This may suggest that these countries are potentially underrated, with structural fundamentals stronger than reflected in their ratings. Examples include Costa Rica and Italy, both of which score highly in the external adjustment capacity and social inclusion pillars. Conversely, a limited number of countries appear above the confidence band, suggesting that credit rating agencies assign higher scores than warranted by their CSI values. Notable examples include Slovakia, Estonia, and Luxembourg, where the medium-term growth potential pillar is the weakest.

Figure 1: Shadow Ratings for Selected OECD Countries

Source: Continuum Economics

See Article Resources (below) to access the full range of scores.