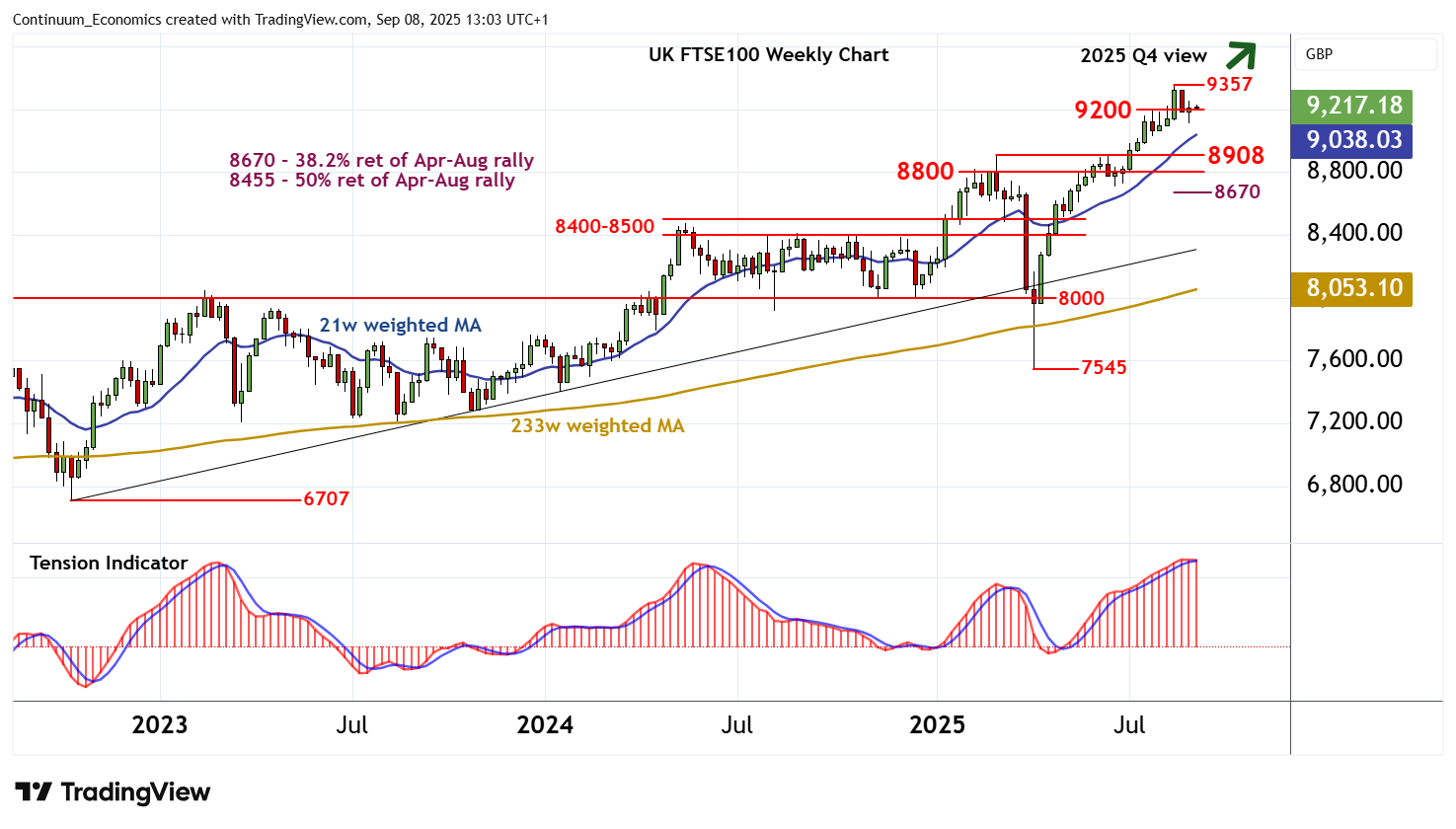

Chartbook: UK Chart FTSE 100 Update: Balanced beneath all-time highs. Long-term studies rising

Anticipated gains have extended to post a fresh all-time high around 9350/60

Anticipated gains have extended to post a fresh all-time high around 9350/60,

before settling lower in consolidation around congestion support at 9200.

Overbought weekly stochastics are turning down, unwinding negative divergence, and the positive weekly Tension Indicator is also coming under pressure, highlighting increased risk of further profit-taking into the coming weeks.

A close back below 9200 will add weight to sentiment and open up a pullback, correcting the steep April-August rally and opening up support within congestion around 8800 and the 8908 monthly high of March 2025. By-then oversold weekly stochastics should limit any tests in consolidation.

Further losses, if seen, will confirm a deeper correction and target the 8670 Fibonacci retracement.

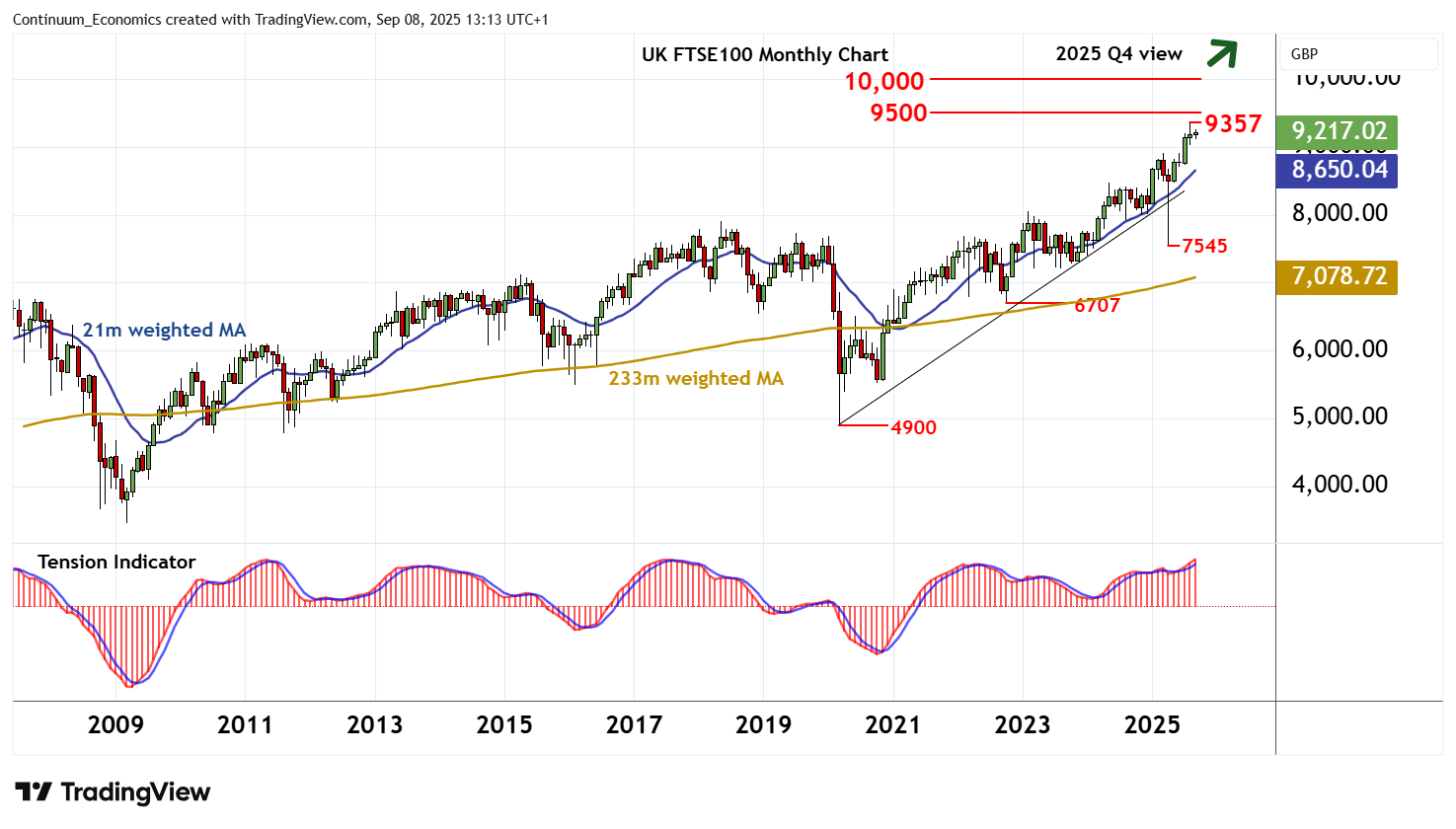

Following corrective trade, rising monthly charts are expected to prompt fresh gains.

A close above 9350/60 will turn sentiment positive once again, and open up 9500.

Continuation beyond here will target strong psychological resistance at 10,000, where already overbought monthly stochastics could prompt significant profit-taking.

However, positive longer-term charts point to potential for continuation beyond here in 2026.