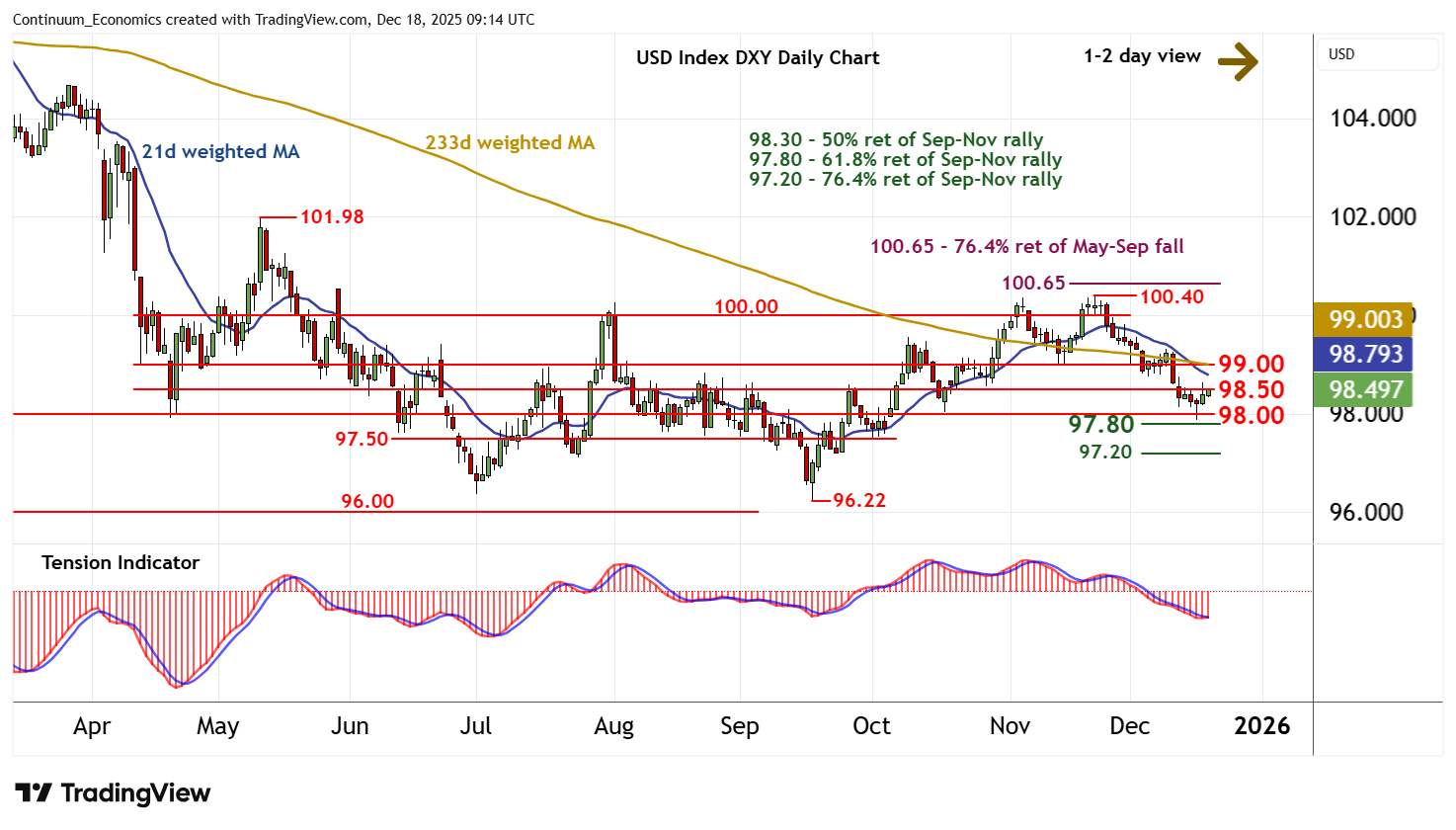

Chart USD Index DXY Update: Limited scope above 98.50

The sharp pullback from congestion resistance at 98.50 has reached 98.25

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 100.00 | ** | congestion | S1 | 98.00 | * | congestion | |

| R3 | 99.50 | * | break level | S2 | 97.80 | ** | 61.8% ret of Sep-Nov rally | |

| R2 | 99.00 | * | congestion | S3 | 97.50 | congestion | ||

| R1 | 98.50 | * | congestion | S4 | 97.20 | ** | 76.4% ret of Sep-Nov rally |

Asterisk denotes strength of level

09:05 GMT - The sharp pullback from congestion resistance at 98.50 has reached 98.25, where a steady bounce has pushed prices back to 98.50. Oversold daily stochastics are unwinding and the negative daily Tension Indicator is flattening, suggesting potential for a test above here. But negative weekly charts are expected to limit scope in renewed selling interest/consolidation towards further congestion around 99.00. Following corrective trade, fresh losses are looked for. But a break below support at the 97.80 Fibonacci retracement and congestion around 98.00 is needed to turn sentiment negative and extend late-November losses towards congestion around 97.50.