Published: 2025-04-07T10:28:27.000Z

Chart EUR/CAD Update: Early losses not sustained - studies improving

Senior Technical Strategist

1

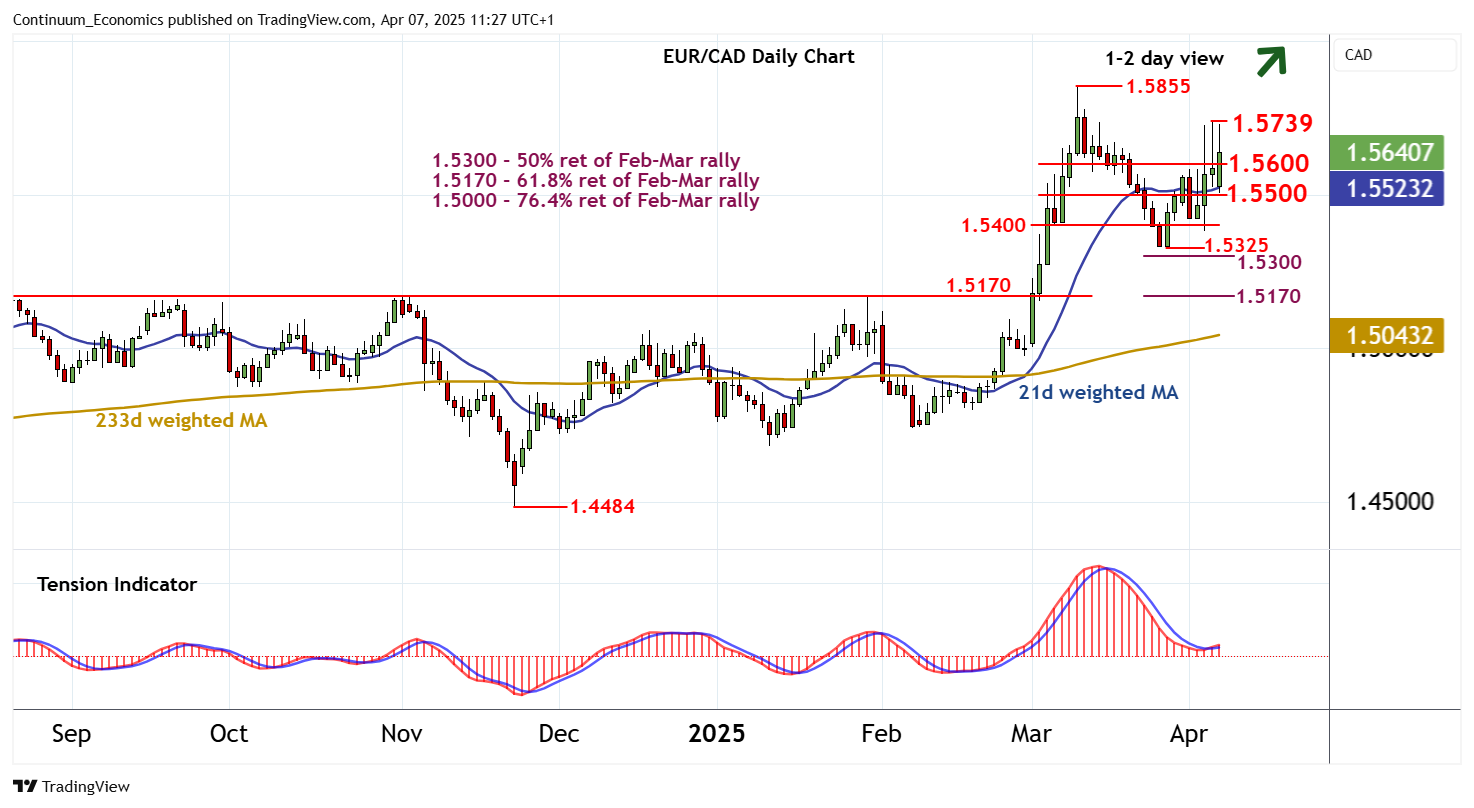

The early test down to congestion support at 1.5500 has bounced smartly

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.5855 | ** | 11 Mar YTD high | S1 | 1.5600 | * | congestion | |

| R3 | 1.5800 | figure | S2 | 1.5500 | ** | congestion | ||

| R2 | 1.5739 | * | 4 Apr (w) high | S3 | 1.5400 | * | congestion | |

| R1 | 1.5700 | break level | S4 | 1.5325 | ** | 27 Mar (w) low |

Asterisk denotes strength

11:05 BST - The early test down to congestion support at 1.5500 has bounced smartly, with prices currently balanced in choppy trade above congestion support at 1.5600. Intraday studies are mixed, highlighting potential for further sideways volatility. But daily readings are improving and broader weekly charts are also turning up, suggesting room for fresh gains in the coming sessions. A break above the 1.5739 weekly spike high of 4 April is needed to improve sentiment. But a further close above critical resistance at the 1.5855 current year high of 11 March is needed to turn sentiment positive and extend August 2022 gains towards 1.6000. Meanwhile, a close below 1.5500, if seen, will turn sentiment neutral and give way to fresh range trade above further congestion around 1.5400.