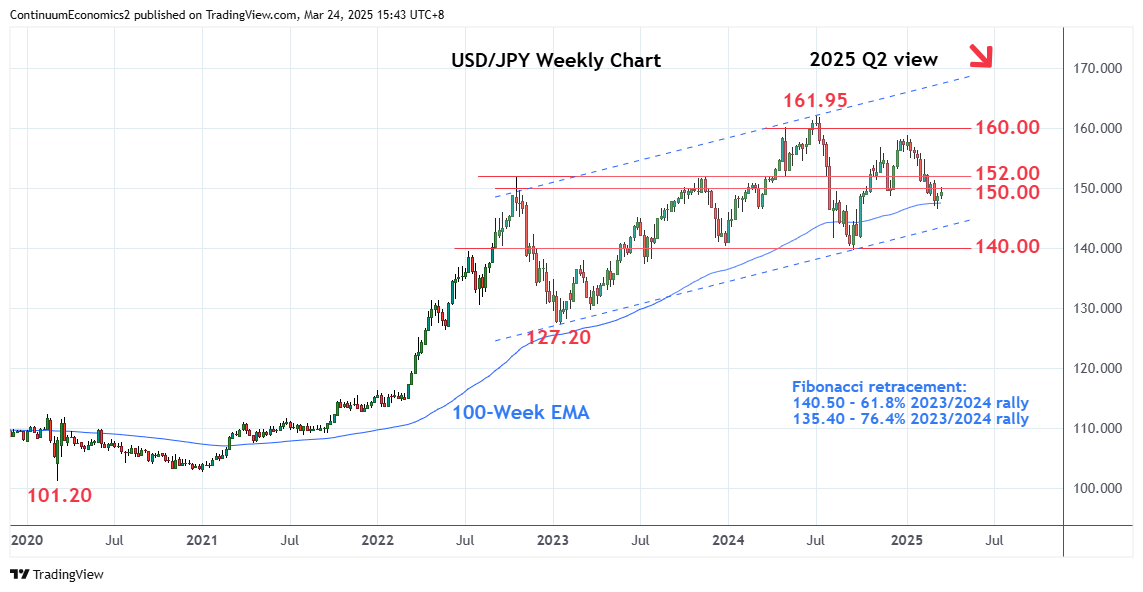

Chartbook: Chart USD/JPY: Consolidating losses from January high, scope for lower

Saw rejection from the 159.00 level at the start of January to retrace 61.8% of the September/January rally to reach 147.00 level

Saw rejection from the 159.00 level at the start of January to retrace 61.8% of the September/January rally to reach 147.00 level. Rebound here see prices unwinding the oversold weekly studies but gains are expected to be limited and giving way to further losses later.

Below the 147.00 level will see room for deeper pullback to the channel support from the January 2023 low around the 145.00/144.00 area. Break of this area will open up room for retest of the strong support at the 140.00 congestion and 139.58, September 2024 year low. Below these will confirm a broad head-and-should top pattern at the 161.95 high and see deeper pullback to correct the underlying bull trend from the 2016/2020 year lows. Lower will see room to the 138.00 congestion and 135.40, 76.4% Fibonacci level.

Meanwhile, resistance is at the 150.00 level and this extends to the 152.00 congestion and the 2022/2023 year highs level. Gains beyond this, if seen, will open up room for stronger corrective bounce to the 154.00/155.00 congestion area.