Published: 2025-08-04T13:39:23.000Z

Chart AUD/USD Update: Gains to remain limited

Senior Technical Strategist

1

Little change, as prices extend cautious trade around 0.6485

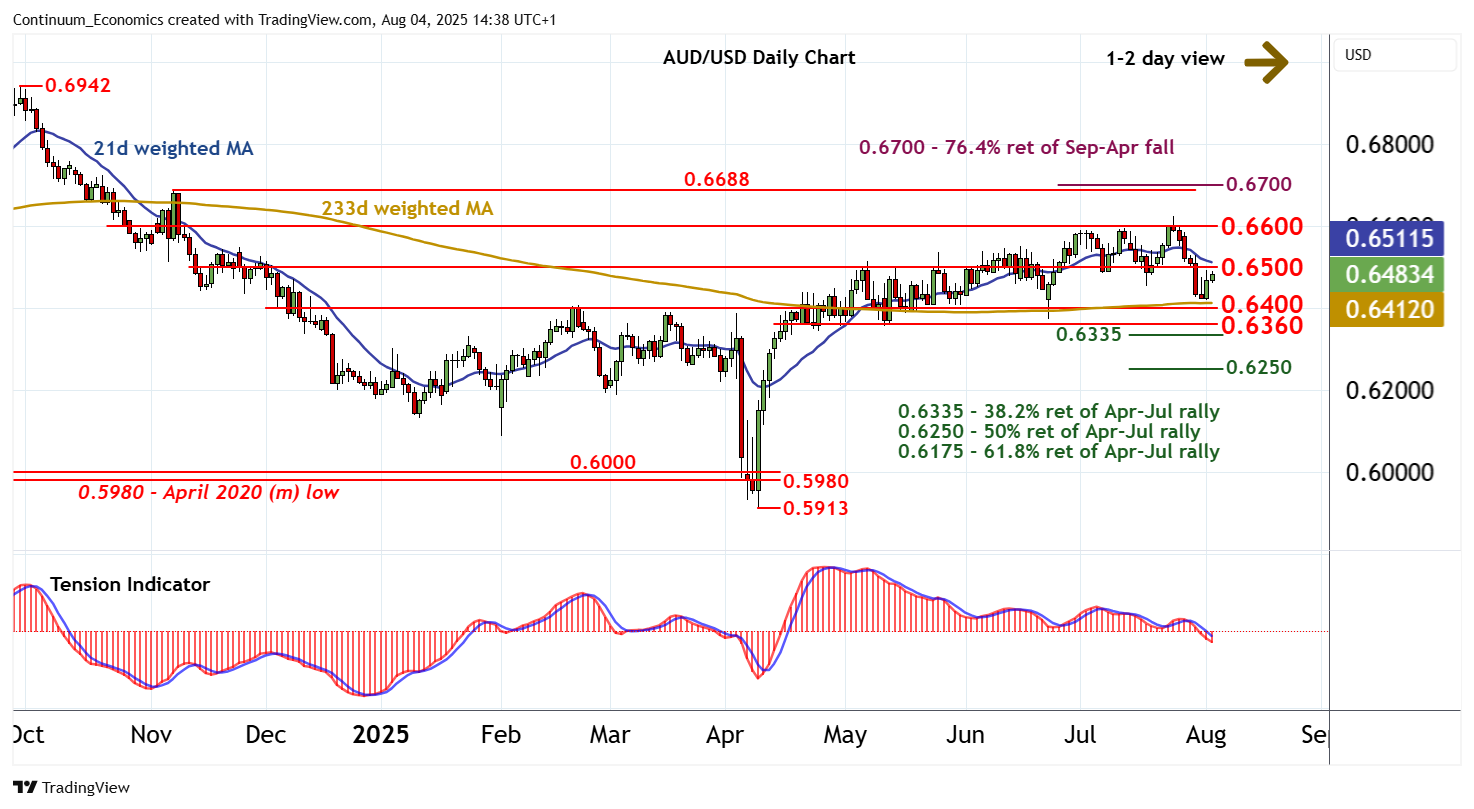

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.6688 | ** | 7 Nov (m) high | S1 | 0.6400 | * | break level | |

| R3 | 0.6625 | 24 Jul YTD high | S2 | 0.6360 | ** | break level | ||

| R2 | 0.6600 | ** | congestion | S3 | 0.6335 | ** | 38.2% ret of Apr-Jul rally | |

| R1 | 0.6500 | * | congestion | S4 | 0.6300 | * | congestion |

Asterisk denotes strength of level

14:30 BST - Little change, as prices extend cautious trade around 0.6485. Intraday studies are positive and oversold daily stochastics are rising, suggesting room for a test of congestion resistance at 0.6500. But the negative daily Tension Indicator and bearish weekly charts should limit any break in renewed selling interest beneath further congestion around 0.6600. Meanwhile, support remains at 0.6400 and extends to 0.6360. A close beneath here is needed to turn sentiment negative and confirm a near-term top in place around 0.6600, as July losses then extend initially towards the 0.6335 Fibonacci retracement.