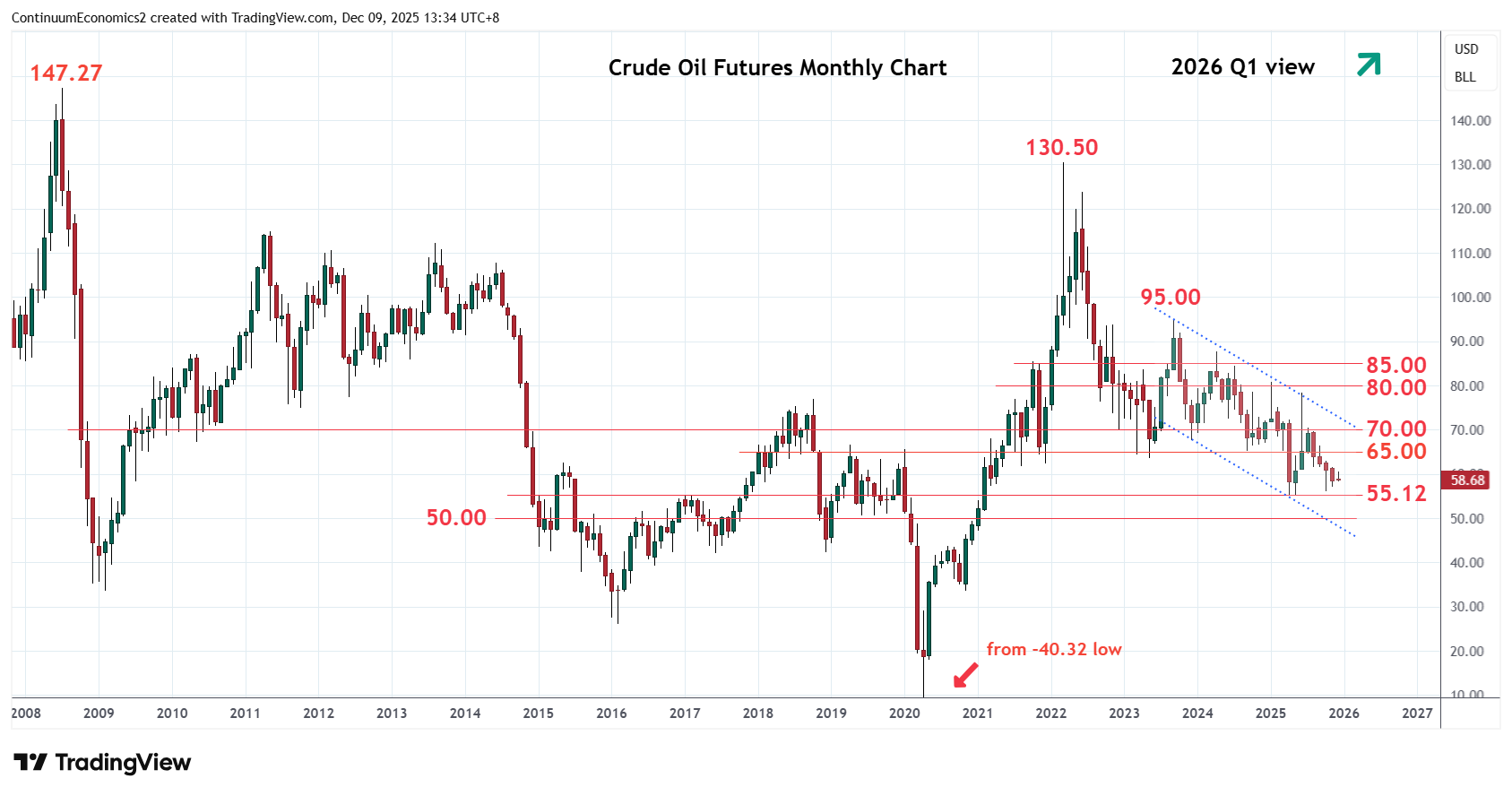

Chartbook: US Chart Crude Oil Futures: Room to extend bounce from 56.00 low

Found support at the 56.00 level at the start of Q4 as prices consolidate losses from the 78.40 June high

Found support at the 56.00 level at the start of Q4 as prices consolidate losses from the 78.40 June high and unwind the oversold daily and weekly studies.

Subsequent bounce see prices extending consolidation within the 62.00/58.00 range area. Bullish divergence on weekly studies suggest scope for break above resistance at the 62.00 congestion to open up room for stronger gains to retrace losses from the 78.40, June swing high. Higher will see room to strong resistance at the 65.00 congestion and the 67.20, 50% Fibonacci level. Clearance here will turn focus to strong resistance at the 70.00 level and 61.8% Fibonacci level. Break of the latter, if seen, will turn focus to the 78.40/80.00 area.

Meanwhile, support at the 56.00/55.12 lows are expected to underpin. Would take break here to further extend losses from the 130.50, March 2022 high, to the 50.00 figure.