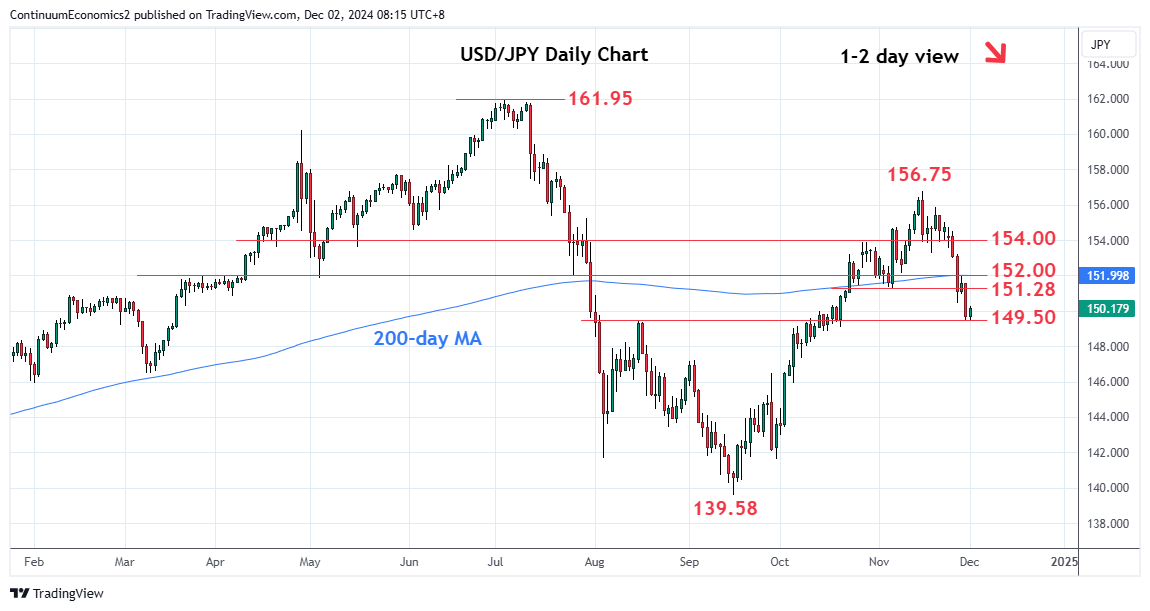

Break of the 150.00 level saw losses to reach 149.50 low

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 154.00 | * | congestion | S1 | 149.50 | * | 29 Nov low | |

| R3 | 153.28 | ** | 19 Nov low | S2 | 149.10/00 | * | congestion | |

| R2 | 152.00 | * | congestion | S3 | 148.15 | * | 50% Sep/Nov rally | |

| R1 | 151.28 | * | 6 Nov low | S4 | 148.00 | * | congestion |

Asterisk denotes strength of level

00:25 GMT - Break of the 150.00 level saw losses to reach 149.50 low ahead of bounce as prices unwind the oversold intraday studies and consolidate sharp losses last week. However, the upside likely to remain limited and lower will see further losses to retrace gains from the September low and see room to the 149.10/00 congestion. Below here will turn focus to the strong support at 148.15/00, 50% Fibonacci retracement and congestion area. Meanwhile, resistance is at the 151.28/152.00 area and this is expected to cap bounce attempt.